China steadies the path

China’s National Peoples Conference has set an economic growth target for the country over the next year of 5%.

China has always liked achieving whatever target was set, but in recent years this has been more difficult.

This is by no means a subtle shift in the state of affairs when it comes to China. The ramifications for all of Asia and the rest of the world are significant.

Though some may make the mistake of thinking this is a policy decision, it is now more about what is ‘achievable’, given the nature of the various realities that confront the world’s second largest economy, both domestically and overseas. Where once the NPC set economic growth targets as the goal to be achieved. As an incentive target. The shift has been to what they now think is achievable.

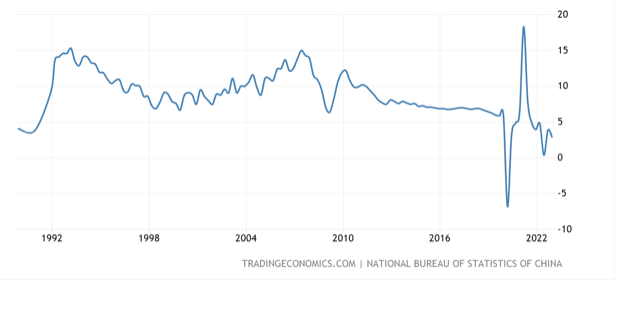

For some time, I have been warning that the Covid experience was economically masking a far deeper reset taking place in the Chinese economy. That, from the super-growth period of recent decades, form a largely agrarian economy to a fast modernising industrial and consumer society. Hence the tremendous growth and wealth outcomes of the past twenty years.

The Chinese economy was already past the tipping point where that style of growth rate would settle back toward more sustainable levels that would normally be sustainable for a maturing, if not yet fully mature, truly modern economy.

Post-Covid volatility the Chinese economy is permanently reset lower.

This means that growth rate outcomes over the next 1-3 decades will be more akin to those of the mature western economies. Not as low as their normal trend levels of the west, but certainly tending much closer to these levels.

This is why, for the past year, I have been forecasting a normalised growth path of 2% to 5%. The NPC has decided to shoot for the top of my range.

They do like to exceed their targets though. In much the same as US corporations like to set low expectations so they can give themselves bonuses when they exceed them. For this reason, it is possible that China could achieve 5.5% to 5.6% this next year.

This would be stretching to the high side however. Even if there are no other lockdowns or interruptions to the mainstream functioning of the economy.

It would be a grave economic error for anyone to suggest this lower than we were previously accustomed growth target, was merely still due to temporary factors surrounding Covid.

This is indeed the new normal for China, and will remain so enduringly for decades to come.

The economic policy of other nations around the world should indeed adjust for this shift.

Things will be different going forward. Still a strong economic trajectory, but no longer the spectacular.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a