Can anything stop Bitcoin?

S2N spotlight

Yesterday, sitting at a luncheon, one of the guests said to the people sitting around the table that he and a group of his friends have worked out that because of the size of the outstanding debt in the US, the value of the US dollar is going to go down, and therefore the place to invest is in Bitcoin. Then he turned to me and said, Mike. What do you think?

I wanted to say, No shit, Sherlock. But I chose a more reflective approach. This is what I said.

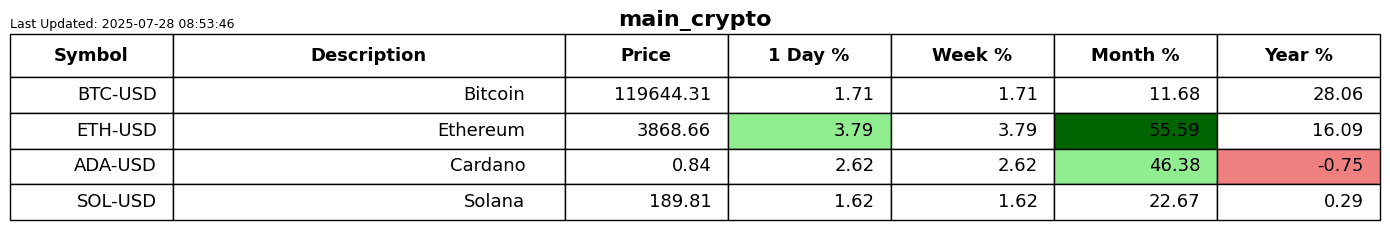

The first point is this is not a novel idea, so much so that an asset class that never existed—crypto—has become worth $4 trillion in 15 years on the back of that thesis. Gold has gone from a $6 trillion asset class 15 years ago to around $20 trillion today.

The second point I made is that if the currency is being devalued at the rate of, say, 3% inflation per annum, this does not mean that the stores of wealth like gold and bitcoin should go up 33% per annum due to scarcity. There are many scarce things in the world.

The third point I made is that Bitcoin, a 15-year-old invention, could encounter many unthought-of reasons, both technical, legal, and practical, that could jeopardise its future.

The fourth and main reason I want to leave you with today is this. Around 2005 gold was ending a 20-year bear market, trading around $400-500. The government was running Twin Deficits which was the focal point of much of the media coverage at the time. For those not familiar with the term, it referred to the budget deficit and the trade deficit. The commentary back then was that the deficits and borrowing were unsustainable. I am not sure if the lunch guest I am referring to and his merry band of friends who worked out that Bitcoin can only go up had pondered that this is a decades-old problem. Michael, drop the sarcasm!

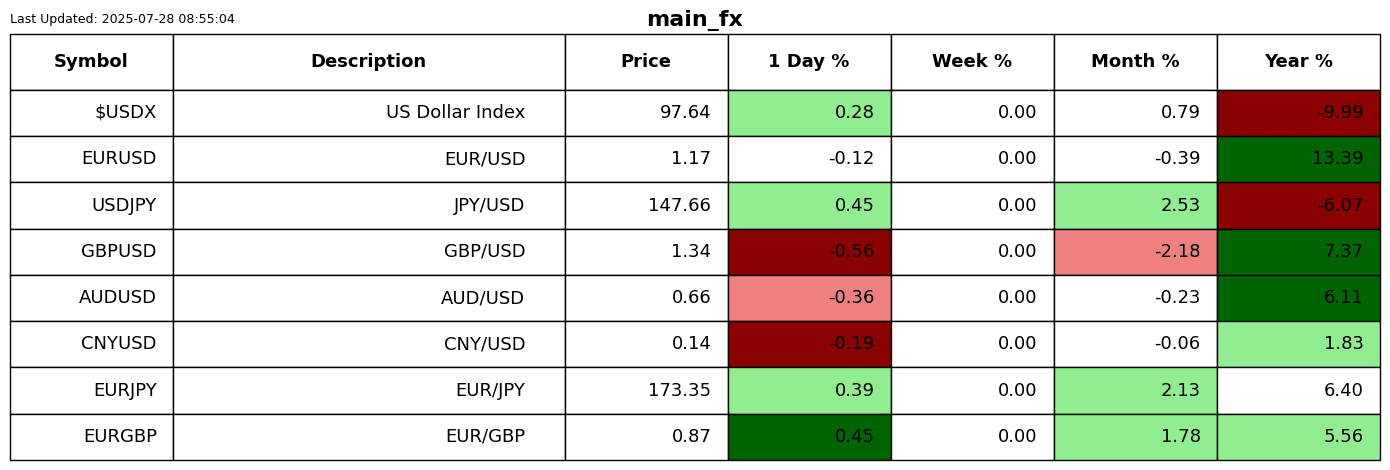

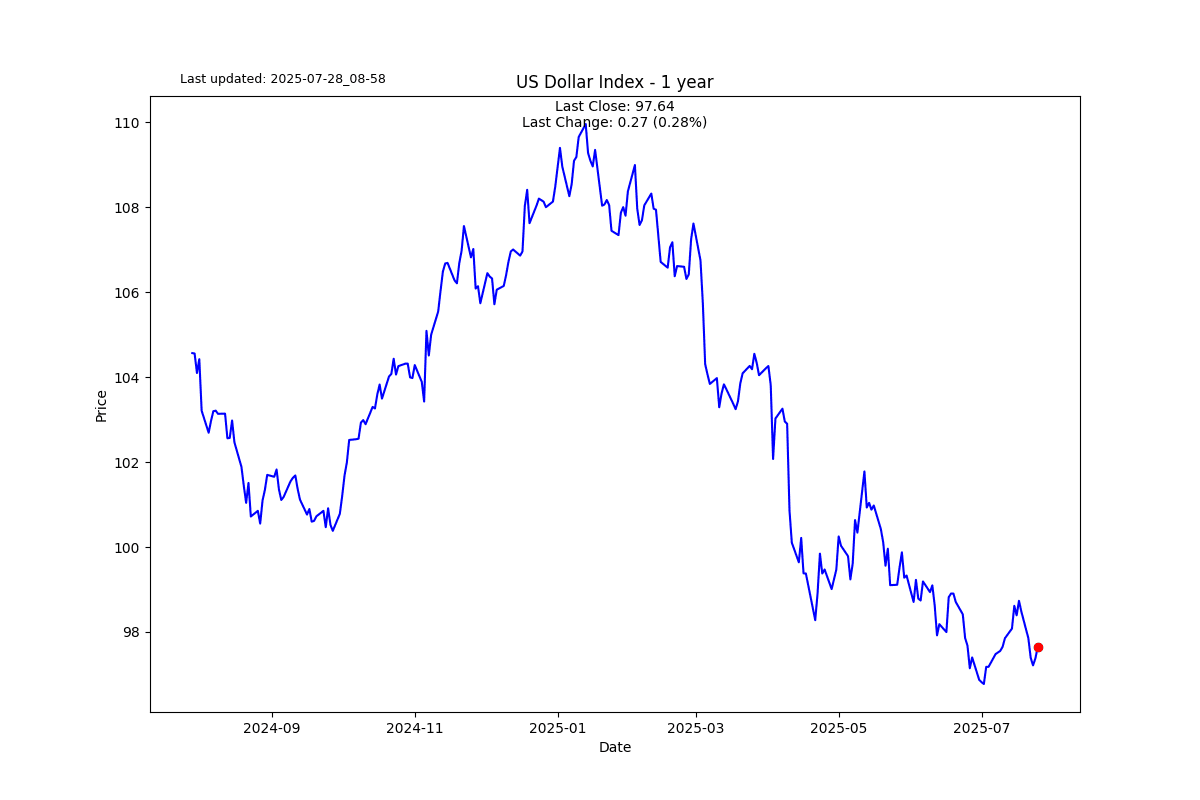

This is the part that I find interesting. Why did the twin deficits not turn into a shit-show for the dollar back then? The reason is quite simple. The world was not experiencing any inflation; in fact, there was a fight against deflation as China became a party to the WTO in 2001 and brought cheap goods and labour to the global economy. The economic future looked bright, and concern for the sustainability of the debt burden was not a concern for the psyche of the time.

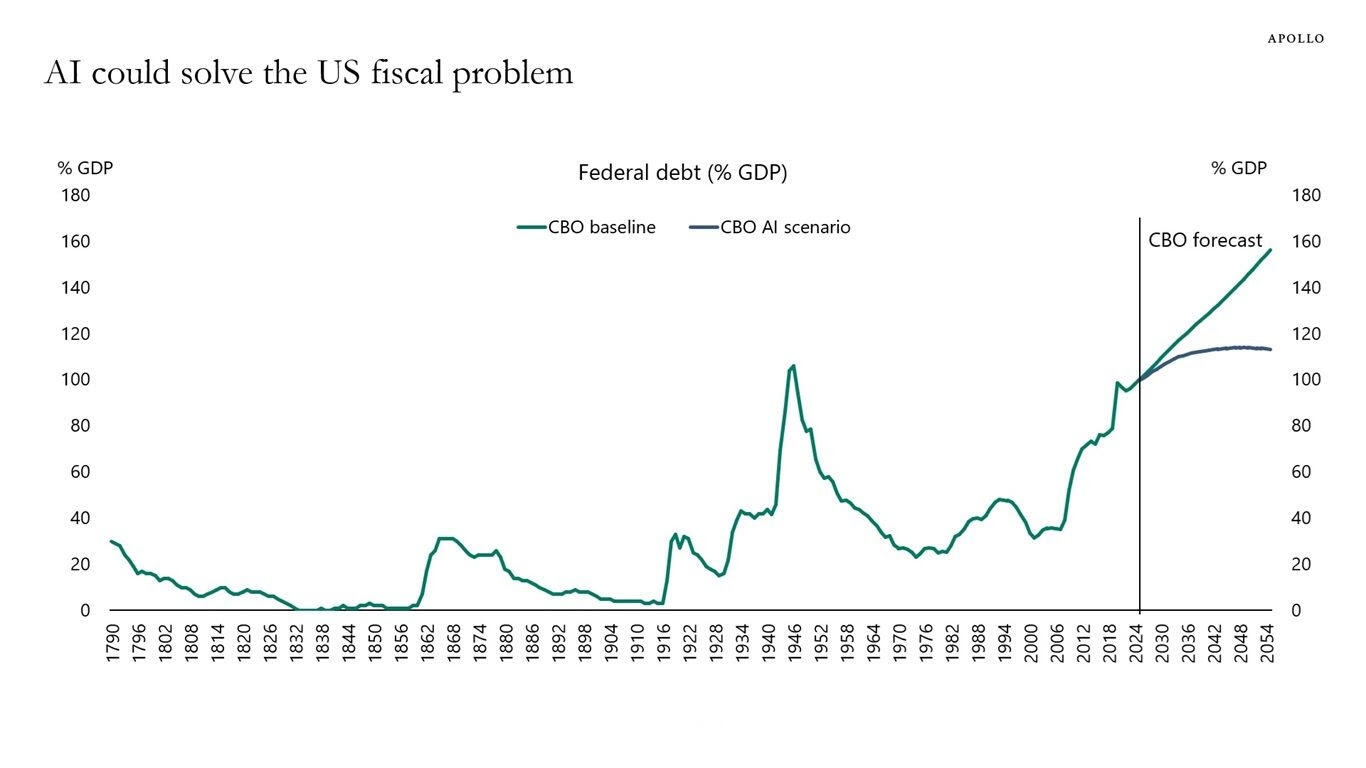

I am not saying that what I am going to say now is what I truly believe, but it is a possibility and therefore a scenario one needs to build into your future Bitcoin valuation. What if AI ushers in the next era of deflation and economic prosperity?

This is not so far-fetched. In fact, the Congressional Budget Office estimates that if AI results in permanently lower inflation, it could solve the US fiscal problem.

What I am saying in a rather long-winded way

Things are always changing. Don’t think the current view shaped by the uncontrolled spending of government and the quantitative easing experiments of central bankers will be forever. Fair value will eventually rise to the table as sentiment and mood shift.

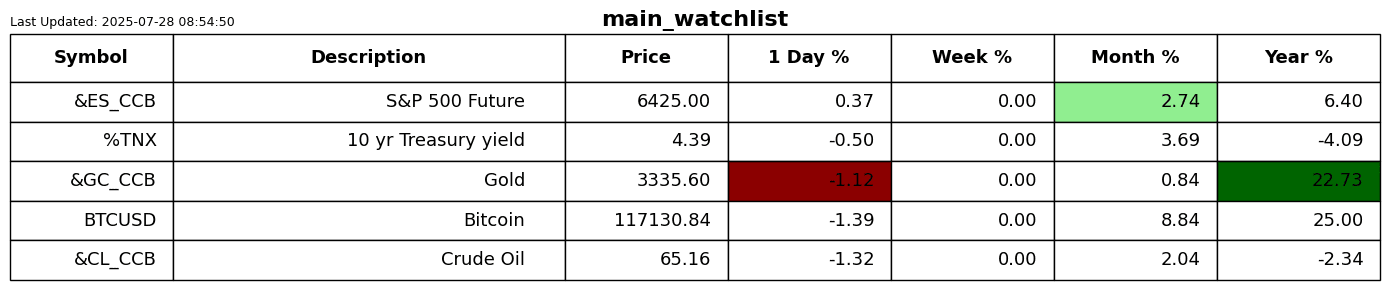

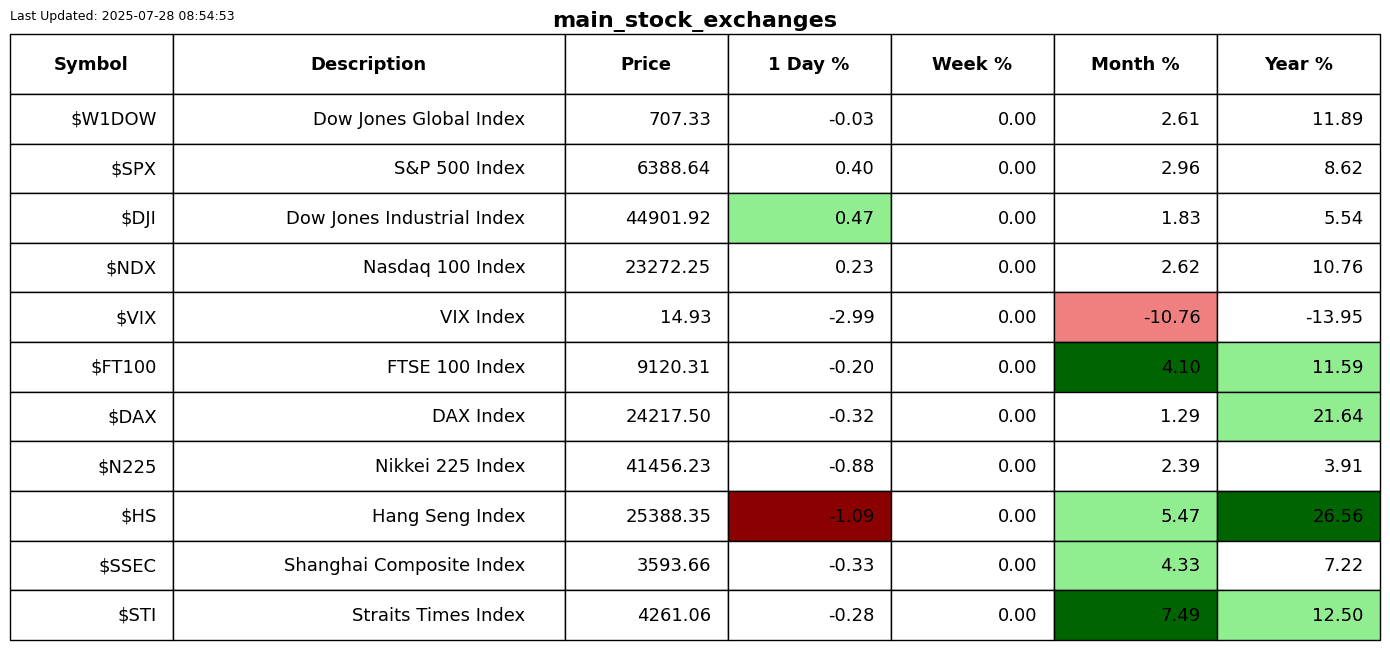

S2N observations

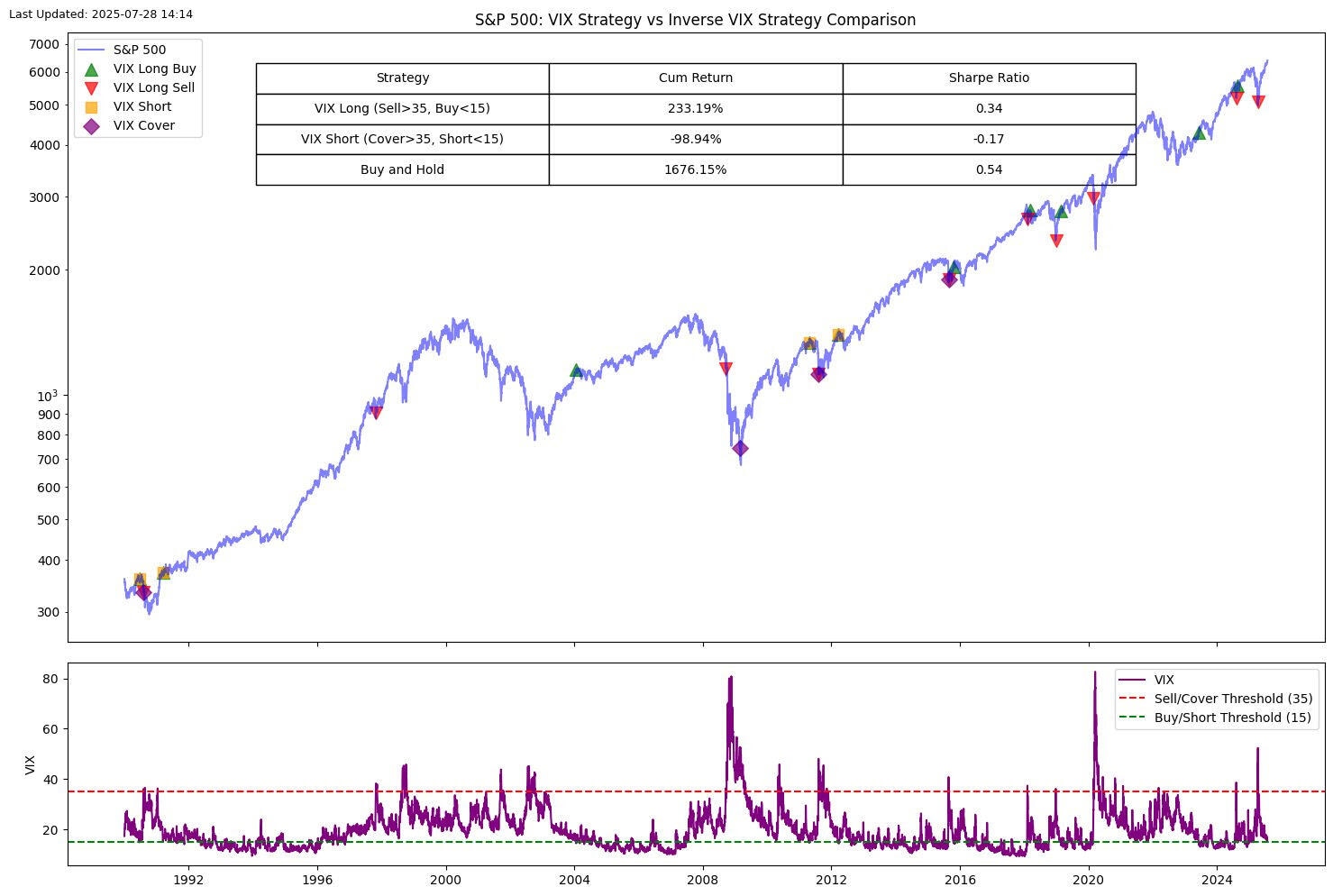

You may have seen that VIX is now trading below 15. Crazy given the current environment. It is easy to see that these are low levels historically. Admit you are tempted to short the market based on such complacency?

The results are not what you probably are thinking. Firstly, the best strategy is to buy and hold the S&P 500, which I am including for the sake of completeness and soberness.

If you go short the market when the VIX is below 15, like now, and cover your short when the VIX is above 35, you will lose 99% of your account.

If you go long the market when the VIX is below 15 and exit when it is above 35, you will make 233% with a lower Sharpe Ratio than buy and hold.

The point I am making is how hard it is to use the VIX as a market timing strategy for market tops and bottoms. I know this is a bitter pill to swallow.

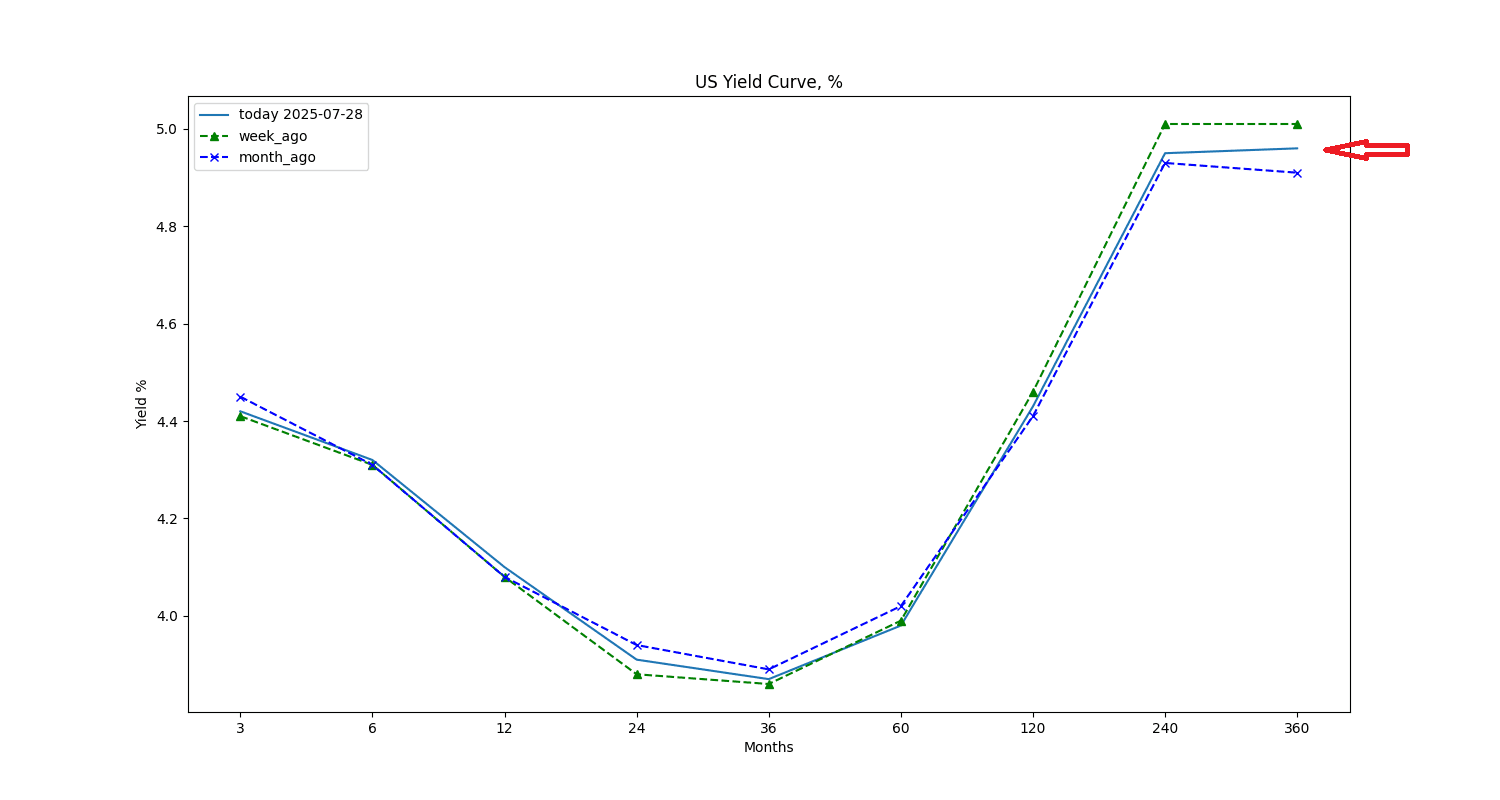

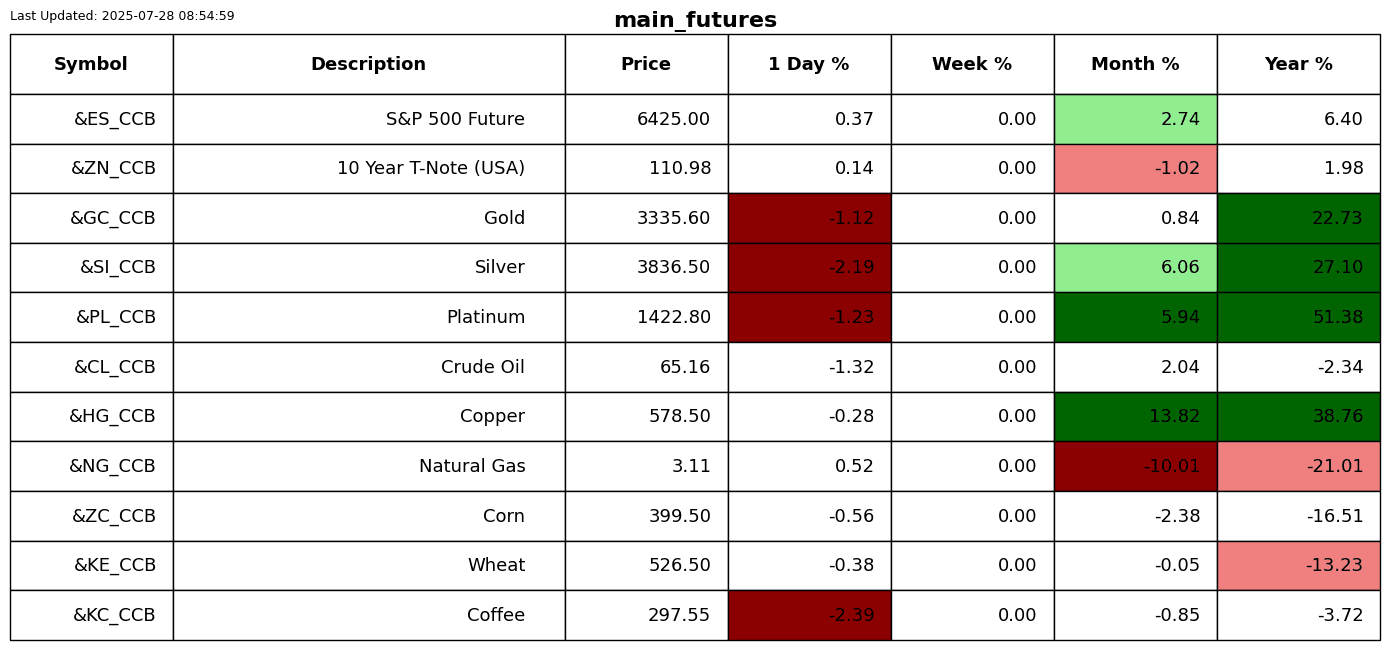

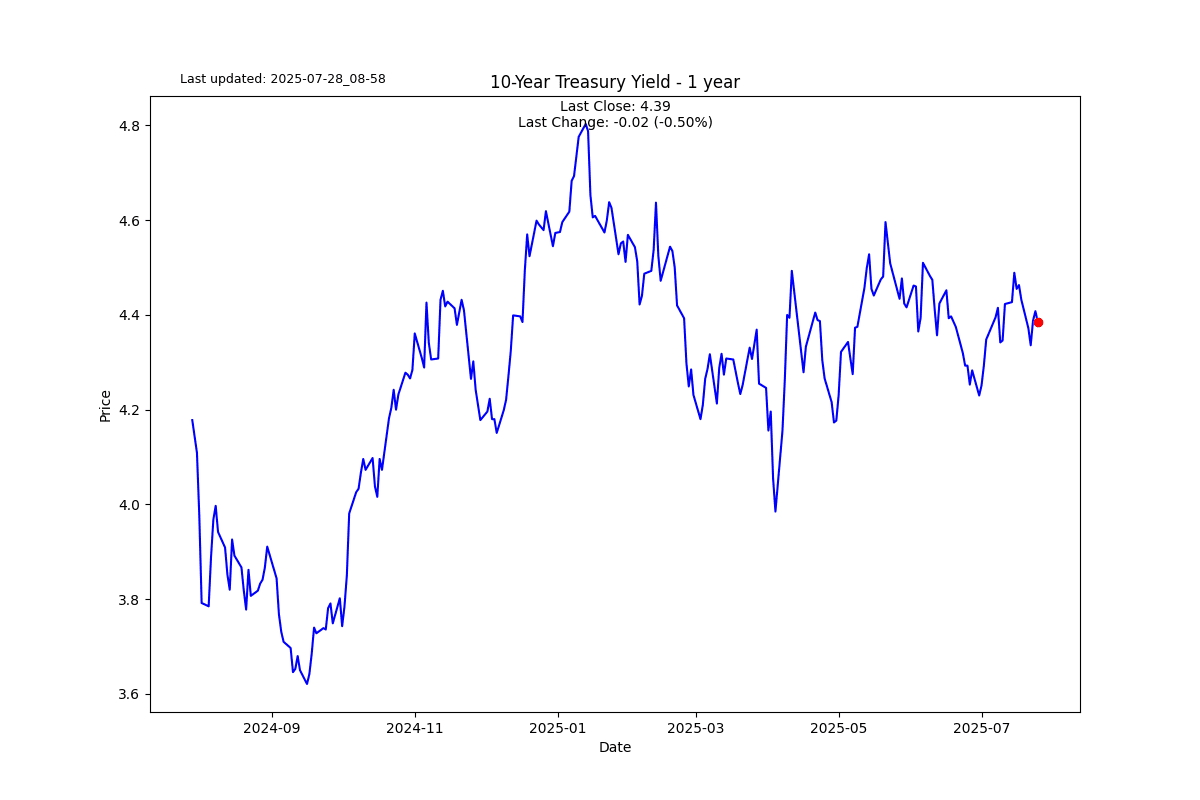

The tail of the US yield curve, i.e., the 30-year yield, is refusing to give up the higher interest rates fight.

S2N screener alert

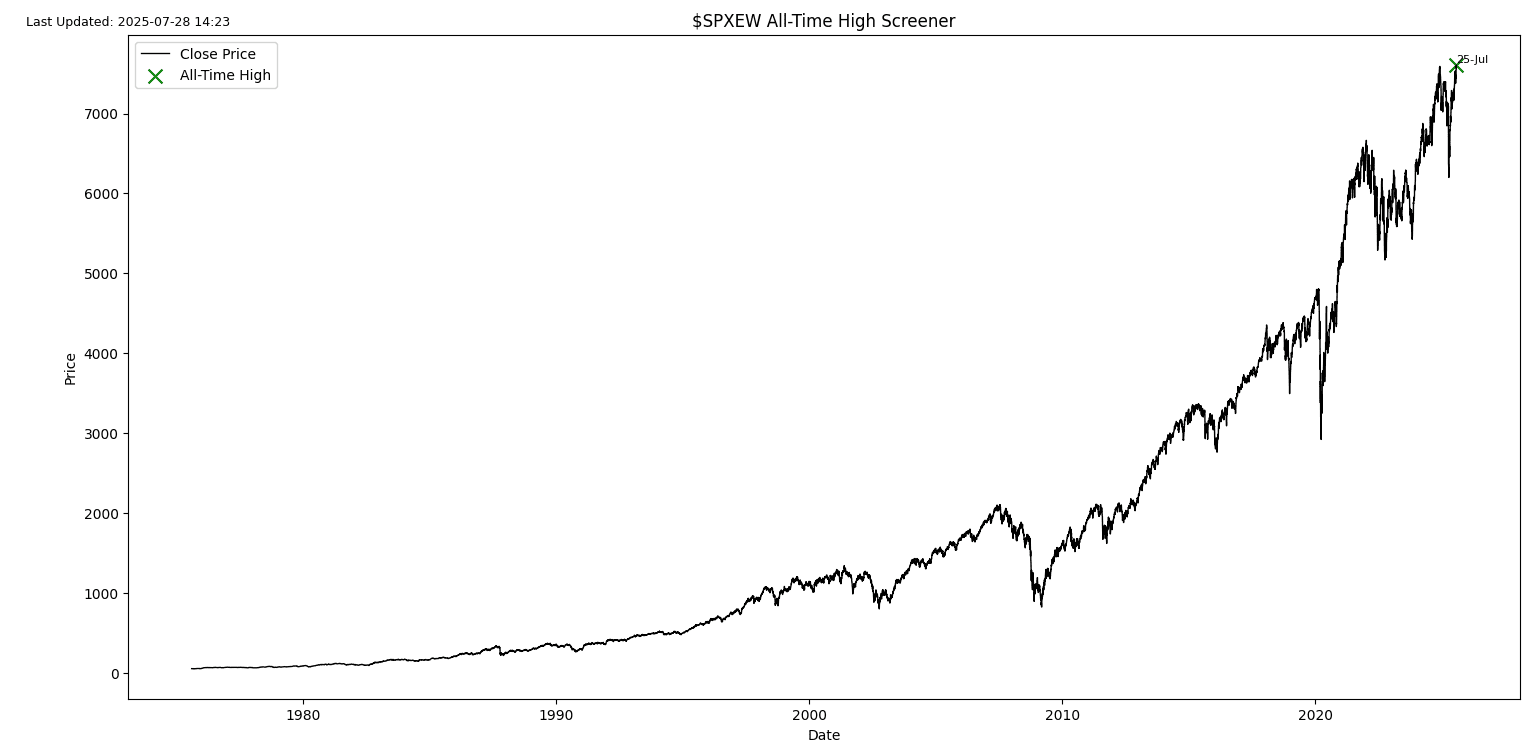

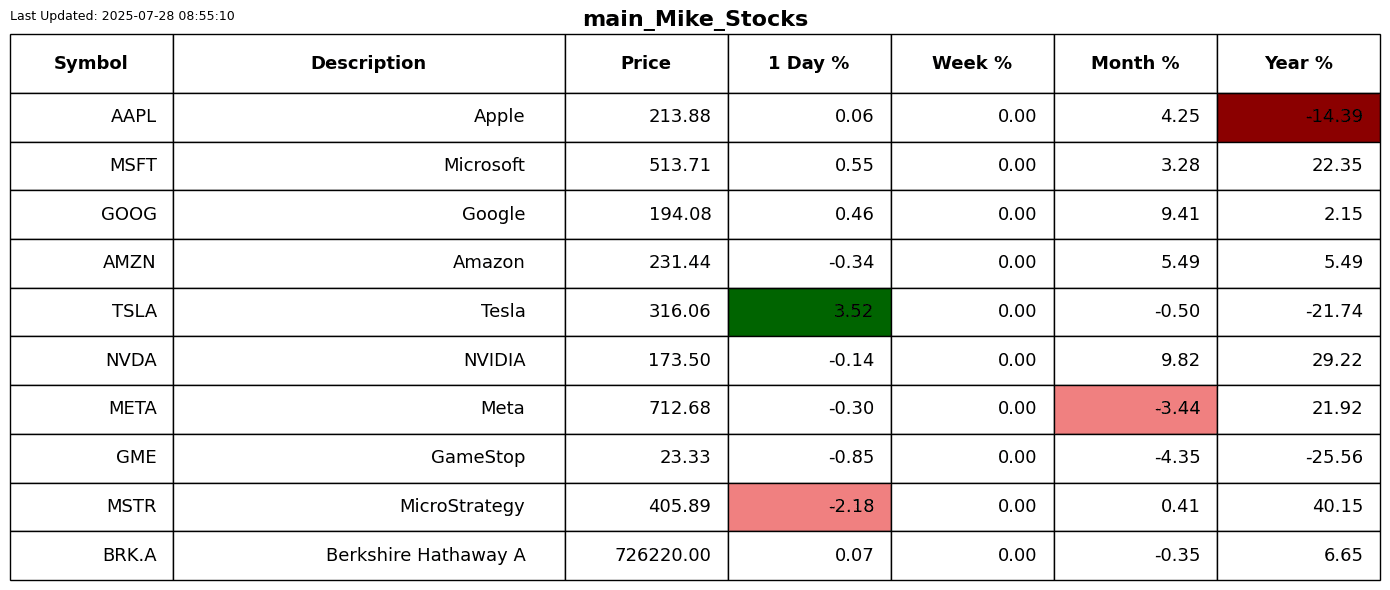

Friday saw many new all-time highs. The S&P 500 Equal Weighted Index just joined the party.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.