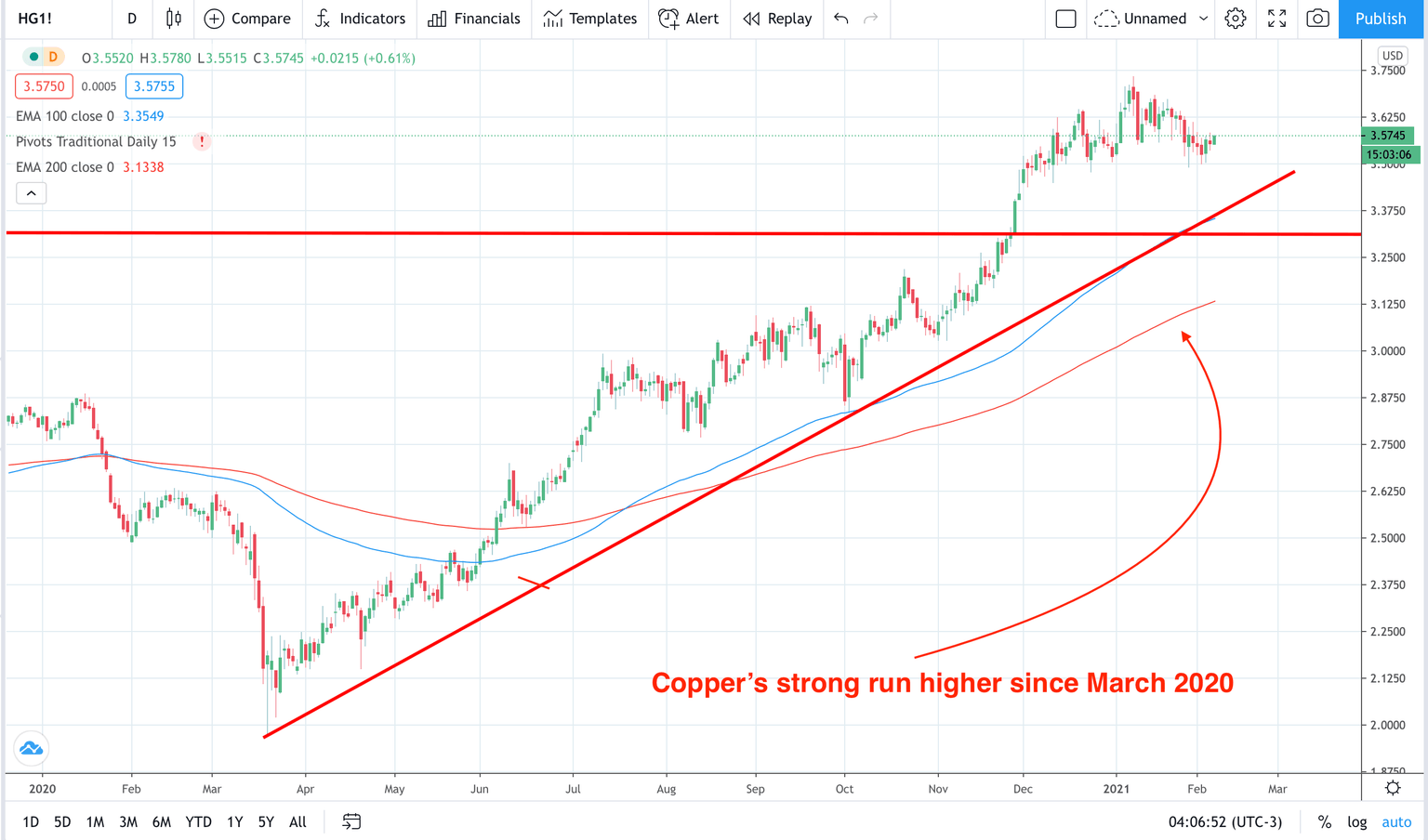

Copper set for dip buyers

Copper is sometimes referred to as Dr. Copper since it has such a strong connection to global economic health. One appointment with Dr. Copper can give you a quick global health analysis. The verdict since March 2020 is that the globe is setting up for a very strong post viral recovery. As long as vaccines are largely effective then the world should get back to business. As it does in construction and manufacturing copper is set to find high demand. Getting into this copper long trade has proven to be more difficult since it has had few pullbacks on recent strong buying.

Citigroup see pullback ahead

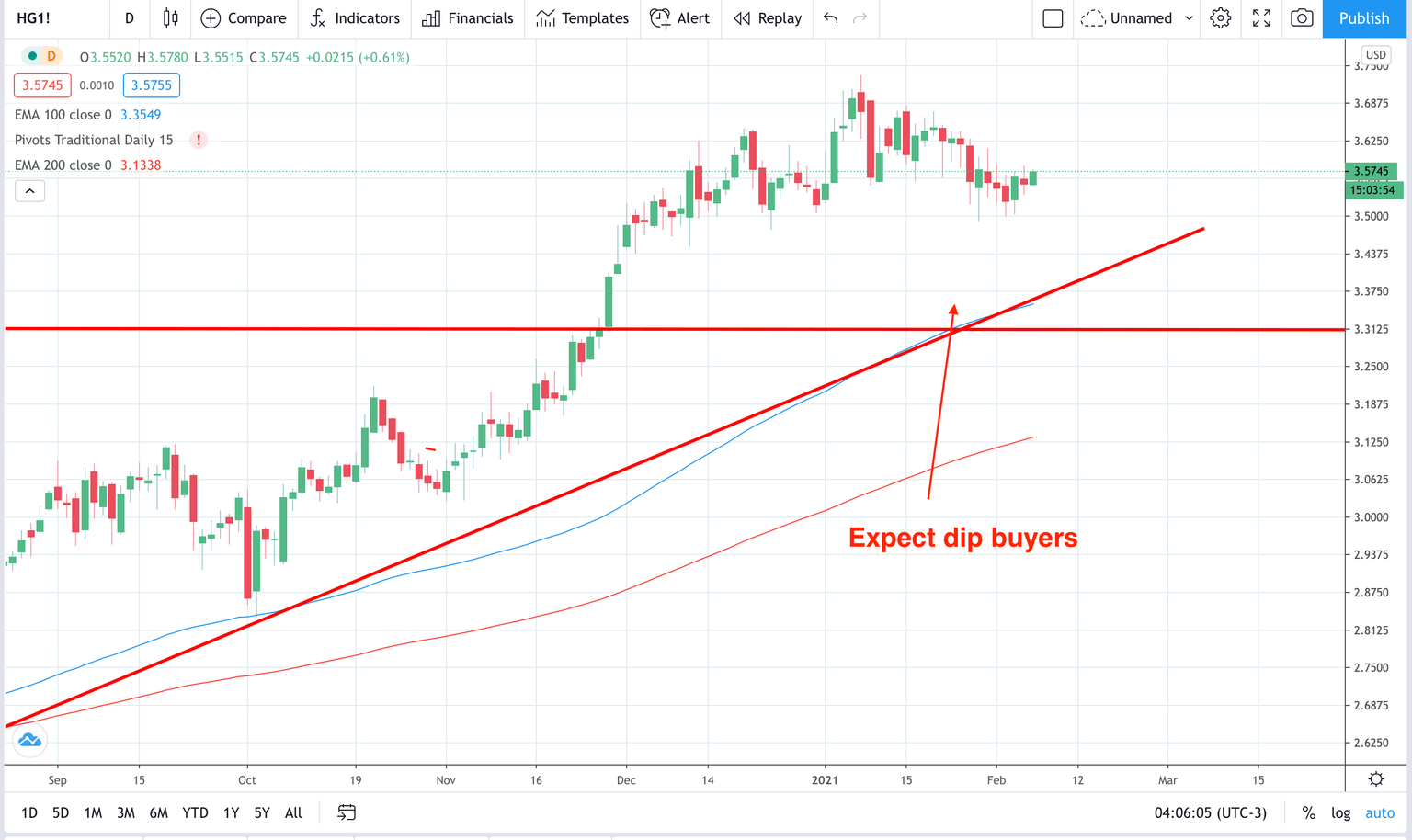

Copper has seen some weakness recently and this could be an opportunity to buy the dip according to Citigroup. They see potential for copper pulling back in the next couple of weeks for the following reasons:

-

There has been weakness in China's PMI data.

-

There is growing potential for further local lockdowns.

-

There is the possibility of coronavirus mutations.

However, the above should be considered as = opportunities for dip buying according to Citigroup because of the following reasons:

-

There has been good data from the developed world's construction, consumer goods and automotive sector. Especially so when you consider the lockdowns we have been under.

-

The bank sees copper averaging prices of $7,800 a ton.

On top on Citigroups reasons there is also heavy green tech demand for copper. That should prove to be another upside pressure for copper going into 2Q onwards. Take a look at the chart below for areas where we may find copper buyers on pullbacks.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.