Busy week ahead for UK data – Inflation heading back to target?

The UK data docket is stacked this week, starting with the December jobs report on Tuesday, followed by the January CPI inflation print on Wednesday. While these two will command most of the attention, the January retail sales and February PMI data will also be released on Friday.

Jobs market is expected to continue to loosen

According to current estimates, unemployment is projected to remain at 5.1%. However, according to LSEG's forecast distribution at the time of writing, only 54% of analysts polled expect that outcome; the remaining 46% project 5.2%. Also of note, the BoE forecasts that unemployment will rise to 5.3% by mid-year. If unemployment rises to 5.2% or higher, this will be considered dovish and weigh on the GBP.

Private payrolls data continue to trend downward – recording 3.6% in the three months to November – but remain above levels consistent with 2.0% inflation. Although 3.6% has not been seen since late 2020, I believe we would need to see more progress before the BoE would be comfortable with further policy easing. With inflation expected to cool to 2.0%, the central bank may want to see it reach around 3.25%, given current UK productivity levels. Consequently, this will be a key metric to monitor; if wage growth comes in lower, it could strengthen the dovish case.

Average earnings growth – both regular and including bonuses – is also expected to cool to 4.2% (from 4.5%) and 4.6% (from 4.7%), respectively. The minimum estimates for these data are 4.2% and 4.4%, respectively; therefore, anything around these levels increases dovish relevance.

The January HMRC payroll data will also be important to monitor, having declined for four consecutive months, with December posting a 43,000 decline – the largest since November 2020. Job vacancies also remain subdued, with a clear downward bias evident since 2022.

Wednesday welcomes the CPI inflation figure. Economists expect headline YY inflation to cool to 3.0% from 3.4% in December, with a forecast range between 3.5% and 2.9%. An in-line 3.0% number would align with the BoE’s Q1 26 projection. However, many desks, including the central bank, anticipate further disinflation in the months ahead and expect it to reach the BoE’s 2.0% inflation target in Q2. On the core front, YY inflation is forecast to moderate to 3.1% from 3.2%, with YY services also expected to cool to 4.3% from 4.5%.

BoE: Balancing growth and price stability

Regarding the BoE, the minutes of the February meeting indicate that the 9-member voting Committee remains divided, with Governor Andrew Bailey serving as the swing voter. The central bank held the bank rate at 3.75%, following a 25-bp rate cut in December from 4.00%.

On the hawkish side of the Committee, Megan Greene, Huw Pill, and Clare Lombardelli delivered clear hawkish commentary, centred on sticky inflation and wage growth. Bailey and Catherine Mann were moderately hawkish, acknowledging the case for cuts but wanting to see how the incoming data unfolds.

On the dovish side, Alan Taylor, Swati Dhingra, Dave Ramsden, and Sarah Breeden argue that inflation risks have shifted to the downside, given weak demand, rising unemployment, and slack in the economy. They maintain that policy is too restrictive with the neutral rate around 3.0%, and that the costs of waiting too long outweigh the risks of cutting now as inflation returns to target.

There is no denying that the UK jobs market continues to loosen, and I expect this weakness to eventually feed through to lower wage growth and disinflation, creating an environment supportive of policy easing.

Investors have assigned a 65% probability to a BoE rate cut on 19 March, with a total of -47 bps of easing implied by year-end (i.e., two rate cuts). Personally, given the central bank's expectation of lower inflation, its recent downgrade to growth, and expectations of higher unemployment, I feel the markets may be even ‘under-pricing’ these cuts, meaning there could be more downside on the table, which may well materialise depending on how the data unfolds this week.

How to trade the UK numbers?

If jobs data come in softer than expected, this could increase rate-cut bets and weigh on the GBP, particularly after recent growth data, which revealed meagre economic activity. You may recall that the preliminary Q4 25 UK GDP figures showed that the economy grew by 0.1%, matching Q3 and slightly below the expected 0.2% growth.

If CPI inflation also prints a solid miss across key measures, traders will likely add to GBP shorts, as investors price in additional easing. At this point, a March cut will likely be fully priced in, and three rate reductions might be on the menu by year-end.

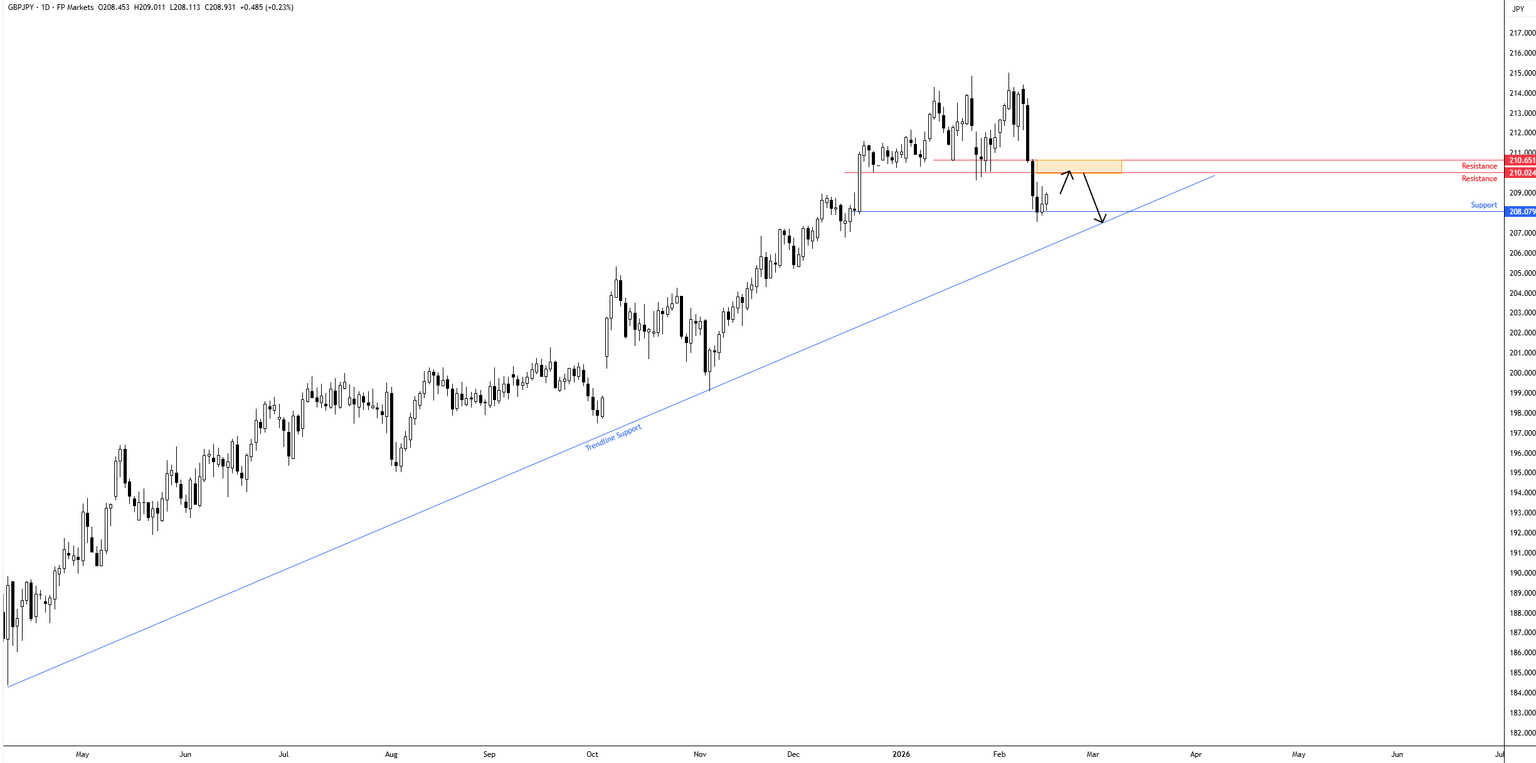

For pairs to watch, I will monitor GBP/JPY, GBP/NZD, and GBP/AUD solely from a policy divergence perspective. As shown in the daily chart below for the GBP/JPY, price recently rebounded from support at ¥208.08, with resistance calling for attention between ¥210.65 and ¥210.02 in the event of dovish UK prints this week. An ideal downside target for shorts could be the trendline support, extended from the low of ¥184.38.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,