Poland: Correction on bond market

NBP to hold first QE operation this month. So far, PLN 85bn bought within program. No macro release scheduled this week in Poland. Zloty lost most of last week's gains and EURPLN should stay around 4.45.

Watch this week

June 12 | NBP to hold next QE operation

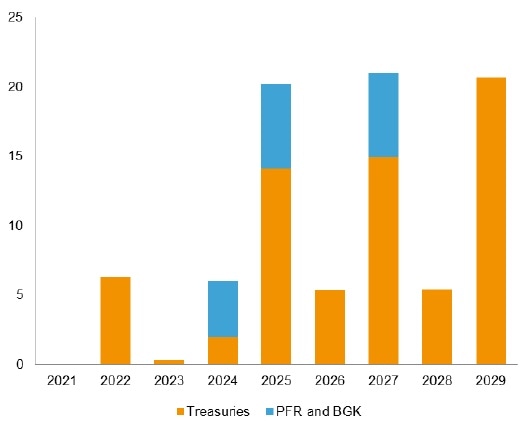

The National Bank of Poland will hold its eighth QE operation this week (a second monthly operation is scheduled for June 24). So far, the NBP has bought PLN 85.4bn, out of which PLN 16.2bn is in BGK and PFR papers. The bond buying program is focused on papers with longer maturity (above 5Y). We expect the central bank to continue buying state-guaranteed papers issued by PFR and BGK.

QE volume by maturity, PLN bn

Source: National Bank of Poland, Erste Group Research

Last week's highlights

-

Postponed presidential election should take place on June 28.

-

According to Ministry of Family, Labor and Social Policy, unemployment rate increased to 6.0% in May from 5.8% in previous month.

-

Polish Investment Fund (PFR) issued bonds worth total of PLN 12bn (PLN 10bn in 7Y paper and PLN 2bn in 10Y paper). State-owned BGK sold PLN 8.5bn. Total volume of PFR issuance stands at PLN 62bn. Issuance will be used to finance Financial Shield program, worth PLN 100bn.

-

MPC members expressed opinion that space for further rates cut is very limited and rule out scenario of negative rates.

Market developments

Bond market drivers | Long end of curve corrected

Over the course of the week, the long end of the curve went strongly up by 30bp and returned to levels of around 1.45% seen before the last policy rate cut. The Polish curve followed global developments, as the 10Y German Bund went up by roughly 15bp to -0.3%. As a result, the spread over the 10Y Bund widened towards 180bp. As far as other maturities are concerned, the 2Y yield corrected as well and increased by 20bp towards 0.25%, while the 5Y yield bounced back by roughly 20bp to 0.85%. With no local macro releases scheduled for this week and a national holiday on Thursday, the bond market will likely follow global news. The FOMC meeting could gather some market attention.

FX market drivers | Zloty lost gains

The zloty continued appreciating in the first half of last week, as it went below 4.40 vs. the EUR. However, in the second half of the week it lost its gains and returned to the area of 4.45. We expect the EURPLN to stay between 4.40-4.45 in the coming months. This week, the FOMC meeting will likely be the most important event. The EURUSD could react to specific news on how long interest rates could remain at current levels, and to what extent and how long securities will be bought in the future.

Author

Erste Bank Research Team

Erste Bank

At Erste Group we greatly value transparency. Our Investor Relations team strives to provide comprehensive information with frequent updates to ensure that the details on these pages are always current.