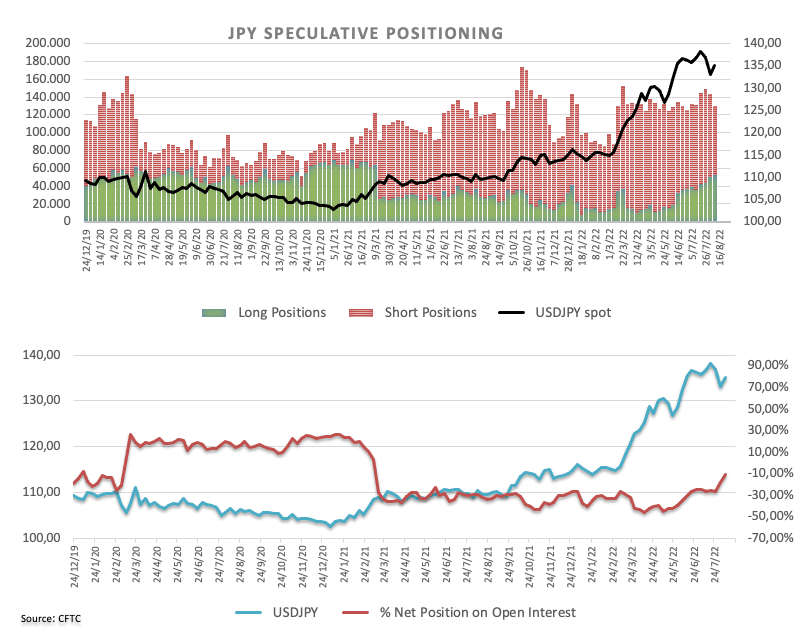

CFTC Positioning Report: JPY net shorts trimmed further

These are the highlights of the CFTC Positioning Report for the week ended on August 9th:

- Speculators reduced further their negative exposure to the safe haven yen and trimmed their net shorts to levels last seen back in early February 2020. The resurgence of the risk aversion during the Pelosi’s visit to Taiwan seems to have reignited the sentiment towards the Japanese currency. However, the stellar print from July’s US NFP lifted US yields and pushed USD/JPY back to the area north of 135.00, where it met some tough resistance.

- Still in the safe haven realm, net shorts in the Swiss franc fell to 4-week lows amidst a multi-session consolidative mood in USD/CHF.

- Net shorts in the euro shrank to 4-week lows in a week dominated by the resurgence of the risk-on mood despite solid results from US fundamentals, while the impact of the Pelosi’s trip to Taiwan started to fade away. Against that, EUR/USD kept the range around the 1.0200 neighbourhood, always amidst the broader side-lined theme between 1.0100 and 1.0300.

- The speculative community scaled back their net shorts in the British pound to 5-month lows against the backdrop of the sustained improvement in the appetite for the risk complex and in spite of the “dovish hike” by the BoE at its event on August 4. That said, GBP/USD initially prints new monthly lows near 1.2000 just to regain some traction soon afterwards.

- The bearish mood remained unchanged around the Aussie dollar, as net shorts climbed to levels last seen in early March in response to the pick-up in US-China effervescence and despite the RBA hiked the OCR by 50 bps on August 2. AUD/USD attempted some consolidation which it will eventually break on the back of the better tone in the risk-associated universe.

- In the commodities’ space, net longs in the WTI dropped to levels last seen in late February 2016, as recession chatter and renewed US-Iran talks around the nuclear deal weighed on prospects for the demand of crude oil. The barrel of the WTI extended the downtrend and revisited prices seen before the Russian invasion of Ukraine. Net longs in Gold rose to 5-week highs amidst short covering, which was in turn propped up by the US economy entering a technical recession and declining US yields.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.