Brent Crude: Oil advances on Russian sanctions – Will the 100-day MA cap gains?

- Oil prices rose due to new US sanctions on Russian oil and tankers.

- The Kremlin warned these sanctions could destabilize global energy markets.

- Indian 'sources' stated it would avoid purchasing Russian oil from sanctioned entities and vessels.

- Markets are assessing the potential for a supply shock and whether OPEC+ will increase output.

Oil prices continued their rise this morning following a harsh batch of sanctions by the US on Russian Oil and tankers. The sanctions are the harshest yet and include producers Gazprom Neft SIBN.MM and Surgutneftegaz SNGS.MM, as well as 183 vessels that have shipped Russian oil, targeting revenue Moscow has used to fund its war with Ukraine.

The Kremlin responded this morning, warning that such decisions are bound to destabilize global energy and oil markets. The Kremlin also reiterated its stance to minimize the impact of US sanctions.

India and China to buy Oil elsewhere?

There have been rumors since Friday's announcement of the sanctions that countries who were still purchasing Russia will cease to do so under the new sanctions. This morning an Indian Government source stated that India won't take Russian oil from sanctioned entities and in sanctioned vessels.

However, this has not been confirmed by official channels. Several tankers listed in the new sanctions have been transporting oil to India and China. This shift happened after Western sanctions and a price cap set by the Group of Seven in 2022 redirected Russian oil trade from Europe to Asia. Some of these ships have also been carrying oil from Iran, which is also under sanctions.

The move comes just as proceeds from oil and gas sales for Russia's federal budget in 2024 jumped by more than 26% to 11.13 trillion roubles ($108.22 billion). Many see the oil industry as the main source of funding for the war in Ukraine with oil and gas proceeds accounting for about a third to half of the total Federal Budget.

Markets are now weighing up a potential supply side shock following sanctions. However, given that OPEC+ have been waiting to increase output, will they now do so if Russian output is taken off the market?

For now, it appears markets are adopting a more cautious approach and hence the increase in Oil prices. Markets do not appear to be sold yet on the idea that OPEC + will bridge any supply deficits.

Intriguing to see how this develops in the coming weeks as President Trump assumes office.

The week ahead - Inventories data and US inflation

Higher Oil prices may not be ideal for Financial Markets after last weeks US jobs data smashed estimates. The result has seen market participants expecting inflationary pressure in 2025 especially in the US which could halt interest rate cuts.

An increase in Oil prices could have a similar impact and see market participants price in more inflationary pressure globally in 2025. Such a move would no doubt stoke demand concerns as well.

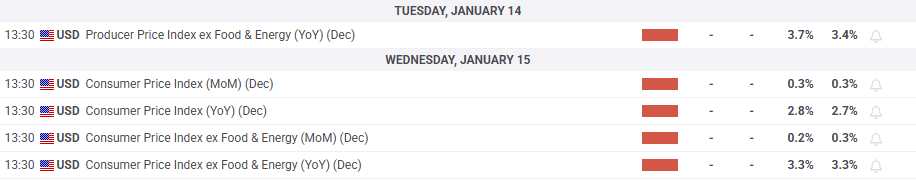

US inflation data is due this week and any significant uptick in the inflation print will also add to the market's growing concern. On the inventory front markets will be paying attention to stockpile levels from both the EIA and API, due on Tuesday and Wednesday respectively.

Technical analysis

From a technical analysis standpoint, this analysis is a follow up from the technicals last week: Brent Crude – Oil Eyes Break of Key Confluence Level on Chinese Optimism.

As discussed last week, Oil prices have rallied tremendously at the start of 2025 much to the surprise of many analysts.

However, given the length of time Oil prices remained in consolidation, i for one was not surprised by the aggressiveness of the breakout.

As things stand, Oil has run into a spot of bother on the weekly chart below. The Oil price is currently rejecting of the 100-day MA which could leave Oil prices with some downside in the coming days.

Brent Crude Oil weekly chart, January 13, 2025

Source: TradingView (click to enlarge)

Dropping down to a daily timeframe and immediate support rests at $80 a barrel mark with the 200-day MA resting below at 79.28.

A break of this level could open up a retest of the 76.35 before the 75.00 psychological level.

If bulls were to seize control of the narrative then Oil could eye resistance at 81.58 and 83.00 respectively.

Brent Crude Oil daily chart, January 13, 2025

Source: TradingView (click to enlarge)

Support

- 80.00

- 79.28

- 76.35

Resistance

- 81.58

- 83.00

- 84.72

Author

Zain Vawda

MarketPulse

Zain is a seasoned financial markets analyst and educator with expertise in retail forex, economics, and market analysis.