British pound wavers on upbeat services PMI numbers

The British pound was little changed today as traders reacted to the impressive services PMI numbers from the UK. According to Markit, the PMI rose from the previous 29 to 47.1, which is the highest it has been in the past four months. The composite PMI, which includes the manufacturing sector increased from the previous 30.0 to 47.7. These numbers provide more evidence that the UK economy is doing relatively well as the country starts to reopen. At the same time, customer deposits in the UK rose by a record £25.6 billion in May to £1.5 trillion, according to the Bank of England.

The euro was little changed against the US dollar as traders reacted to the services and composite PMI numbers from the country. According to Markit, the services PMI rose to 48.3 in June from the previous 30.5. The composite PMI rose from the previous 31.9 to 48.5. Business activity increased in all countries, with the composite PMI in France and Germany rising to 47.0 and 51.7, respectively. As with the United Kingdom, most people in the eurozone are saving more and investing less. Household investment rate declined to 8.7% of disposable income in the first quarter from 9.1% in the previous quarter.

The Australian dollar rose slightly against the US dollar as traders reflect on the Chinese and Australian data. According to the Australian Industry Group (AIG), the construction index rose from the previous 24.9 to 35.5. Other data from Markit showed that the services PMI rose from the previous 26.9 to 53.1. Similarly, retail sales in the country rose by 16.9% in May after falling by 17.7% in the previous month. In China, data from Caixin showed that services PMI rose to 58.4 while the composite PMI rose to 55.7. These numbers mean that the Australian economy is recovering well.

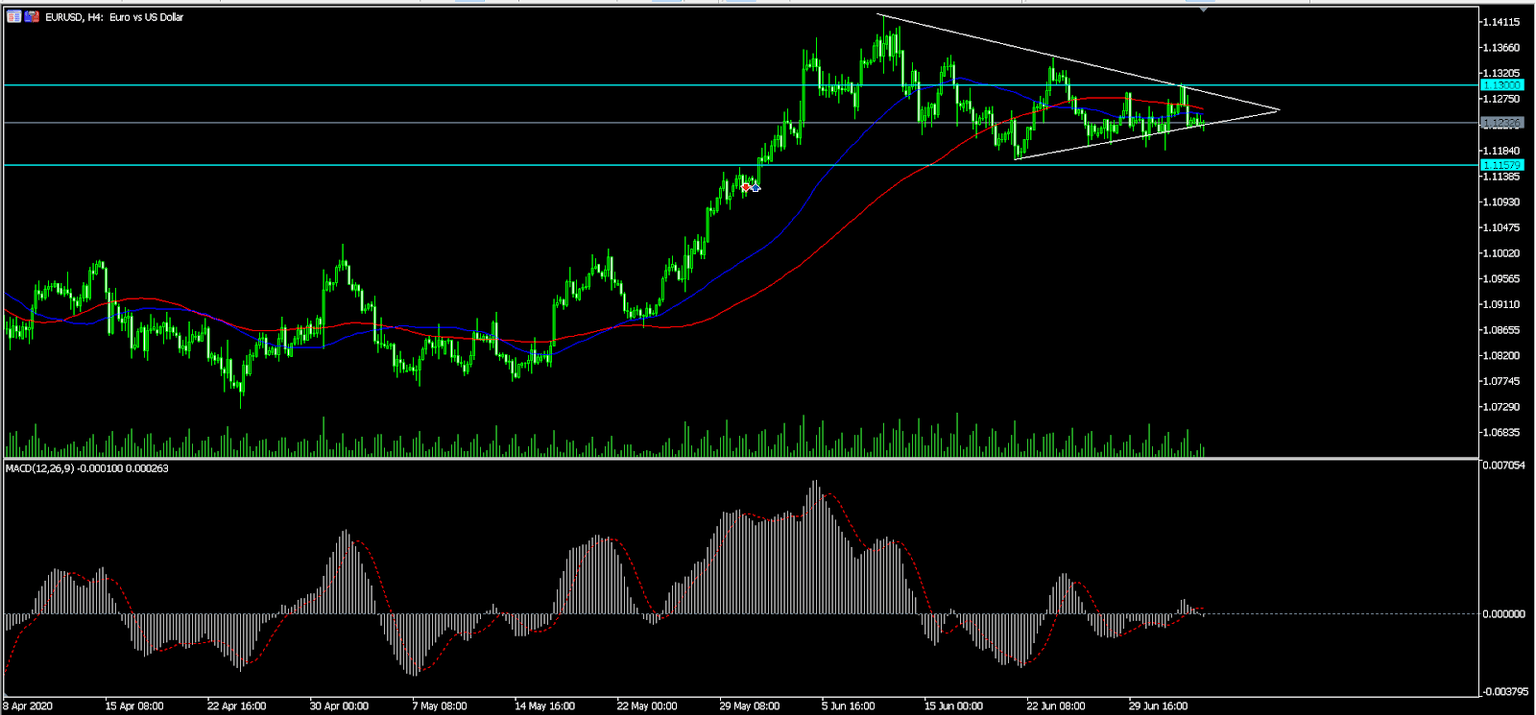

EUR/USD

The EUR/USD pair is trading at 1.1230, which is slightly below the 50-day and 100-day exponential moving averages. The price is also along the lower line of the triangle pattern. Also, the histogram of the MACD has moved slightly below the neutral line. The pair is approaching the tip of the triangle pattern, which means that the price could break out in the coming week.

AUD/USD

The AUD/USD pair is trading at 0.6935, which is above the 50-day and 100-day exponential moving averages. On the four-hour chart, the price is heading towards the upper side of the triangle pattern. It is also above the 78.6% Fibonacci retracement level. Therefore, the pair is likely to test this descending trendline at 0.6955. Like the EUR/USD pair, it will possibly break out in the coming week.

USD/CAD

The USD/CAD pair is little changed today as traders reflect on the upbeat jobs numbers from the US and higher oil prices. The pair is trading at 1.3567, which is slightly below the 50-day and 100-day exponential moving averages. The RSI is also moving sideways at the 41 level while the two lines of the Stochastic Oscillator are in the overbought zone. Therefore, the pair is likely to experience a breakout in either direction in the coming week.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.