Crescat Capital: Finally time for its view to cash in?

Crescat Capital has been bullish on gold for a long time. It is a conviction that has been costing the company in the recent climate with USD strength, rising yields, and rising real yields - all negative headwinds for gold. You can see its precious metals hedge fund is down -23.2% year to date.

However, is the tide now turning? Crescat makes a powerful argument in its latest newsletter based on the recessionary risk for the US and the historical reaction of gold to two prior recessions it considers comparable to today.

The recession risk

There is now a 70% breach in the percentage of inversions of the US Treasury Yield curve.

Crescat sees this as important because every time, since 1970, the US Treasury yield curve has breached this level of inversions it has resulted in a recession. This also explains why the Fed recognises recession as a base case for 2023. It said as much in the last FOMC minutes.

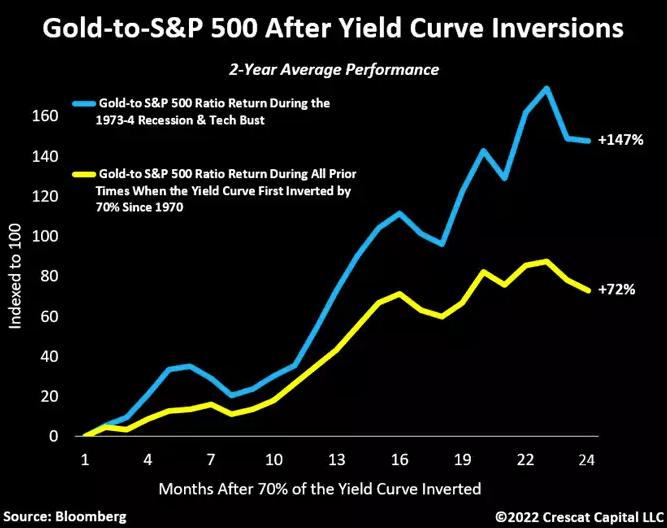

Based on this outlook Crescat sees a two-fold approach - sell the S&P500 and buy Gold. Crescat’s belief is that the current macro climate is very similar to the stagflationary risk from the 1973-1974 recession and the early 2000s tech bust. It posts an interesting chart which highlights the outstanding performance of short S&P500 and long gold here. See below:

This is research well worth reading and the outlook for gold has been growing increasingly bullish. Is this now the time to look at gold, gold mining stock, and silver. Certainly, there will be moves towards this as the data is released and points towards and away from this outlook. Certainly, short-term opportunities ought to be ahead in abundance even if the long-term view from Crescat doesn’t play out this time. Whatever view you take, always make sure to manage risk.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.