Chart of the week: Oil prices spiking and intent on 2019 highs

- Bulls in control due to the conflict in the Middle East between Iran and the US.

- The price action is bullish in the short term charts following a 50% mean reversion of a breakout from the 200-hour moving average.

- The daily outlook targets the 2019 highs initially and tougher resistance higher up through 69.60.

Following the escalations of tensions between the US and Iran and the US drone strike on Qassem Soleimani, head of Iran's elite Quds, oil prices are moving higher and are set to target the 2019 highs ahead of key resistance.

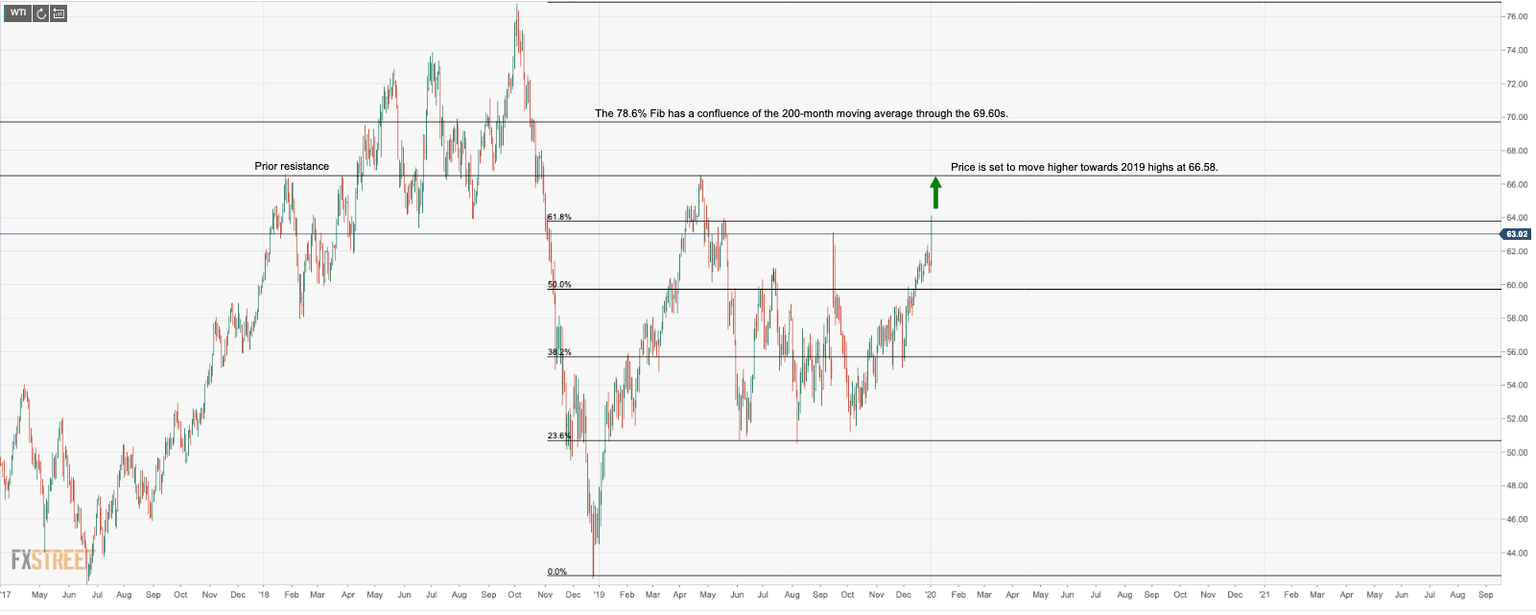

WTI daily chart

- The price of oil surged to a fresh eight-month high last week.

- Bulls can target a break of the 61.8%% Fibonacci retracement of the October to Dec lows.

- Price is set to move higher towards 2019 highs at 66.58.

- The 78.6% Fib has a confluence of the 200-month moving average through the 69.60s.

- 76.88 Oct 2018 highs has a confluence with Sep 2011 lows/summer 2006 highs which could prove to be a tough resistance.

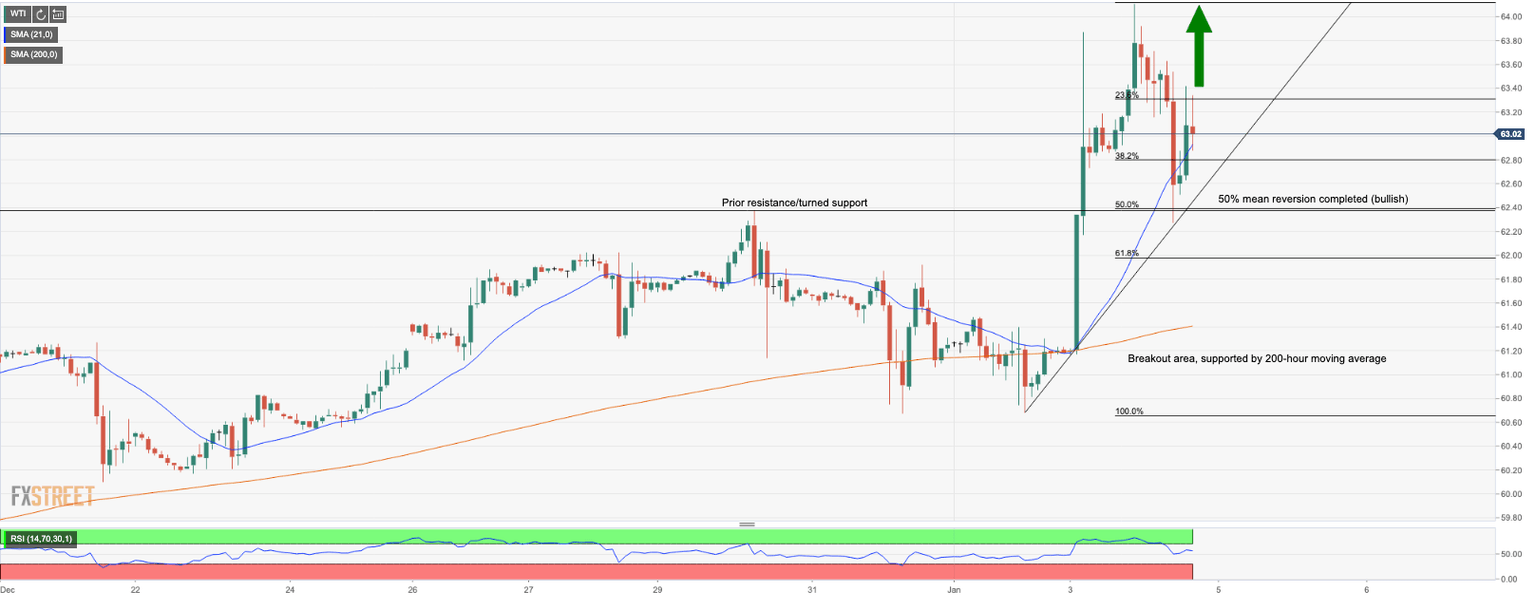

WTI hourly chart

- The price is a constructive bid holding above 21-hour moving average and trendline support.

- RSI is below overbought territory although holds above 50 as price is supported at a 50% mean reversion.

- Support comes at a prior resistance level with the confluence of a 50% Fibonacci retracement of the breakout at the 200-hour moving average.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.