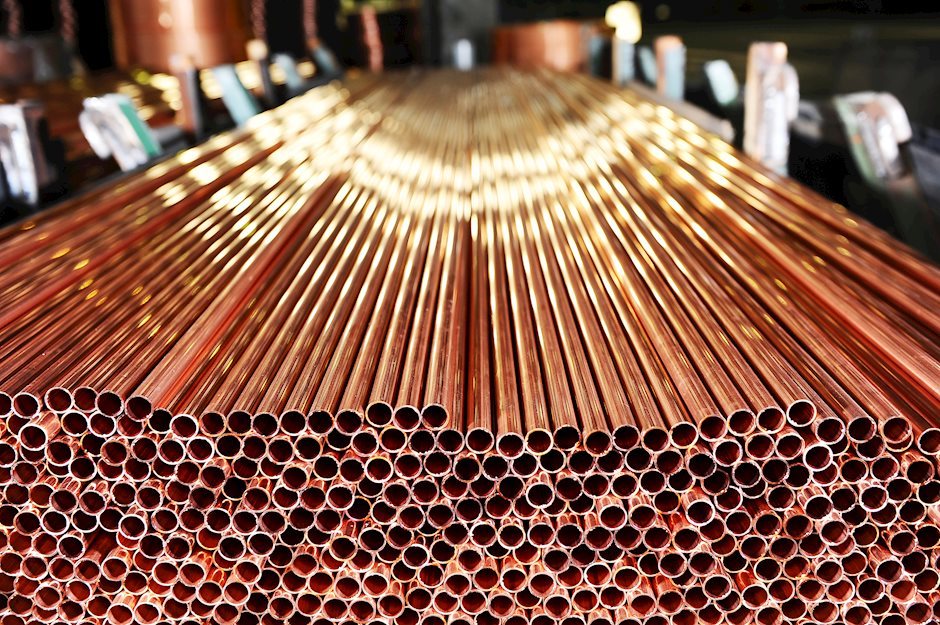

Copper set for structural boost higher?

Joe Biden has stated that he will spend $2 trillion over four years to improve infrastructure, create zero-emissions, public transport and create clean energy jobs. Green investments stand to gain with a Biden Presidency. With green technology relying heavily on copper for conducting electricity via wiring and conductors the need for copper is expected to grow in the coming weeks and months ahead.

Commodities are at a two year high even as the pandemic cases rise and winter approaching for both Europe and the US.

This optimism in the commodity market had led Goldman Sachs to forecast a 12 month return of 28% for commodities in 2021. Metals and crops are expected to do well supported by policy aided demand, a weaker USD, rising inflation risks and a lack of investment. Goldman Sachs also point out that a number of commodity markets are in a deficit at the moment with, ‘all but cocoa, coffee, and iron ore in a deficit’.

Although oil will face a hard winter, with demand falling on rising COVID-19 cases, the continued expansion of China and weak dollar should support commodity gains going forward.

Looking at the copper futures chart from a longer term view it is reasonable to expect buyers from any heavy falls into support. These areas highlighted are particularly worth keeping an eye on as well as any key areas for break outs higher. Watch out for sharp price action on a Biden victory and any unexpected moves like we saw in the 2016 election.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.