China’s press conference confirms a COVID-19 ‘pivot’ in all but name

Back in May, the outlook for China exiting its Covid-Zero looked like it was going to be a long draw out affair. Weaker hospital infrastructure, lack of vaccination of the elderly, and the lack of an endgame policy, all meant the retreat was going to be gradual rather than fast for China. However, some things have been changing.

In May, about half of those 80+ were not vaccinated. That has now risen to around 66% that are double vaccinated. Furthermore, this week China’s Health Official urged the elderly to have their Covid vaccines, so the messaging is now prioritising the correct, vulnerable elderly group. You can watch the broadcast here via Reuters. From a policy perspective, any stress on vaccinating the elderly is equivalent to saying, ‘let’s accelerate our exit’.

The pivot is afoot

First of all, China’s CDC officials say that they will promptly and effectively solve difficult problems reported by the masses. When asked if the protests will prompt them to reconsider the Covid-zero policy they said they will continue to ‘fine tune’ their policy. Remember, when it comes down to what to do next, President Xi’s options are limited.

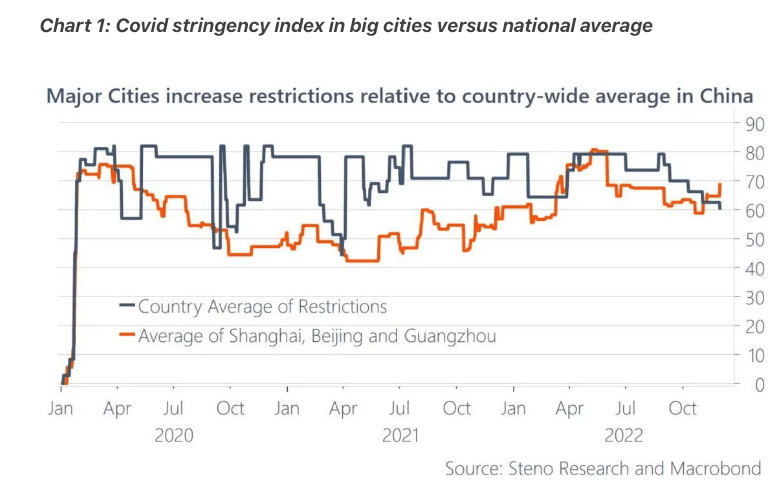

In the early hours of Tuesday morning, China Global Times Hu Xijin tweeted that, ‘China may walk out of the shadow of Covid-19 sooner than expected’. This is in keeping with the fall in stringency measures across China. Here is a chart taken from Andreas Steno’s helpful piece on China’s re-opening.

So, the constant negative stream of expectations for China on Covid-Zero policies may well be overdone. For those with a longer-term view, the re-opening argument has become unhelpful. Long-term traders may continue to see this dip as well worth buying as indicated at the bottom of the article here.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.