Charts of the week: AUD/JPY & GBP/USD move to critical levels, extensions likely

As we head into the closing trading days of the year, two charts have stood out the most – AUD/JPY & GBP/USD. However, holiday lull likely means consolidation and profit-taking.

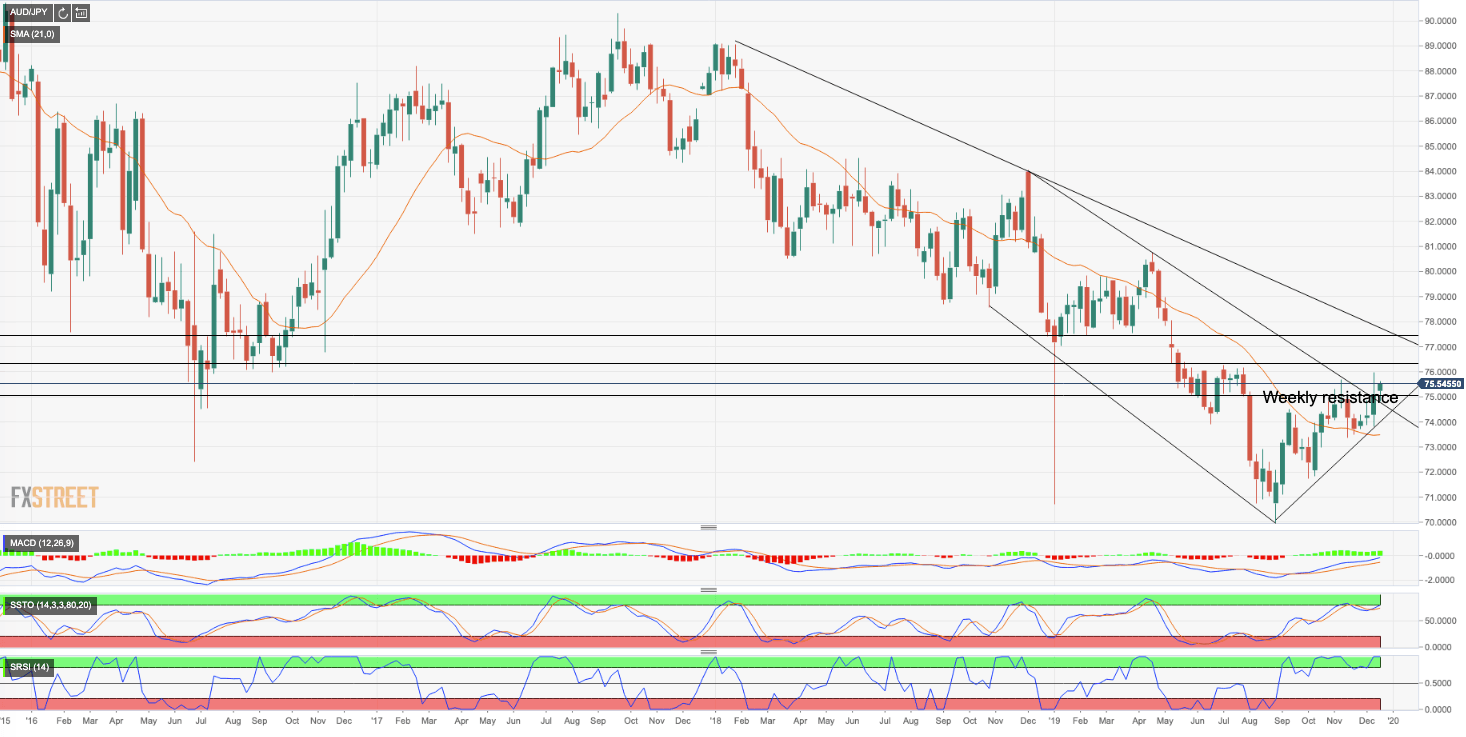

AUD/JPY bulls targetting 76.50 ahead of 77.50

- Broken the weekly down channel resistance.

- Supported by the 21 200-week moving average.

- Weekly RSI/Stock and MACD have upside.

- Next upside targets can be located at 76.34/50 and 77.54.

Supported by the 21 200-week moving average, AUD/JPY has been grinding its way higher within an ascending wedge pattern as traders buy the dip on positive fundamentals. The price action ended last week technically bullish with momentum indicators in positive territories with plenty of upsides yet to go on the longer-term time frames, such as the daily and weekly charts – Weekly RSI/Stock and MACD have upside.

Bulls extended the Thursday close above the 200-day moving average on Friday making for three days of consecutive higher highs and lows. The December low so far has been higher than the November and October lows, bullishly reinforced by a higher December high versus the November high and price action paints a bullish bias. The move has also broken the weekly down channel resistance. While liquidity in thin out there, outside of a surprise geopolitical trigger, it is highly unlikely that we will see additional moves unlit after the holiday lull. However, the next upside targets can be located at 76.34/50 and 77.54.

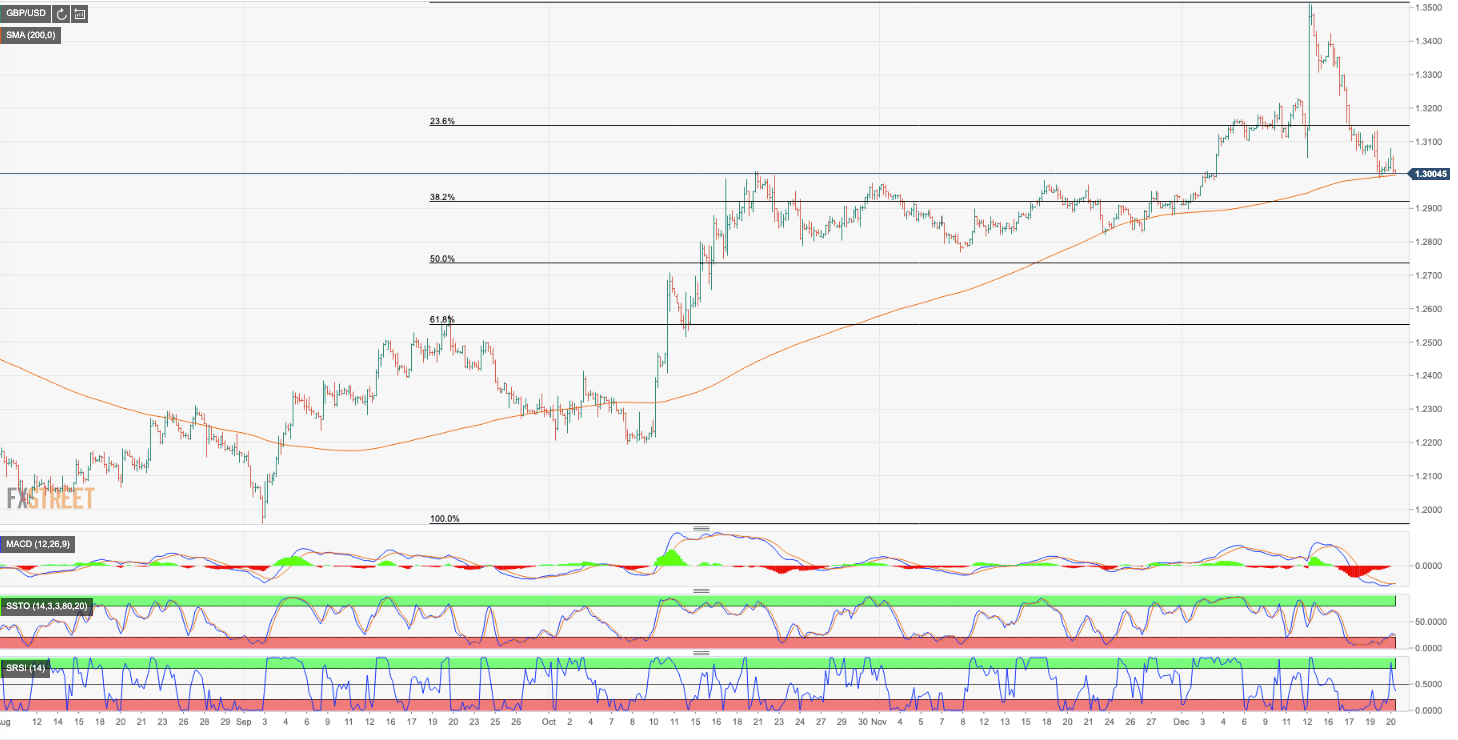

GBP/USD bears seeking critical support down at Nov 7th lows

- GBP/USD testing the 200 4-hour moving average.

- GBP/USD closes below a key support at 1.3011.

- Bears eye a 38.2% Fibo retracement confluence target (50-DMA) around 1.2920.

- The 7th Nov lows are located at 1.2768 ahead of 50% Fibo around 1.2740.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.