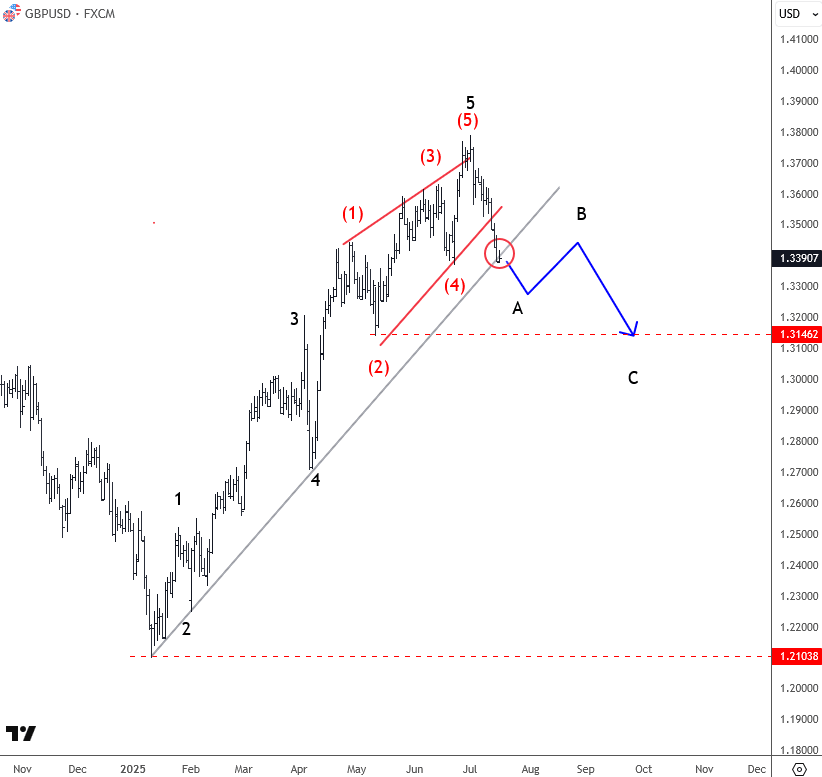

Cable is breaking out of an ending diagonal

Cable is turning lower and has been one of the weakest currencies over the last week or so, and the main reason for this, of course, were the UK GDP figures reported last week, which showed that the economy has contracted, while at the same time, Bank of England said that they will be looking into more rate cuts in the future. That’s why cable came nicely down towards the 1.3380 area in a relatively short period of time.

Now, what’s really important here is that the market is turning down after an ending diagonal that was positioned in the fifth wave, something we’ve been tracking closely with our members, and already warned about this limited upside back in June. Ending diagonals are known to be slow patterns, but once completed, they usually lead to a sharp reversal — and that’s exactly what we are seeing here.

If we assume that the five-wave rally from the January lows is completed, then we should be looking for a minimum three-wave counter-trend decline. So even if the drop from 1.3780 will turn out to be only corrective, it’s probably just the first leg (wave A) of a larger ABC pullback. In such case, wave C could extend all the way down to 1.3140, if not even lower.

Of course, short-term we may still see some counter-trend bounce, but such rallies could offer opportunities to rejoin the trend, which for now remains bearish, at least from a short- to medium-term perspective.

Grega

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.