CFTC Positioning Report: EUR net longs rose to multi-month tops

These are the highlights of the CFTC Positioning Report for the week ending March 25:

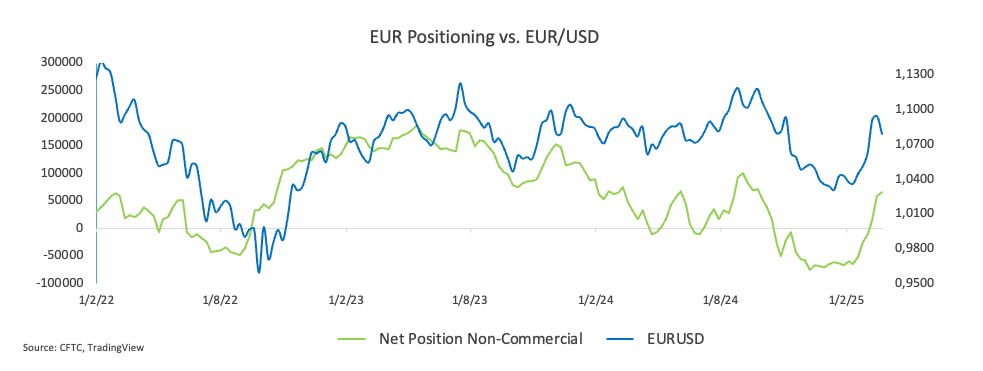

- Speculators have ramped up their bullish bets on the Euro (EUR) for the eighth week running, pushing net longs to about 65.5K contracts—territory last seen in late September 2024. Against this backdrop, EUR/USD has entered a steady corrective phase that would eventually challenge its critical 200-day SMA.

- Meanwhile, non-commercial traders nudged their net longs in the US Dollar (USD) slightly higher, to nearly 7.5K contracts. Even so, that figure remains roughly half of what it was between mid-January and early March. The US Dollar Index (DXY) has nonetheless mounted a multi-day rebound, reclaiming the 104.00 mark amid ongoing tariff headlines and persistent concerns over the US economy.

- As for the British Pound (GBP), speculators have lifted their net longs to multi-month peaks around 44.3K contracts. Over the same period, GBP/USD slipped from its yearly highs above the key 1.3000 level but found some footing near 1.2900.

- In the precious metals space, speculative net longs in Gold ticked slightly lower from the previous week, yet they stayed near multi-week highs despite a marginal decline in open interest. Prices of the yellow metal underwent a mild correction, but still held their bullish posture above the pivotal $3,000 mark—buoyed by ongoing uncertainty surrounding US trade policy and recession fears in the US economy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.