Crude Oil faces continued bearish pressure after OPEC news

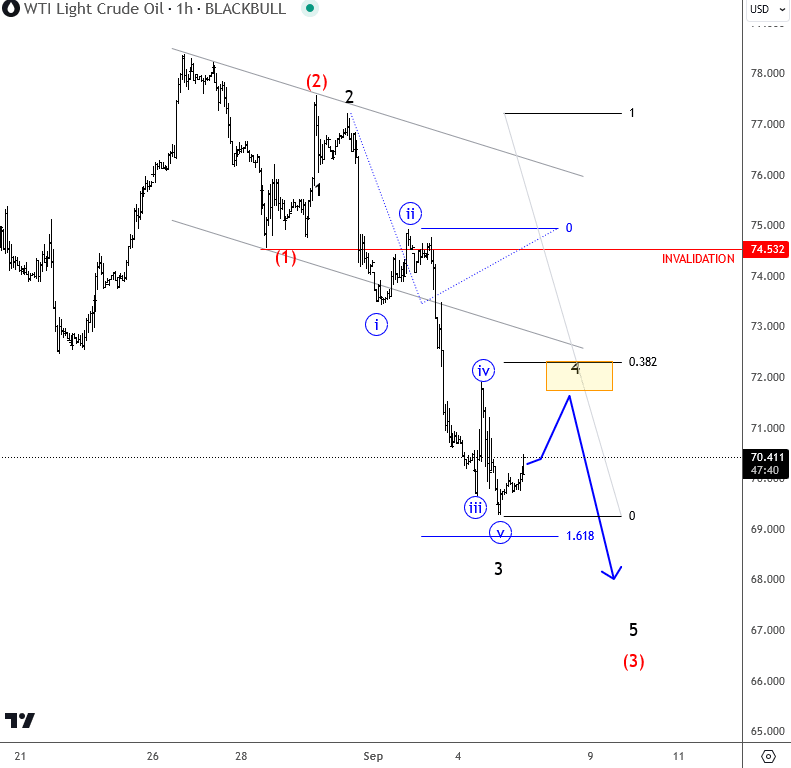

Crude oil firstly rallied for a bit yesterday, on the news that OPEC's planned production increase starting in October will be delayed. However, that rally was short-lived. It's important to note that production increases are still on the horizon, and this should have a bearish impact on energy prices. It's not surprising that energy retested the lows later during the US session, suggesting that the decline remains strong. From an Elliott Wave perspective, the move appears impulsive, so I expect further weakness after a potential wave 4 rally, which could head back to the 71-72 resistance area. The invalidation level is at 74.57, and as long as this holds, the trend for crude oil remains bearish.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.