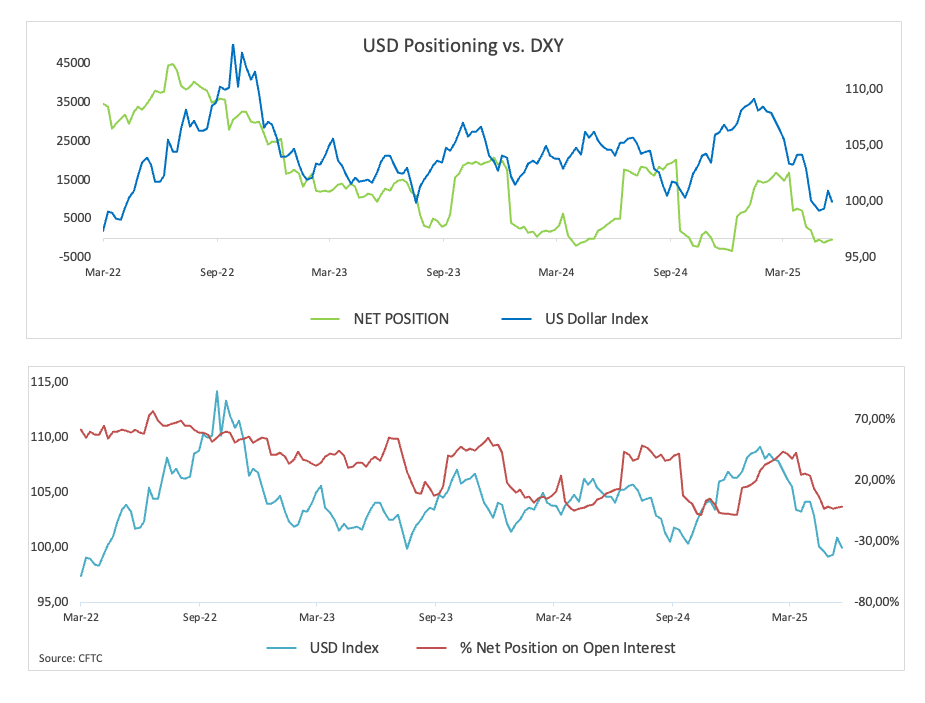

CFTC Positioning Report: Speculators reduced their short bets on the Dollar

The most recent CFTC Positioning Report for the week ending May 20 illustrates investors' repricing of the probable Fed rate path in the aftermath of dropping US inflation in April, despite those readings still not revealing any impact from tariffs and contradictory data releases from fundamentals. Meanwhile, market players continued to examine the recently announced trade agreements between the United States and China, as well as the United States and the United Kingdom.

Speculative net shorts on the US dollar (USD) fell to three-week lows of just over 500 contracts, despite an increase in open interest. The US Dollar Index (DXY) has begun a retreat from monthly highs near the 102.00 level, putting the psychological 100.00 conflict region to the test once again.

Non-commercial net longs in the euro (EUR) fell from recent multi-month highs to the lowest level in the past four weeks, at 74.5K contracts. Meanwhile, commercial players, primarily hedge funds, reduced their net shorts to multi-week lows of around 126.8K contracts. Open interest continued to rise, reaching approximately 760K contracts. Despite a decline in bullish posture, the EUR/USD managed to continue its rally far north of 1.1200, after bottoms at 1.1060 the previous week.

Speculators reduced their net long bets in the Japanese yen (JPY) to a six-week low of around 167.3K contracts. At the same time, commercial traders reduced their net short position to just over 181K contracts, while open interest rose to two-week highs of over 367K contracts. Meanwhile, USD/JPY remained at its multi-day leg low, dropping back to the144.00 neighbourhood.

Net long holdings in the British Pound (GBP) retretaed to three-week lows around 24K contracts, followed by a minor increase in open interest. GBP/USD extended its slow rebound from May's lows near 1.3170, challenging the 1.3400 hurdle once again amid improving mood and positive UK fundamentals.

Speculative net longs in Gold reached four-week highs around 164K contracts, followed by an acceptable increase in open interest. After bottoming out near the $3,120 mark per troy ounce, prices of the yellow metal have rebounded to the $3,300 level, boosted by renewed tariff uncertainty and geopolitical tensions.

Non-commercial players upped their net long bets on WTI to levels last seen in February, totalling approximately 186.5K contracts. The move, however, coincided with a decline to multi-week lows in open interest. Prices for the American benchmark remained erratic around $62.00, closely tracking developments in US trade policy, geopolitics, and OPEC+'s intentions to boost output.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.