CFTC Positioning Report: Japanese net longs kept rising

These are the main takeaways of the CFTC Positioning Report for the week ending September 17.

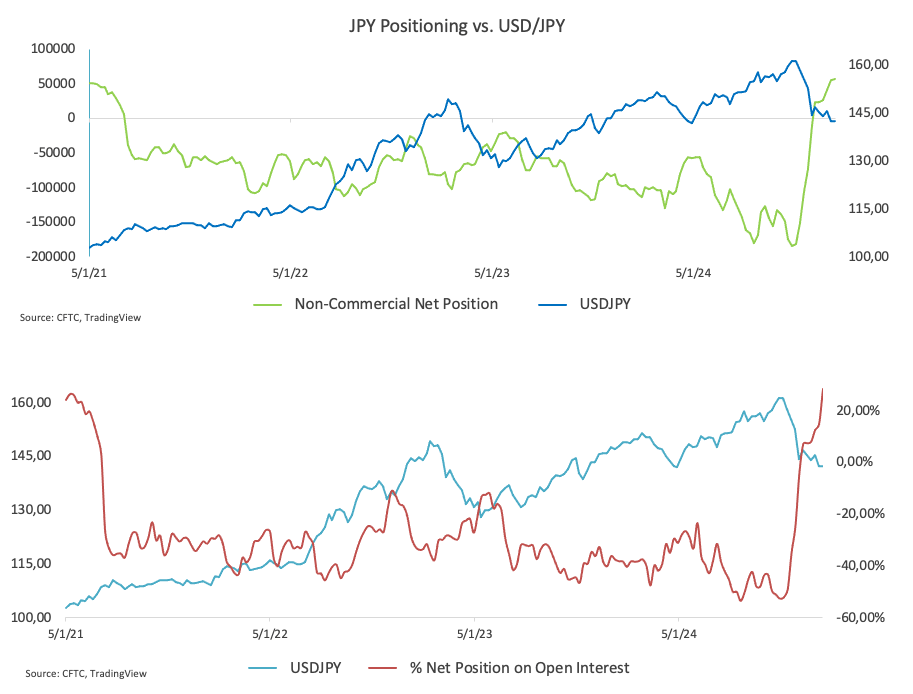

- Speculators increased their net longs in the Japanese yen for the sixth consecutive week along with a rise of the long/short ratio. In the meantime, Commercial players maintained their net shorts well in play despite trimming their gross positions markedly. Of note, however, is that open interest dropped strongly by around 47%. USD/JPY maintained its bearish leg unchanged and dropped to 2024 lows near 139.60, just to regain some balance ahead of the Fed’s meeting on September 18.

- Speculative net longs in the Euro retreated to four-week lows along with a similar move in Commercial net shorts. Open interest, in the meantime, shrank by nearly 9%. During the period, EUR/USD gathered fresh upside traction and reclaimed the 1.1100 barrier and beyond as investors were digesting the ECB’s rate cut on September 12.

- Non-commercial net longs in the US Dollar retreated to level last seen in mid-March as speculators more than halved their gross longs. Furthermore, that move came in line with a marked decline in open interest. The US Dollar Index (DXY) embarked on a weekly retracement that will eventually see it drop to the 100.20 region for the first time since July 2023 following the Fed’s jumbo rate cut on September 18.

- Speculators trimmed their net shorts in the British pound to five-week lows amidst a strong decline in gross longs. Open interest followed suit and drop by nearly 22%. That said, GBP/USD remained firm and extended its advance ahead of the BoE meeting, surpassing the 1.3200 hurdle.

- Speculative net longs in Gold rose to fresh tops past 310K contracts amidst a 5% increase in open interest. Gold prices maintained their uptrend well in place on the back of firmer speculation of Fed easing in the latter part of the year. and helped by the weak Dollar and the resurgence of geopolitical tensions in the Middle East.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.