China’s March exports shrugged off early tariffs, but headwinds are intensifying

President Trump’s fentanyl rounds of tariffs did little to dent China's exports in March, with growth beating forecasts once again. However, several categories already are starting to show the trade-war impacts. Next month's bilateral trade data is likely to fall off sharply.

China's first quarter trade balance beats expectations on stronger exports and weaker imports

Exports continued to beat expectations in March

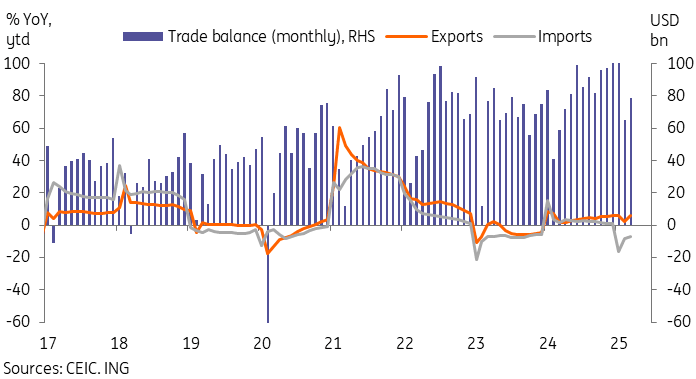

Chinese exports bounced back stronger than expected in March, up 12.4% year on year from 2.3% YoY in the first two months of the year. Though trade data forecasts often have a high margin of error, exports were significantly higher than forecasts for 4.6% YoY growth. In the first quarter, exports grew by 5.8% YoY, just 0.1pp short from last year's annual growth rate.

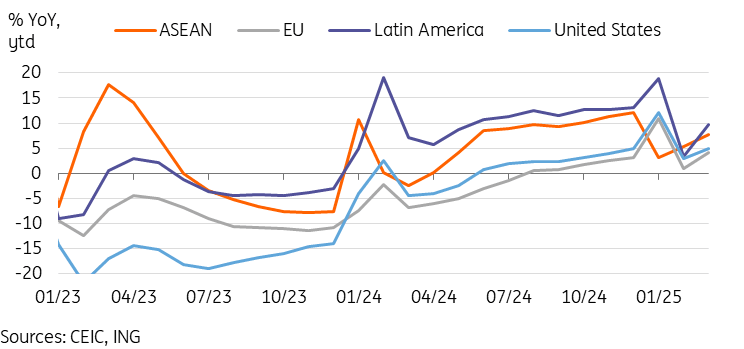

By export destination, exports to the US picked up despite President Trump’s fentanyl tariff hikes of 20%. The March data brings the first quarter growth rate to 4.5% YoY, up from 2.3% YoY in the first two months of the year. Savvy US importers likely saw tariff hikes coming in April onward and frontloaded imports. Furthermore, the tariff exemption for packages already in transit may have also supported the data. The US aside, exports to many other regions accelerated in March. Exports to ASEAN, China's largest export destination, accelerated to 8.1% YoY in first quarter, driven by strong export growth to Vietnam, Thailand, and Indonesia. Other outperformers included exports to India (13.8%) and Latin America (9.6%). On the other hand, exports to the EU (3.7%), Japan (2.8%), and Korea (-1.7%) underperformed the headline growth.

By product, semiconductor (10.8%), household appliance (8.7%), and LCD display (8.4%) exports outperformed in the first quarter. However, we saw exports of footwear (-11.2%) and apparel (-1.9% contract, perhaps reflecting early impacts from tariffs where products with easy substitutions were displaced. Exports of rare earths also slumped -10.9% YoY, year to date, as export controls increased.

This month's data was highly anticipated, with markets looking for the first signs on how tariff might be starting to impact trade. The data showed that overall exports remained quite resilient, but that easily replaceable and price-sensitive categories are already taking a hit.

With a staggering 145% tariffs coming into effect, it's likely that next month's data will tell a dramatically different story.

Exports to US still in positive growth in 1Q25

Import weakness shows there's work to be done in shoring up domestic demand

Imports on the other hand fell to just -4.3% YoY in March, bringing the first quarter import growth to -7.0% YoY.

By product, the rise of the domestic car industry combined with a more cost-conscious Chinese consumer resulted in a sharp -44.5% YoY decline of auto imports in the first quarter. Continued sluggishness in the property market also resulted in related declines of steel (-10.5%) and lumber (-9.7%) imports. Energy and agricultural imports were both on the soft side as well.

The lone bright spots included hi-tech (9.2%), automatic data processing equipment (85.0%), and aircraft (156.7%) imports, which could've also reflected some pre-tariff import frontloading.

Strong trade surplus to support 1Q25 growth

As a result of outperforming exports and underperforming imports, China's trade balance rose to $273bn in the first quarter. This was nearly $100bn higher than the trade surplus from first quarter of 2024, and suggests that net exports will offer a nice boost to the first quarter 2025 GDP growth.

We're expecting first quarter GDP growth could hit 5.3% YoY, which will likely be the strongest reading of the year, barring a sharp U-turn in terms of external conditions and stronger-than-expected domestic stimulus.

April's sharp tariff hikes will likely have a dramatic impact on the next few months of data

While March data showed encouraging signs that the 20% tariff hasn’t significantly hampered China's exports. But the sharp escalation of tariffs since then no doubt will paint a much different picture once April's data comes in.

Trump's temporary carve-out of semiconductors, computers, and smartphones from the country-wide tariffs will offer some relief for those exporters. Indeed, we could end up seeing continued frontloading of imports to offset later tariff hikes that Trump has already signalled.

However, the rest of China's exports to the US (as well as US imports to China) will now be put to test a real-world case study for price elasticities. At the current tariff rates, it’s likely that trade in the majority of products which have a viable substitute on the global market will be discontinued. It's also likely that even products without viable alternatives could see trade temporarily plummet as importers wait to see if there will be any adjustment to tariffs -- and work through inventories -- before deciding to import new stock. As a result, it's likely that direct trade between the US and China will crater starting in April. It could take several months before we get any definitive answers on which party ends up bearing more pain from a sharp drop in trade. By that point, it’s possible that tariff scenario looks completely different from today.

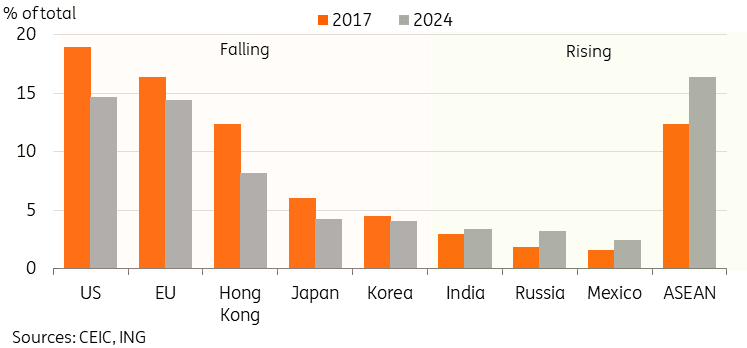

As we’ve written in the past week, it's likely that China and the US are now in a test of endurance. Nonetheless, we expect that talks eventually will resume in the coming weeks and months. Much has been made of US de-risking of China in the past few years. But China's de-risking from the US, with a lower proportion of US-bound exports and fewer companies existentially reliant on US suppliers or customers, also has emboldened policymakers to retaliate.

China's US de-risking has emboldened policymakers to retaliate

Read the original analysis: China’s March exports shrugged off early tariffs, but headwinds are intensifying

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.