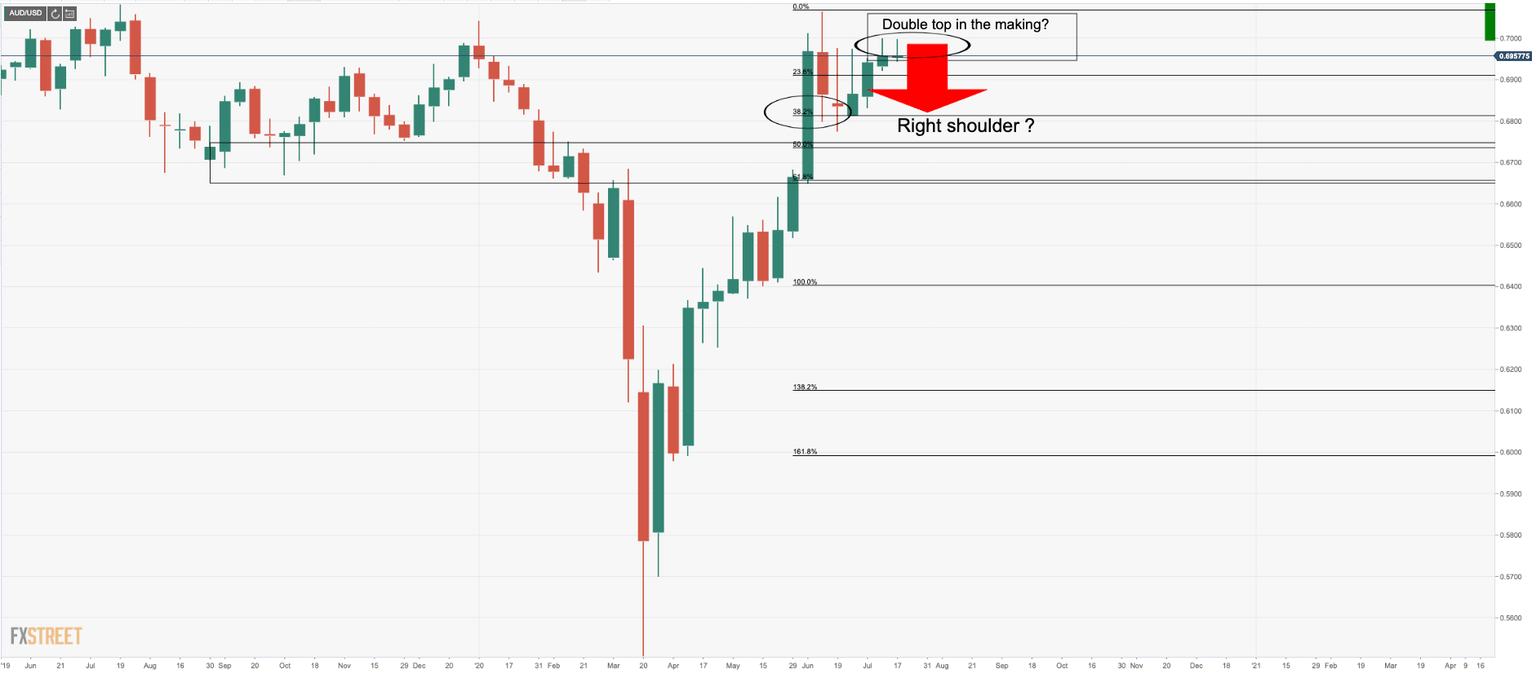

Chart of the Week: AUD/USD bears seeking a double top for H&S downside targets

- AUD/USD can be perceived to have entered a phase of accumulation on the long-term time frames.

- A reverse H&S is in the making for a reversal pattern.

- First, the bears will be in charge and seeking out a right-hand shoulder target.

AUD/USD is in a critical area as bulls and bears battle it out in the barroom brawl between breakout resistance and support.

On the monthly chart, the outlook is clear, with a reverse head and shoulders in the making.

However, should the price fail to move lower at this juncture, then the bulls will keep control and the bearish play will be invalidated.

Instead, the weekly impulse, correction impulse will be in play as follows (Bullish scenario):

First bearish, then the bullish scenario

As we move down to the weekly, daily and 4HR, we can zoom in on the critical areas in a top-down analysis as follows (presuming the right-hand shoulder being completed):

Monthly outlook, inverse Head & Shoulders

The weekly double top in the making

Bears seek break below daily bullish structure

4HR on the verge of turning bearish (MACD)

From a four hour perspective, MACD is still holding in bullish territory.

However, price is below the 21 4-hour moving average and a break below the zero line would pressure the support structure and open prospects of a run towards the 200 4-hour moving average.

A series of tests below the 200 4-hour moving average and what will become a confluence with a 161% Fib retracement at the near-term support structure will open the prospects for completion of the distribution phase.

This is where the right shoulder of the month head and shoulders will be made over a series of consolidation.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.