Collecting pennies in front of a bulldozer

2020 is almost over and it will take its unique place in history. Imagine that someone told you a year ago that a global pandemic hits the world and leads to the most severe economic downturn since the Great Depression. Yet, equities trade at all-time highs near year-end. You would have probably questioned that person’s sanity.

The market path did not surprise us. Our base case scenario was a correction towards 2000-2200 that resolves in a bull run. It is reflected in the first chart below that we shared with our clients in January 2020. The template remained valid as the year progressed. It guided our write-ups that warned of an imminent bear market towards the February 2020 selloff. Eventually, the breakout of COVID-19 in China reversed the US equity bull trend. Moreover, policymakers across the globe had a constructive response to the events. Their measures against the pandemic appeared favorable. Therefore, we made a case to buy equities from mid-March until mid-April 2020.

Yet, analysis and investing can be two different things. Our perfect track record got a black eye as we questioned the rally and expected another leg down. Long-term evidence pointed to an unlikely bull market mid-year. However, it proved wrong to repeatedly attempt to fade the rally on the back of that reasoning. Eventually, it became highly likely that the equity market continues rallying into year-end.

Holiday Season

We are about to greet 2021 and equities shrugged off a colossal economic downturn induced by a global pandemic. The first people have been vaccinated most recently. What could possibly go wrong? The answer is not much into January and a lot after that! Large parts of the population are suffering from a social distancing blues. They get less careful as a vaccine solution seems in reach. Moreover, the holiday season is on our doorstep. It is the largest event in the Christian culture next to Easter. Travel typically picks up during the next weeks. The period is the exact opposite of social distancing as we spend that time with our friends and family. More infections are highly likely short-term.

Ineffective COVID-19 Response

Meanwhile, the pandemic has a tight grip on the US and Europe. The infection and death incidences shot up during the past weeks. Likewise, some hospitals reached their ICU capacity limits already. Unfortunately, the Western COVID-19 response did not prove effective. We did not copy countries’ policies that proved successful. Singapore, South Korea, and Taiwan had a great emphasis on their tracking and tracing. None of the Western countries increased its tracking system capacity despite plenty of time during the summer months. Consequently, we are entering a race against time during the Winter. Immunization of a critical mass within the high-risk group is unlikely within the next 6-8 weeks. Therefore, either an overwhelmed health care system or more lockdowns are likely in Western economies short-term. Our policymakers tended towards imposing lockdowns as the situation escalated.

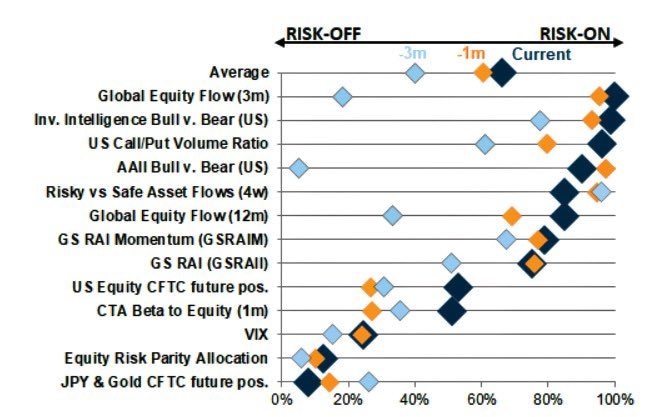

Everybody Is Bullish

Further lockdown restrictions remain the base case. Consequently, adverse economic effects are likely during the first quarter of 2021. Moreover, the sizable monetary and fiscal impulse did not feed into the private sector. Early indicators, such as loan demand, are contracting again. Yet, US equities are priced for perfection and market participants are extremely bullish. Sentiment gauges across all cohorts record extreme bullish sentiment, low cash ratios, and high equity exposure at the time of this write-up. The popular opinion is that nothing can take the equity market down if a pandemic and the severest recession since the Great Depression couldn’t. However, empirical evidence reveals that extreme consensus expectations proved most often incorrect. Moreover, historical cycle statistics support the bear case. The past 170 years never recorded such a short stock market correction during an economic recession in the US. Neither has there been such a swift recovery. Instead, recessionary forces are most likely persisting in the real economy. Combining that with the exuberant sentiment picture and likely corona escalation hints to a sharp correction at some point in early 2021.

Source: Goldman Sachs, Haver Analytics, Datastream

Technical Analysis

The most likely Elliott wave interpretation is in line with that scenario and points to a sharp selloff in early 2021. The S&P 500 wave structure counts best as a sideways correction of primary degree. The 2020 rally has a three-wave character and probably traces the last bull run within the pattern. It is probably not finished and likely to lead above 3888 in early January. Subsequently, the pattern ends with a strong selloff and likely leads once again to the March 2020 low. The plot that we witnessed in 2020 probably won’t change from a policy perspective. Policymakers will keep their supportive stance and bail out the economy and market once again. That’s precisely what they believe worked in the past 12 years repeatedly in Europe and the US. A supportive scenario remains the base case as long as we do not witness a regime shift in monetary and/or fiscal policy.

Conclusion

The bottom line is that the recession is probably not over. Stocks decoupled from the economy in a liquidity-driven melt-up. Nonetheless, positive seasonality will probably carry the S&P 500 slightly higher during the next few weeks. However, our fundamental, behavioral, and technical indicators signal a similar setup as in early 2020. A substantial asymmetric risk-reward setup built up and signals that bulls are likely to get humbled in early 2021. Therefore, selling around 3900 is probably an appropriate strategy from a tactical perspective.

Interested in more of our ideas? Check out Scienceinvesting for more details!

Author

Science Investing Team

Science Investing