Brexit is Part of Something Much Much Bigger

British Prime Minister Boris Johnson is now arguably very much on the back foot.

His Brexit plans are failing and the imminent deadline of Halloween 2019 is fast approaching.

Currency markets are seeing increases in volatility.

There is an air of nervousness and uncertainty.

However, what people are not aware of is that events such as Brexit in the UK and Election of Donald Trump, not to mention global polarisation are all part of a Modern Day Revolution.

November 2016 brought a revolutionary change in one of the world's largest democracies. Donald Trump, entrepreneur and celebrity, ousted the old guard and took command of the United States of America.

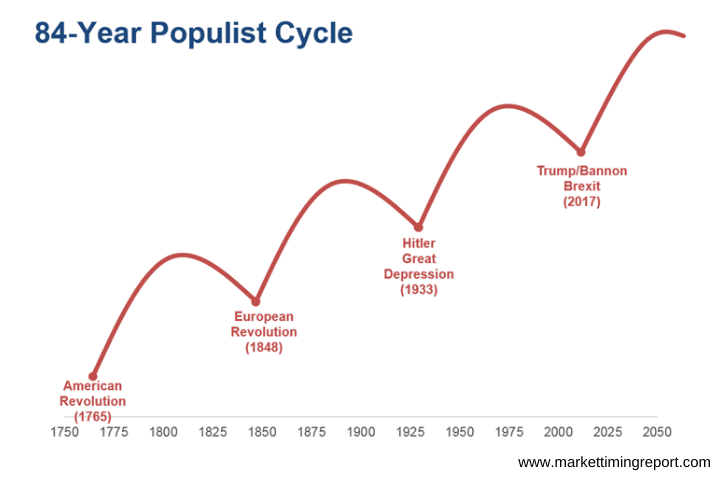

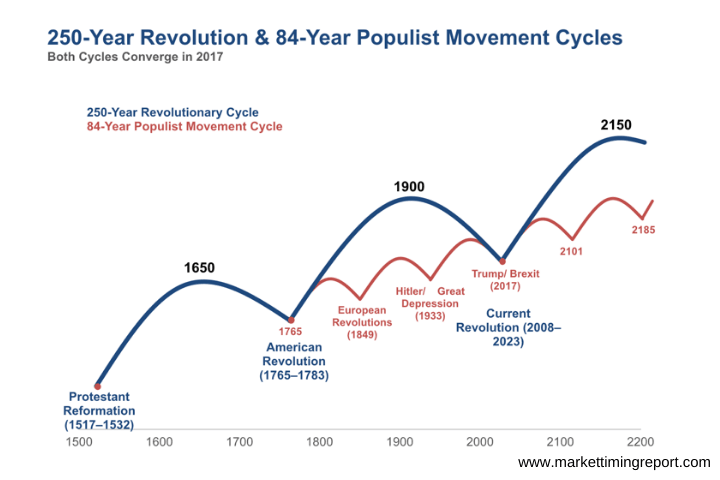

The 84 year cycle repeats in a chilling manner and within a window of a few days. Eighty- four years and its half point of 42 years highlight sudden revolutionary or extreme events. (To be specific this cycle varies between 81 to 84 years but do not worry about this).

Venture back to 1933 and we note that on 30th January Adolf Hitler becomes German Chancellor. We are merely observing cycles - not casting judgement nor accusing anyone. However, flavours are repeating. Human behaviour and mass psychology follow certain patterns. They unfold in similar, sometimes parallel and sometimes identical ways. In this case radical change is the key phrase.

Hitler's power rose rapidly as those around him and before him had been perceived as weak and the masses had had enough. Does this sound familiar?

Following the First World War, Germany faced massive reparations - economic penalties. This was to be one of the causes behind the hyperinflation in the post war Germany's Weimar Republic leading to mass discontent.

A loaf of bread that in Berlin that cost around 160 Marks at the end of 1922 cost 200,000,000,000 Marks less than a year later.

The cycle doesn't stop there. Head back another 84 years and we arrive in 1849. Between 1848 and 1850, the majority of Europe went through revolution. On February 21st 1848, Karl Marx published the Communist Manifesto. By April, France had a revolution on its hands. The contagion spread around Europe over the next two years. By the way this double revolutionary cycle saw Mexico defeated in a war with the United States in February 1848. Presently President Trump is proceeding with a wall on the Mexican US boundary.

If you are still not convinced, then you can turn the wheel back one more cycle — straight into the beginning of the 1765 American Revolution. The British brought in the Stamp Act to tax colonists. This was far more than a tax on commerce. Truly inflaming Americans and settlers alike, the American revolution was now gathering momentum. A significant event in the formative history of America.

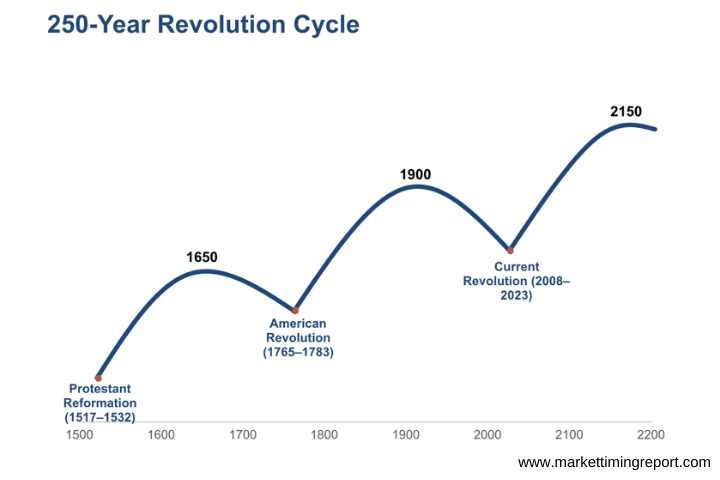

The three cycles of 82 to 84 years approximate to 250 years.

If we double that number up from 2017 then that takes us back to 1517.

This is when Martin Luther nailed his 95 theses to the door of Church in Wittenberg challenging the Pope and thus starting the Protestant Reformation.

So we are now seeing cultural and religious cycles coming together as well as geopolitical cycles.

We are in a period of great change. This is creating huge uncertainty for the masses. For those who understand the root cycles there are huge opportunities, I forewarned readers of these in The Market Timing Report last January. One of these is a flight to safety reflected in the price of precious metals. Whilst we are presently in a pullback - the timing of which was shown in a previous FX Street article on EUR (Oct 15 2019) - I anticipate metals will head higher. That turn I believe will be several weeks away.

Not only do we have the revolutionary cycles in place, we are also seeing the 90 year cycle from the 1929 Wall Street Crash FX Street article on Panics (Oct 15 2019).

We live in interesting times!

Knowing we are in a Modern Day Revolution helps us understand what's going on around us! Keep safe and seize the opportunities!

Author

Andrew Pancholi

Market Timing Report

Andrew Pancholi is a world-renowned trading expert specializing in market timing.