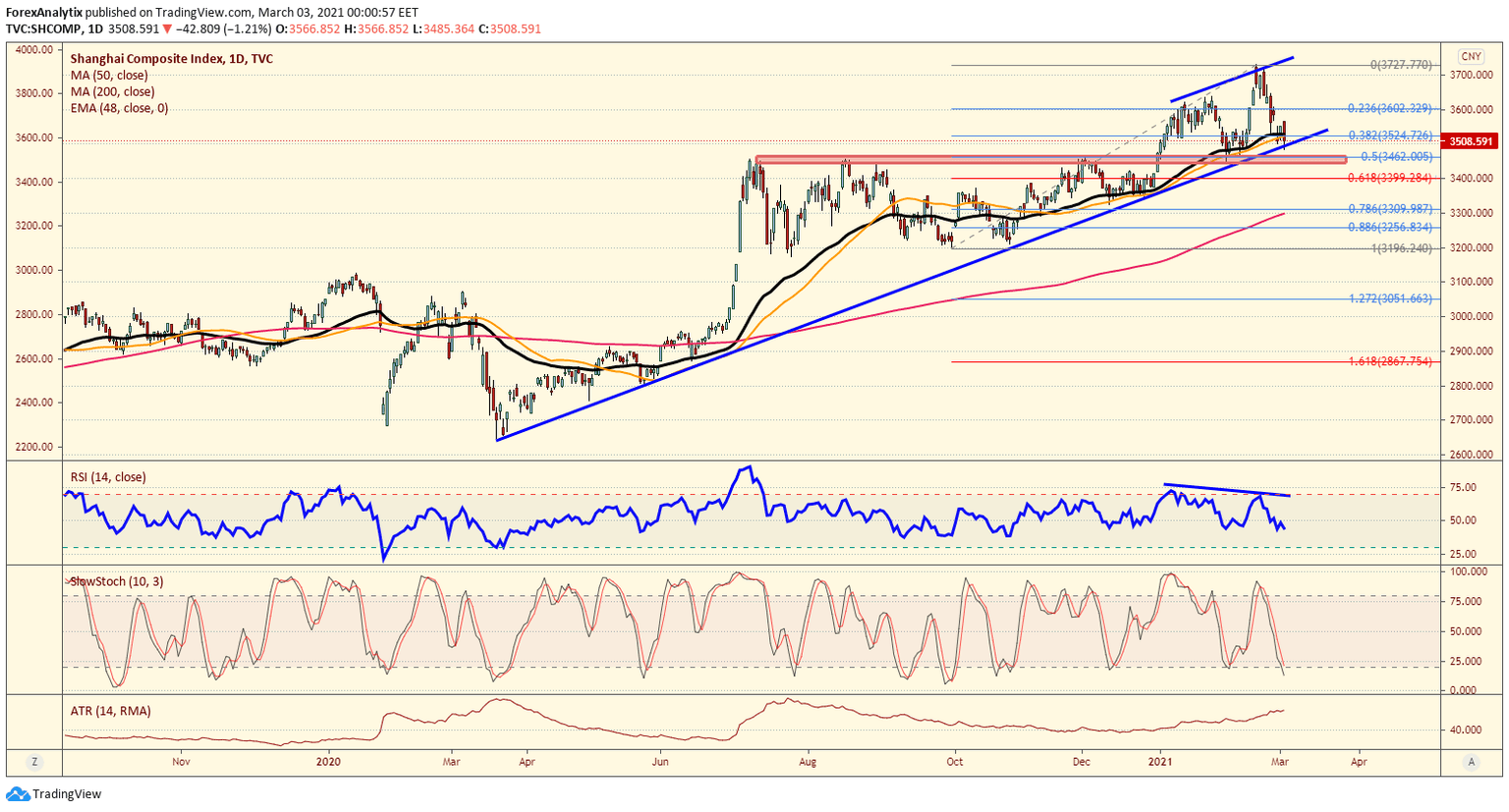

Chart of the Day: Shanghai Composite

One of the pillars of risk appetite globally has been the rally we have seen in equity markets around the world the last year. The Shanghai composite's chart if a great representation of a strong rally since spring of last year. last week and today the composite is testing an ascending trend line near the 3500 level after coming off 52 week highs a couple weeks back with a divergent daily RSI reading. There is a "support zone" at the 50% retracement at 3462 and slightly below at 3442 which bulls should be watching carefully. The risk is a break of this trend line and the 50% retracement could lead to a deeper pullback towards the 200dma near 3300 and could put some pressure on other global market indices.

Author

Blake Morrow

Forex Analytix

Blake Morrow spent most of his professional career as the Chief Currency Strategist for Wizetrade group for 15 years, and then the Senior Currency Strategist for Ally Financial after the acquisition of Tradeking which owned the Wizetrade Group.