British pound slides as traders brace for a no-deal Brexit

The euro rose and then pared back gains after the European Central Bank (ECB) delivered its interest rate decision. In a statement yesterday, the bank left interest rates and the pandemic emergency purchases limit unchanged at 1.35 trillion euros. The bank also pledged to do more to support the economy if needed. In her press conference, Christine Lagarde said that the bank was closely monitoring the stronger euro. Still, analysts expect the bank to make policy tweaks in the December meeting. In the morning session today, the euro will react to Germany inflation data.

The British pound declined sharply as traders reacted to the rising risks of a no-deal Brexit. In a statement, David Frost said that a number of divergencies still remain with the EU. He said this after the two sides concluded the eighth round of talks in London. With less than a month to go for the two sides to reach a deal, there is a growing possibility that they will not reach a deal. He said this as the EU threatened to sue the UK for breaking international law on Northern Ireland backstop. Also, in the United States, Nancy Pelosi said that the UK will not have a deal with the US if it breaks the law. Separately, the Office of National Statistics (ONS) will release the GDP data today.

The US dollar is down slightly ahead of key inflation data from the United States. Analysts expect the consumer inflation to remain low in August. They see the headline CPI rising to 1.2% from the previous 1.0%. On a MoM basis, they expect that the prices fell from the previous 0.6% to 0.3%. At the same time, they expect the data to show that core CPI remained unchanged at 1.6%. These numbers come a day after the bureau released relatively positive PPI data. The inflation data come two weeks after the Fed changed its inflation policy. In a speech. Jerome Powell said that the bank will allow inflation to rise above 2%.

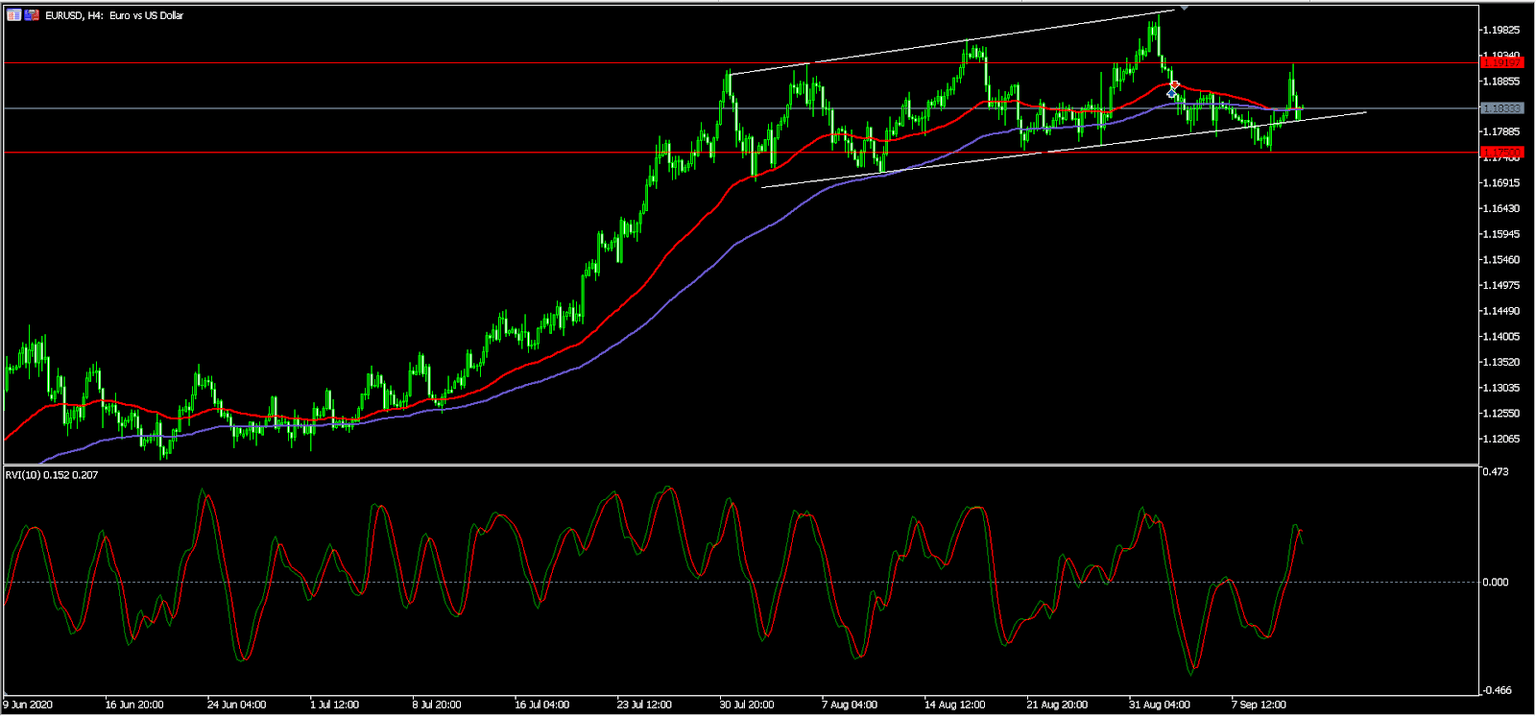

EUR/USD

The EUR/USD pair rose to a high of 1.1920 and then pared back the gains during Christine Lagarde’s press conference. The pair then declined to the lower side of the channel at 1.1800. It is now trading at 1.1833, which is along the 50-day and 100-day exponential moving averages. The two lines of the Relative Vigor Index (RVI) have risen above the neutral level. Therefore, there is a possibility that the pair will continue rising as bulls attempt to retest yesterday’s high at 1.1920.

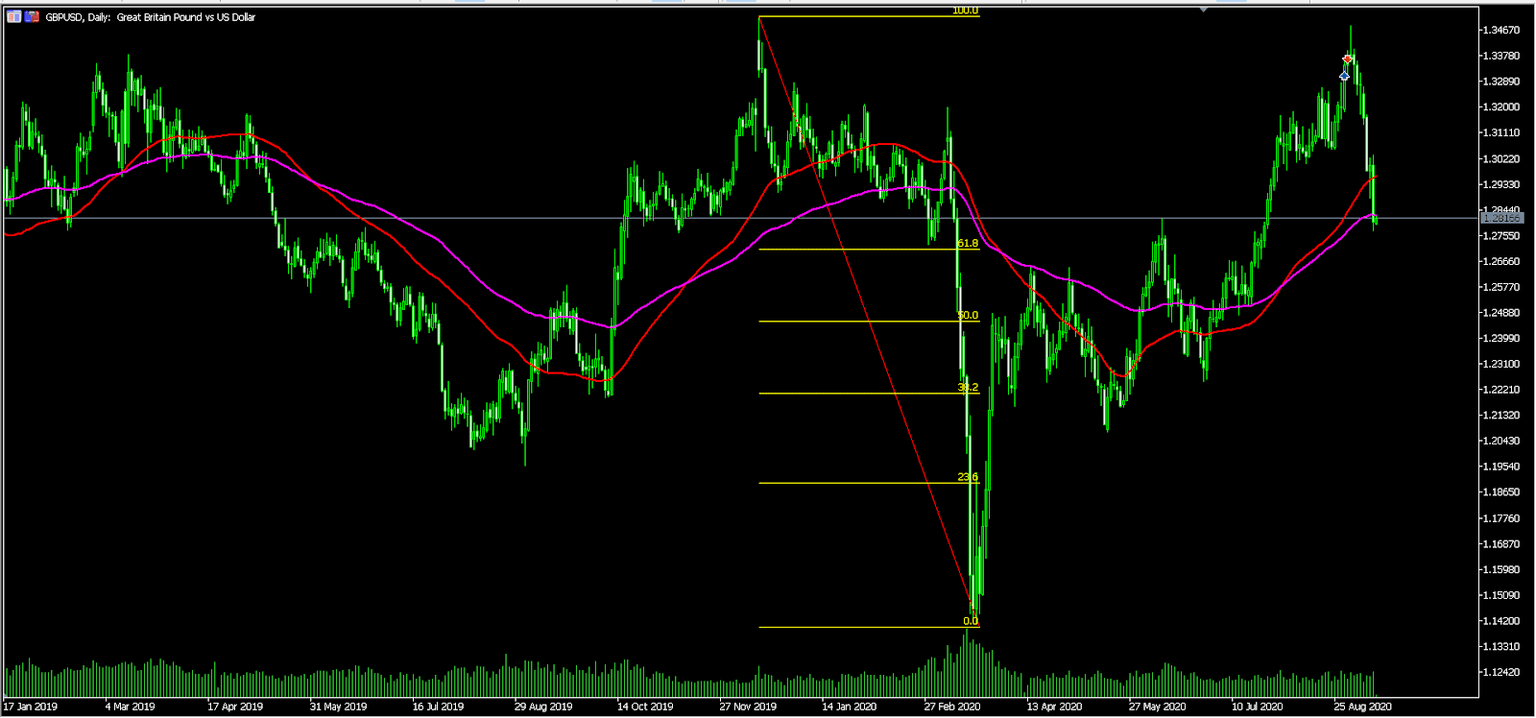

GBP/USD

The GBP/USD pair dropped sharply in overnight trading as traders reacted to the ongoing tussles over Brexit. The pair is trading at 1.2815, which is substantially lower than this month’s high of 1.3480. On the daily chart, it has moved below the 50-day and 100-day exponential moving averages and is a few pips above the 61.8% Fibonacci retracement level. Therefore, the pair is likely to continue falling as bears attempt to move below 1.2800.

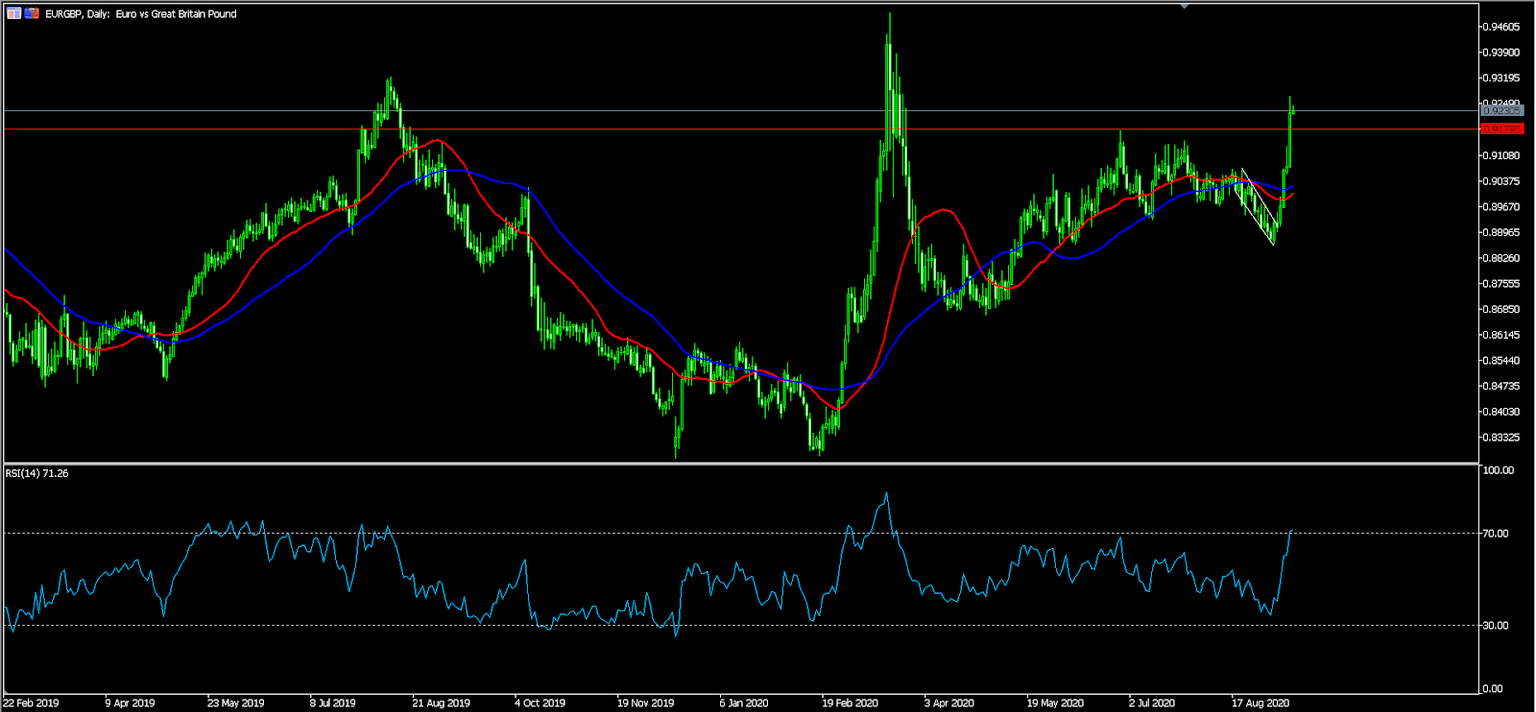

EUR/GBP

The EUR/GBP pair rose to an intraday high of 0.9270, which is the highest it has been since March. On the daily chart, the price is above the 50-day and 100-day exponential moving averages while the RSI has moved above the overbought level. It is also above the previous resistance level at 0.9180. The price is likely to continue rising as the likelihood of a no-deal Brexit remains.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.