CFTC Positioning Report: Speculators were net sellers of the Dollar pre-Fed

The latest CFTC Positioning Report, covering the week to May 6, captures a market navigating mixed signals from the US economy—first-quarter GDP showed a contraction, while April’s jobs data once again beat expectations, all ahead of the Federal Reserve’s May 7 rate decision.

Key Takeaways

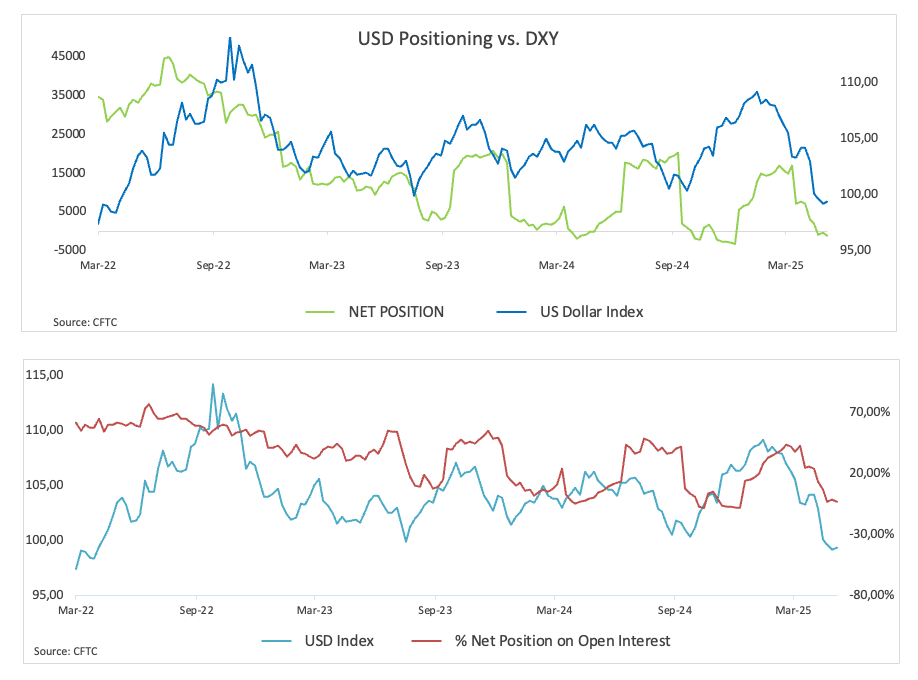

Non-commercial traders extended their net short positions on the US Dollar (USD) to a three-week high of just over 1.1K contracts, even as open interest continued to retreat. The US Dollar Index (DXY) briefly climbed above the key 100.00 level but lost momentum ahead of the Federal Reserve's policy meeting.

Net long positions in the Euro (EUR) were little changed at around 75.8K contracts, levels last seen in early September 2024, while commercial traders (hedge funds) maintained their net shorts near 131.5K contracts. Open interest rose to around 737K contracts but showed signs of slowing. Meanwhile, EUR/USD initially dipped before rebounding toward the 1.1400 mark.

Speculators slightly reduced their net long positions in the Japanese Yen (JPY) to around 176.8K contracts, though positioning remained near recent highs. Commercial traders also trimmed their net shorts to around 200.6K contracts, whjile open interest continued to rise. USD/JPY climbed to three-week tops just pips short of the 146.00 level before slipping into a corrective phase.

Net long positions in the British Pound (GBP) rose to a five-week high of approximately 29.2K contracts, supported by a continued increase in open interest. In spot markets, GBP/USD pulled back from yearly highs above 1.3400, finding tentative support around the 1.3260–1.3250 zone.

Speculative net long positions in Gold fell for a third consecutive week to around 162.5K contracts—the lowest level since February 2024—even as open interest ticked higher. Gold prices initially dipped toward the $3,200 mark before reversing sharply to trade above $3,400 per troy ounce in the days that followed.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.