Canadian Net Change in Employment March Preview: Is the labor market passe?

- Hiring forecast to slow to 80,000 following February’s 336,600.

- Unemployment is expected to edge to 5.4% from 5.5%, labor participation steady at 65.4%.

- Inflation will prompt Bank of Canada to a 0.5% hike at April 13 meeting.

Ottawa’s employment recovery is complete. Canadian firms have added more than half-a-million jobs beyond the pandemic losses of two years ago. The unemployment rate is near a five-decade low and the participation rate is within a fraction of its January 2020 level.

Another 80,000 new workers are expected in March, following February’s surprising gain of 336,000. The unemployment rate should fall to 5.4% from 5.5% and the participation rate is forecast to be unchanged at 65.4%, just 0.2 percentage points below its final pre-pandemic level. Average Hourly Wages were 3.3% higher for the year in February.

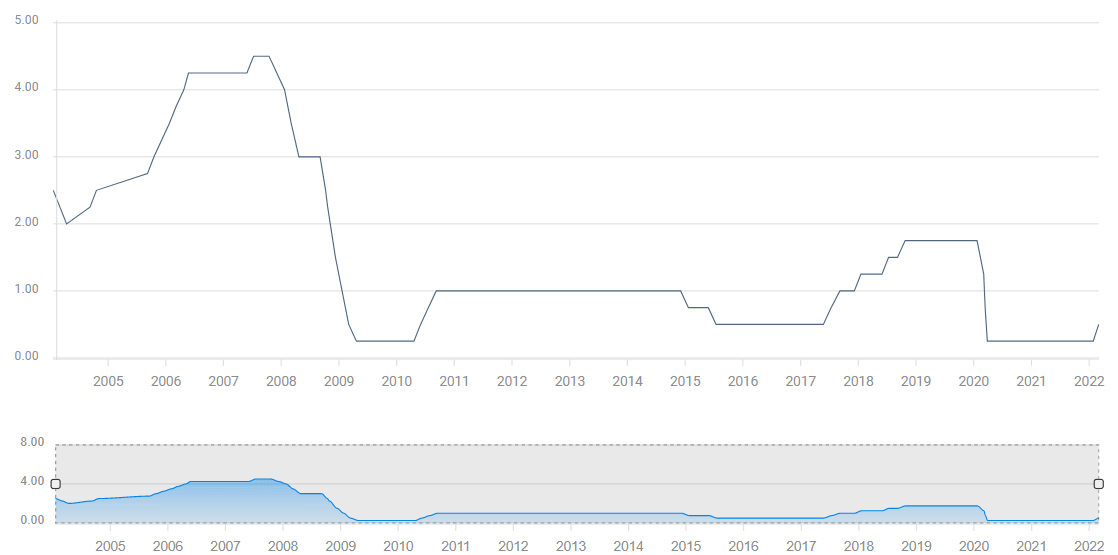

The strength of the labor market is one of the reasons the Bank of Canada (BoC) was the first major central bank to end its pandemic bond purchases last October. It was no coincidence that October was the month when the last of the pandemic job losses were replaced. The BoC was also the first major central bank to end rate accommodation when Governor Tiff Macklem raised the overnight rate by 0.25% to 0.5% on January 26, almost three months before the Federal Reserve killed its own economic support program.

Bank of Canada overnight rate

Canadian economy

Canadian inflation has more than doubled in 12 months from 2.2% in March of last year to 5.7% this February, nearly a three-decade high. The BoC core index has soared, more than tripling from 1.4% to 4.8%.

CPI

Industrial and raw material prices are increasing rapidly, 3.1% and 6% respectively in March, ensuring heightened pressures in the manufacturing pipeline.

Economic growth has been strong averaging 0.4% monthly for the last half-year. Consumer demand rebounded with a 3.2% rise in Retail Sales in January following the 2%% fall in December. Sales have averaged a robust 0.8% monthly since July.

The bank’s quarterly survey of the economy reported that four-fifths of companies said they would have some difficulty meeting demand, a record. About 70% of executives expected prices to increase more than 3% for the next two years and anticipation of rising wages was widespread.

“The number of firms reporting capacity pressures related to labor or supply chain challenges is at a record high,” the BoC noted in its survey. “Because of persistent capacity pressures and strong demand, firms expect significant growth in wages, input prices and output prices.”

A tight labor market and inflation have increased worker demand for higher wages, adding to the pressure on firms to raise prices.

Bank of Canada

The BoC is widely expected to hike its overnight rate by 0.5% on April 13, bringing it to 1.0%, and to continue to 3% or higher over the next year. This would be one of the fastest policy tightenings in the last 30 years and the first half-point hike since 2000. Markets have priced the odds at nearly 80% for a 50 basis point increase.

All six of Canada's major commercial banks, the Canadian Imperial Bank of Commerce, the National Bank of Canada, Toronto-Dominion, the Bank of Montreal, the Bank of Nova Scotia and the Royal Bank of Canada, have either called for a 0.5% increase or said they expect one next week.

Markets conclusion

Canada’s employment report has become an afterthought as markets have focused on inflation and the BoC's response. No possible result for the March figures from Statistics Canada will change that.

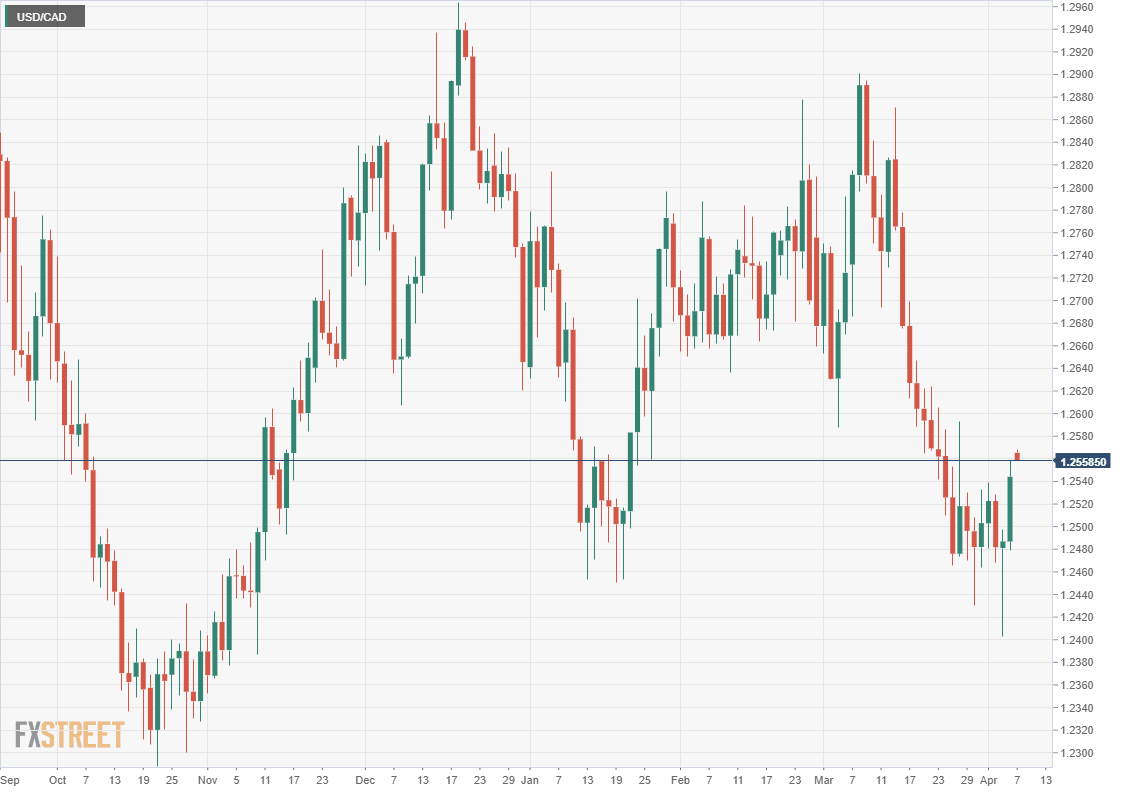

The USD/CAD has largely ignored the rate policies of the BoC and the Federal Reserve because, although the timing of alternating hikes has varied, the direction and the likely endpoints are the same.

Russia’s invasion of Ukraine and the resulting waxing and waning of the safety trade to the US dollar has been the main motive for USD/CAD movement over the past six weeks, with an occasional admixture of crude oil pricing.

Wednesday’s release of the minutes of the Fed’s March meeting detailed the bank’s plans to reduce its balance sheet by $95 billion a month. Though the reduction has been long expected, its inclusion in the minutes was a small surprise and gave the US dollar a boost in all major pairs.

The USD/CAD saw the largest US dollar gain because West Texas Intermediate (WTI) dropped 4.2% on the day and closed at $96.19, its lowest level in three weeks.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637848880803018735.png&w=1536&q=95)