CAD/JPY bearish pattern to be activated [Video]

![CAD/JPY bearish pattern to be activated [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/CADJPY/forex-canadian-and-japanese-currency-pair-with-calculator-4617268_XtraLarge.jpg)

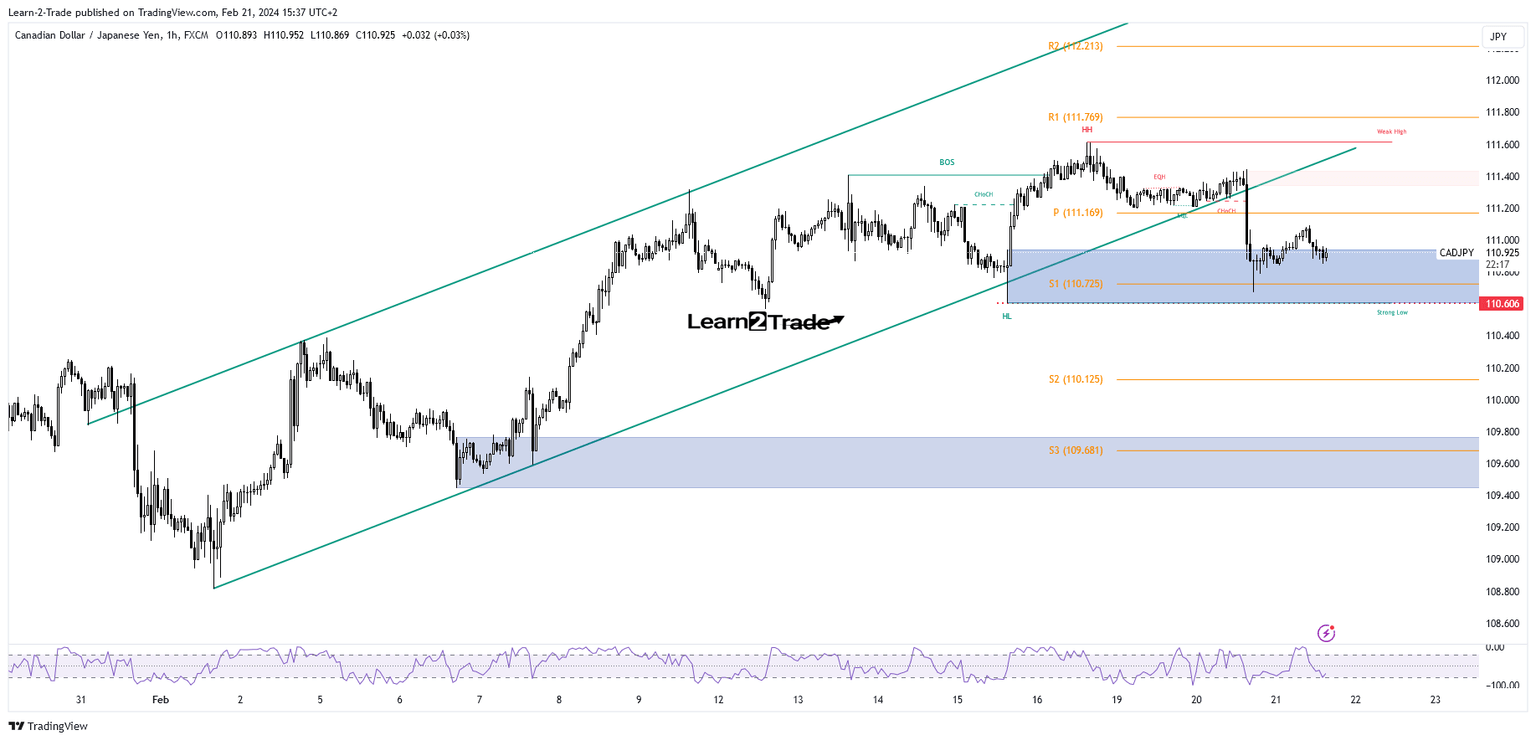

The CAD/JPY pair crashed in the short term as the Japanese Yen Futures tried to rebound. It’s located at 110.92 at the time of writing. Still, a larger drop needs strong confirmation. Today, the FOMC Meeting Minutes could have a big impact on all markets. Tomorrow, the manufacturing and services data should move the markets.

Technically, the CAD/JPY pair escaped from the up channel pattern, signaling a potential reversal. Still, as long as it stays above 110.60, the rate could come back to retest the broken uptrend line and the former highs. Only a new lower low, dropping and closing below 110.60 activates more declines.

Join Learn 2 Trade VIP Group now!

Join Learn 2 Trade VIP Group now!

Author

Olimpiu Tuns

Learn 2 Trade

Olimpiu is a seasoned Market Analyst / Trader with 11 years of experience in the financial markets having expertise in Forex, Commodities, Index, Cryptocurrencies, and Stocks.