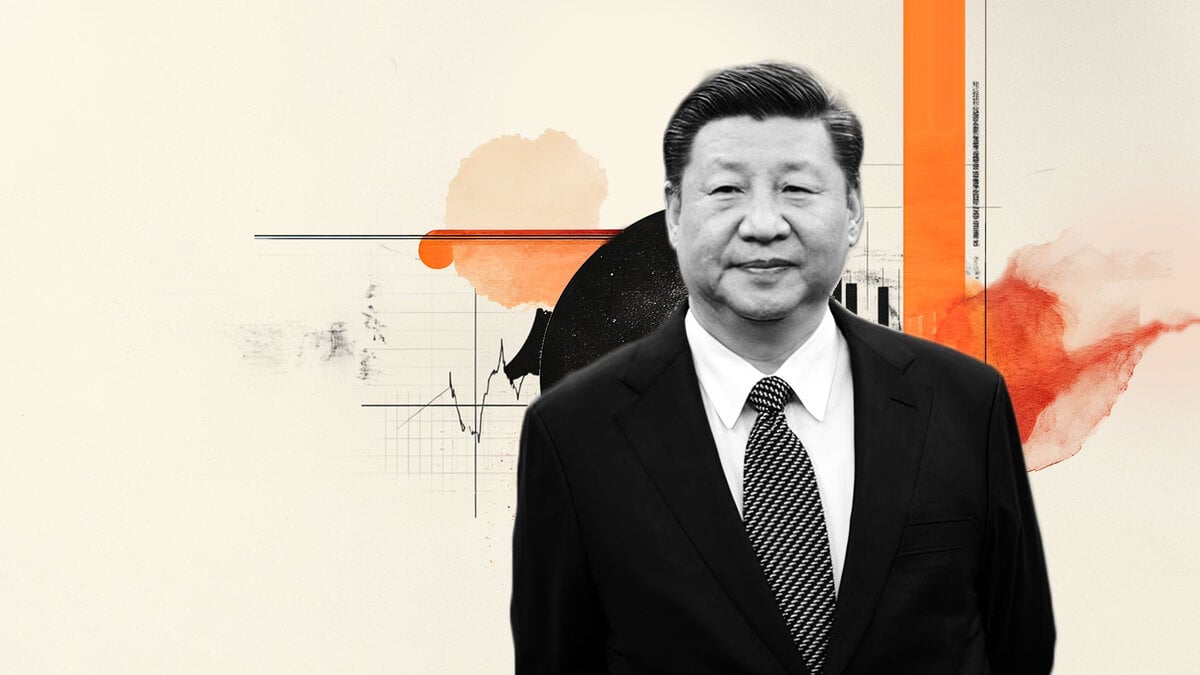

China with bigger leverage over the US?

Important News for the day

-

Wed, 15th, 21:45 CET AU RBA governor Bullock speech.

US-China trade war

Ahead of the meeting between US President Trump and China's President Xi differences in the approach of both countries remain clear. China’s rise has not only been due to the ability to copy western products but also in innovation itself. The US have so far not been able to make up for their lack of rare earth while China increased processing capabilities as well as also innovate in in the semiconductors space. If China would shut access for the US for rare earth the problem of the current advance in the US will fade fast.

Market talk

The positive sentiment in markets returns with the weakness of the Dollar. As the Greenback continues to lose some momentum also equities move higher again. Yet, the positive sentiment does not support the crypto world. Most tokens remain positive after the slide last week but failed to rise further. Worth noting that push higher in precious metals and in particular Gold continues. on the other hand oil prices remain subdued and might weaken further. A break of the USD 56,00 technical support zone might offer another big slide in prices in the near future. The global economy remains fragile and could quickly cause the demand to fade more.

Tendencies in the markets

-

Equities positive, USD weaker, BTC sideways, ETH positive, oil weaker, Silver sideways, Gold positive, JPY sideways.

Author

Frank Walbaum

FX Strategies.Asia

Frank has been working in the TV business for several years. Acquiring his skills in Germany’s biggest broadcasting station, he then chose to work and live in Asia, which was in 2007.