CBR's interest rate increase announcement

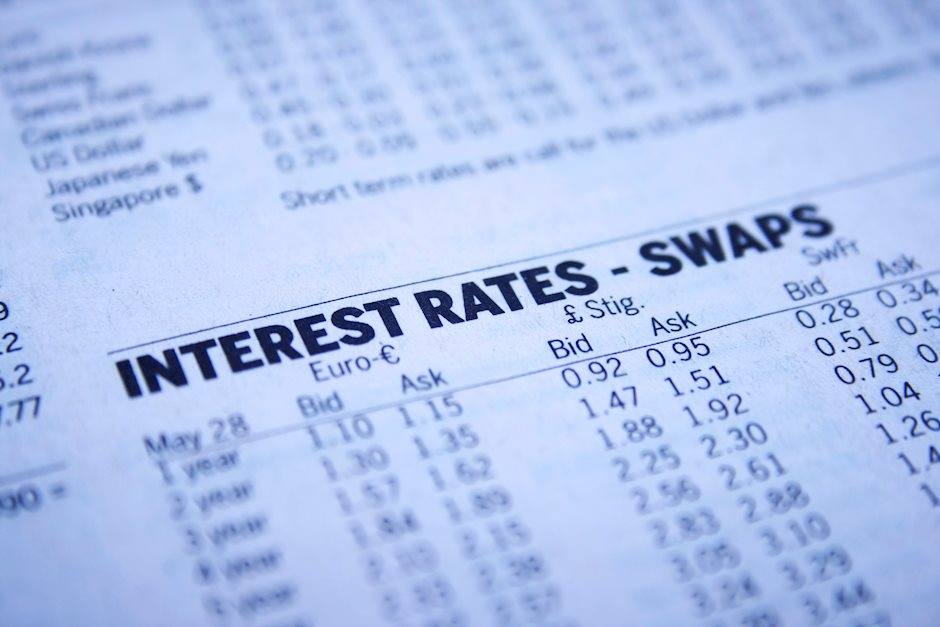

The past two days have gone some distance towards reshaping investor confidence towards central bank independence after the Russian Central Bank (CBR) just announced an interest rate increase. The CBR caught markets unprepared by raising key rates by 25 pbs to 7.50% just one day after the Turkish Central Bank raised its benchmark rates sharply. Both the Lira and Ruble have in recent weeks come under pressure over political interference into potential central bank policy.

While the CBR stated that the rate hike was based on inflationary risks to the economy and external uncertainty, there seems to be a strong trend of EM central banks tightening monetary policy to defend their local currencies. This move should continue to improve risk appetite towards those currencies that have been punished over the past month. The South African Rand for example edged higher following the moves from both the Turkish and Russian Central Banks.

In the FX markets, the USDRUB tumbled towards 67.50. Repeated Dollar weakness could send the USDRUB to levels not seen since mid-August, pushing prices below 67.00.

Author

Lukman Otunuga

ForexTime (FXTM)

Lukman Otunuga has been a Research Analyst at FXTM since 2015. A keen follower of macroeconomic events, with a strong professional and academic background in finance, Lukman is well versed in fundamental and technical analysis.