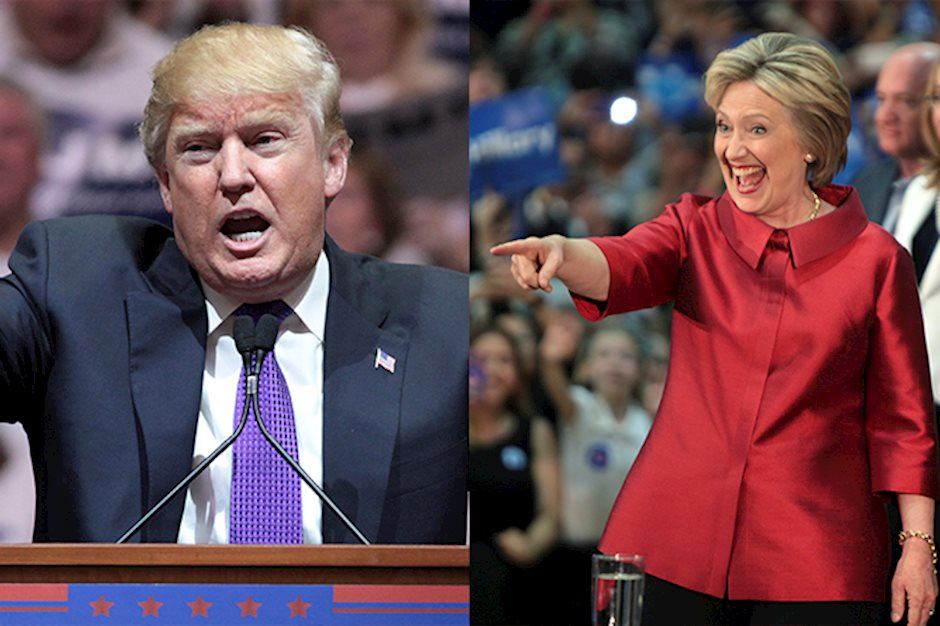

Clinton flailed a little, Trump lied a lot

Outlook:

It might be significant that all the Sept job growth came from the private sector, 167,000 and the public sector contracting by 11,000. Overall, the 3-month average job growth remains at 192,000 and the 6-month, 167,000. Sept almost always overcounts for seasonal rea-sons the Bureau can't iron out, so economists expect a pullback in Q4. Another issue economists look at is the divergence between services (157,000 new jobs) vs. manufacturing (-13,000), although construc-tion added 23,000.

Analysts note that the CFTC Commitments of Trader report shows speculators adding to the gross short euro position by 11,200 contracts to 187,7000 contracts. Traders also went more short the pound, by 11,200 contracts to 154,300, a new record high and from 94,800 in the week after the June 23 Brexit vote.

It's the second week of the month and so data releases are sparse. In the US, notable will be the FOMC minutes on Wednesday and retail sales and consumer sentiment on Friday. Retail sales are forecast at a whopping 0.6% so a shortfall could be dollar-negative. Tomorrow we get the ZEW sentiment in Germany and Japanese machinery orders. Wednesday also brings eurozone industrial production, probably a good 1.5% after several countries reported gains last week. Thursday brings Chinese trade data, with exports forecast down again in Sept after -2.8% in August.

The best event of the week so far is the Noble Prize for Economics going to two economists (one from Harvard and one from MIT) who performed work on contract theory, dealing with such issues as what sectors should be private and which public. (Last time the prize went to two guys with competing theories, which was very annoying.)

In the absence of compelling economic data, we can contemplate the flash crash in sterling last week, which the FT attributes to "liquidity holes," especially in the sleepy Asian hours. Big banks can't do the size they used to because new regulations restrict big positions. Big algo trading firms are starting to dominate. "In May, the annual Euromoney survey found that XTX Markets, a small market maker formed by former traders, was the ninth-biggest trader in global markets, outdoing some banks." See the BIS chart. Maybe the FX market has finally stopped growing and with the composition shifting to mechanical algo trading, volatility may rise.

What else is on the table this week? More talk about the Fed's attitudes and proclivities. Those three dissenters are going to come in for some heavy breathing. Perhaps some talk about political risk and how unwise is too big a position in emerging markets (Turkish lira back to crisis lows). Maybe some additional news about Brexit, although now that everyone is following every twitch and tumble, we are at risk of over-interpretation. Oil, of course. And the US election. Not all of these factors are dollarpositive.

Political Tidbit: The ICK factor emanating from Trump should have been no surprise to anyone and indeed diehard supporters are staying the course, despite Trump admitting he is a lewd and sleazy groper. In case you missed it, Trump is shown on tape bragging about groping women—legally, assault-- and getting away with it because he's a celebrity. Anyone paying attention already knew that.

The cable news channels ran the groper story practically non-stop all weekend along with GOP leaders deserting Trump in droves, including a total of 15 senators and numerous representatives and governors for a total of 160 top leaders, an unprecedented development. Trump's invitation to a party event with puritanical Speaker Paul Ryan was revoked. Many called for Trump to resign from the ticket. The GOP will re-direct campaign spending away from Trump to the down-ticket races, although it's well within reach for the Dems to take back control of the Senate. Oh, dear, that means a return of the slimy Nancy Pelosi. Trump calls the defectors "self-righteous hypocrites."

How can anyone support this repulsive guy? The New Y orker magazine has a stunning article on why West Virginians support Trump, and it goes beyond coal to their imagining Trump recognizes their emotional attachment to their state and wanting to fix it up instead of spending money fixing up other countries.

The debate Sunday night was painful to watch. In the end, the CNN polls showed Clinton won but Trump didn't explode or implode, surpassing expectations. Since when does not failing utterly mean winning? Bloomberg reports the Mexican peso gained 1.3% by the end of the debate, meaning a Trump presidency is really very unlikely.

Clinton flailed a little. Trump lied a lot. Trump answered a question about his groping women with a statement about ISIS beheading people. Other answers were equally unresponsive, irrelevant and incoherent. He also snuffled a lot and prowled the stage, sometimes looming over Clinton from behind. Trump lies include that the trade deficit is $800 billion (it's about $480 billion). Numerous sites have fact-checked Trump's statements and find over half are either flat out untrue or wildly misleading. Politifact has only 16% of Trumps' statements as true or mostly true.

Trump thinks he can make up reality. He denied telling people to go check out the Miss Universe sex tape (which does not, apparently, exist) when his Twitter clearly says exactly that. The comment that is grabbing attention so far is his charge that if elected, he would appoint a special prosecutor and send Clinton to jail, again showing he doesn't know how government works—and also sounding like he thinks the president is a dictator in a banana republic.

The FT's Luce hits the nail on the head—by not losing, Trump won and seems to be the outsider taking down the Establishment, exactly what supporters like. "By another barometer — the one that involves evaluating the truth of each candidate's words — Mr Trump was the clear loser. Virtually every policy answer he gave contained extravagant untruths. Tens of thousands of Syrians were apparently flooding into America. The late Humayun Khan — the Muslim-American officer who died in Iraq — would still be alive if Mr Trump were president. ‘Nobody respects women more than I do.' And so on.

"But if grasp of the facts were important, Mr Trump would not have been on stage in the first place."

The unavoidable implication is that were Trump to win the election, the US voters are a bunch of uninformed nitwits with no respect for truthfulness, let alone self-control and dignity. Well, consider that Boris Johnson "won" the Brexit vote and while considerably less obnoxious than Trump, still pretty obnoxious. Sometimes voters just want to throw the bums out.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 103.29 | LONG USD | STRONG | 10/06/16 | 103.50 | -0.20% |

| GBP/USD | 1.2407 | SHORT GBP | STRONG | 09/10/16 | 1.3041 | 4.86% |

| EUR/USD | 1.1168 | SHORT EUR | WEAK | 09/19/16 | 1.1168 | 0.00% |

| EUR/JPY | 115.36 | LONG EURO | WEAK | 10/06/16 | 115.78 | -0.36% |

| EUR/GBP | 0.9000 | LONG EURO | WEAK | 09/19/16 | 0.8564 | 5.09% |

| USD/CHF | 0.9803 | LONG USD | WEAK | 09/19/16 | 0.9804 | -0.01% |

| USD/CAD | 1.3262 | LONG USD | WEAK | 09/15/16 | 1.3203 | 0.45% |

| NZD/USD | 0.7134 | SHORT NZD | WEAK | 09/19/16 | 0.7305 | 2.34% |

| AUD/USD | 0.7590 | SHORT AUD | WEAK | 09/24/16 | 0.7618 | 0.37% |

| AUD/JPY | 78.40 | LONG AUD | STRONG | 10/06/16 | 78.48 | -0.10% |

| USD/MXN | 18.9659 | LONG USD | STRONG | 05/06/16 | 17.9418 | 5.71% |

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat