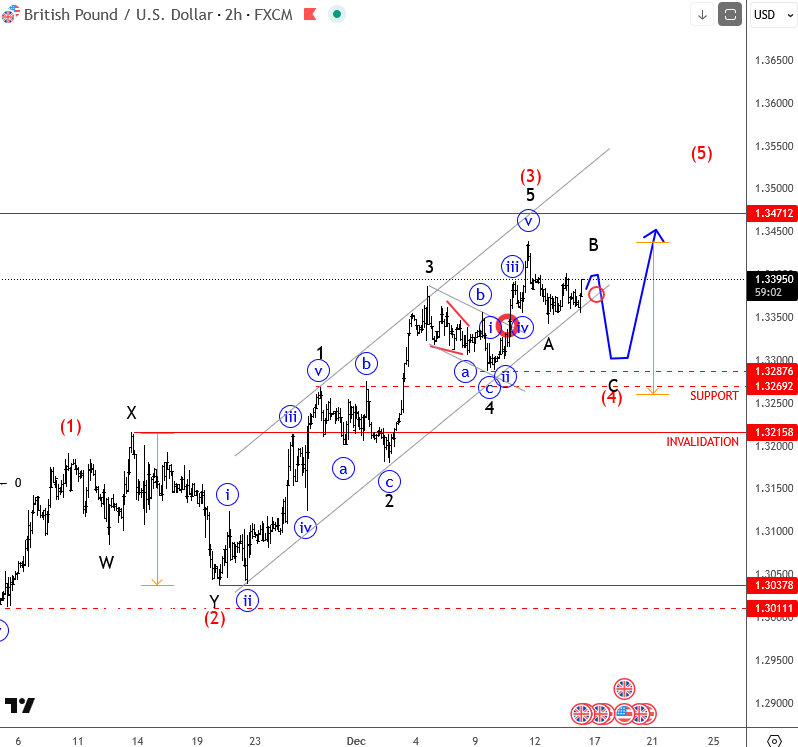

Cable in wave four ahead of NFP, UK CPI and BoE

Cable turned lower at the end of last week and is now testing channel support, which could be broken if the recent move is treated as a wave B rally. This would suggest that a higher-degree wave four correction may not be finished yet. Still, we would expect more upside once this correction is complete, but first we could see a retest closer to the 1.3300 area, which marks the former wave four and could act as key support for a new bounce later on. Full invalidation of the uptrend remains at 1.3215, so as long as this level holds we will treat any weakness as part of an ongoing wave four, with wave five still expected to take the market higher in the days ahead. Keep in mind that important UK data is coming this week, including UK CPI and the Bank of England rate decision on Thursday.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.