CHF/JPY: The Bull continues its domination

CHF/JPY has been bullish on the daily chart. The chart produced a bullish marubozu candle yesterday, which closed above a daily resistance. The breakout may attract the buyers to look for long opportunities and push the price towards the North further. Major intraday charts are bullish biased, but they may consolidate before making the next bullish move. Let us have a look at the Daily- CHF/JPY Chart.

Chart 1 CHF/JPY Daily Chart

The chart shows that the price made a breakout around the level of 112.400. Since the breakout took place right at the level of support, some buyers may wait for the price to be held by the level of support. However, the candle closed well above the breakout level, so any intraday breakout at yesterday's highest high may make the buyers look for long opportunities. The price may find its next resistance at the level of 114.550 on the daily chart.

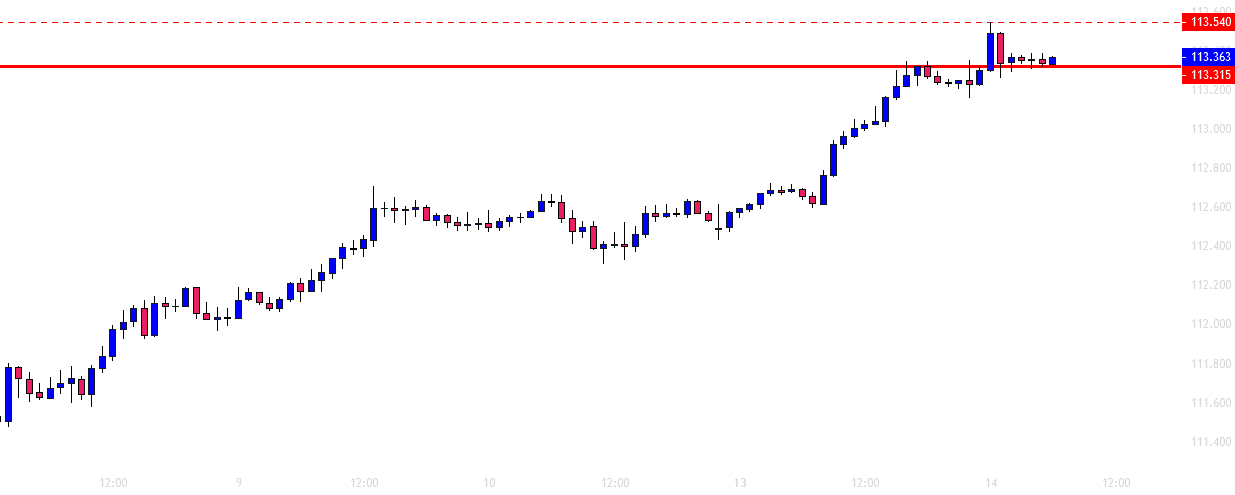

Chart 2 CHF/JPY H4 Chart

The H4 chart shows that the price has kept making new higher highs. After having a rejection, it produced a bullish candle having a long upper spike. This may make the pair consolidate more. The level of 113.230 may come as a level of support and push the price towards the North. If the price makes a bullish breakout at the level of 113.540, it may find its next resistance at the level of 113.945. On the other hand, if the price makes a bearish breakout at the level of support, it may find its next support at the level of 112.640.

Chart 2 CHF/JPY H1 Chart

The H4 chart looks bullish biased. However, a lot depends on the level of 113.315. If the level holds the price and produces a bullish reversal candle, the buyers may go long above the level of 113.540. The chart shows that the price has been around the level for quite a while. If it makes a bearish breakout, the sellers may go short on the pair and drive the price towards the level of 112.640. This is a potential level of support on the H4 chart as well. The sellers may keep their eyes on the H1 chart. However, the daily and the H4 chart are bullish biased. Thus, the H1 chart may get bullish and push the price towards the upside. Considering all these factors, the bull may continue its journey and end up producing another daily bullish candle.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and