CFTC Positioning Report: USD longs plummet to yearly lows

These are the highlights of the CFTC Positioning Report for the week ending March 18:

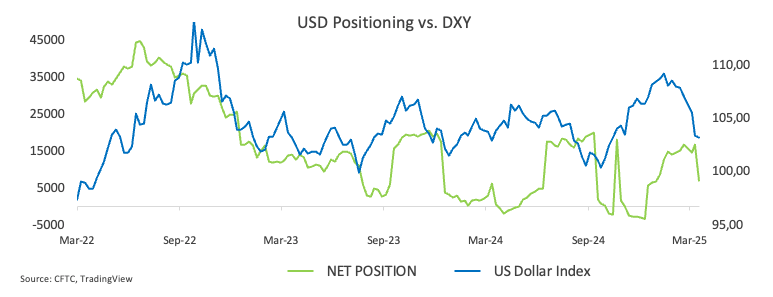

- Speculators trimmed their net longs in the US Dollar to nearly 7.2K contracts, the lowest level so far this year. The period covered the run up to the Fed's interest rate decision, amid ongoing uncertainty over US tariffs and rising concerns about the US economy. The US Dollar Index (DXY) retreated to levels last seen in mid-October 2024 around 103.20, nearly retracing the so-called "Trump trade" (the rally from October to mid-January).

- Non-commercial players turned net longs in the CBOE VIX index (aka “the panic index”) for the first time sin late October 2024, with around 6.2K contracts. The index, in the period, receded from yearly peaks past the 29 mark to levels below 22.

- Speculative net longs in the Euro rose for the second week in a row, this time surging to the vicinity of 60K contracts for the first time since late September 2024. Commercial player (hedge funds) remained net shorts on the single currency for the fourth straight week, although contracts rose to multi-month highs around 92.4K. EUR/USD set aside a knee-jerk to the vicinity of the 1.0800 region to advance to new 2025 peaks past the 1.0950 level.

- The constructive scenario for gold remained firmly in place, as non-commercial net longs rose to a three-week high of around 258K contracts. The precious metal’s climb above the psychological $3,000 mark for the first time was fuelled by ongoing uncertainty over US trade policy, concerns about a possible US recession, and expectations of further easing by the Federal Reserve. Moreover, this uptick in the yellow metal was accompanied by a rise in open interest.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.