BoJ Preview: Policy review to focus on yield curve control framework and ETF-buying

- BoJ is expected to leave its policy rate unchanged at -0.1%.

- Possible adjustments to ETF-buying strategy and YCC framework are likely.

- BoJ's policy announcements are unlikely to receive a significant market reaction.

The Bank of Japan (BoJ) is widely expected to keep its policy rate steady at -0.1% following the two-day policy meeting ending on Friday. More importantly, the BoJ will release the findings of its policy review alongside the policy statement.

Policymakers contemplate YCC and ETF purchases

Earlier in the month, BoJ Deputy Governor Masayoshi Amamiya explained that the purpose of the policy review will be to ensure markets that the bank has the ability to act in an effective and timely manner to economic changes. Amamiya further acknowledged that it’s a favourable development that the JPY doesn’t spike anymore when investors seek refuge in safe-haven assets.

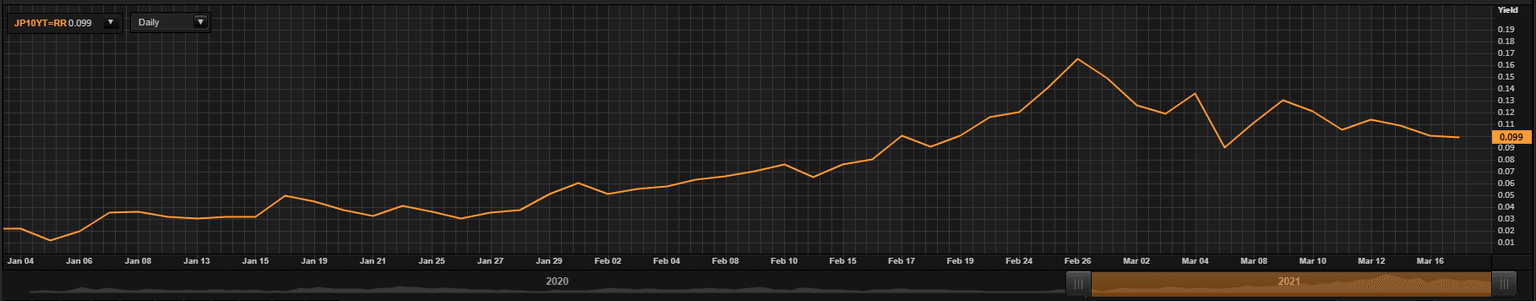

However, the recent upsurge witnessed in bond yields of developed economies amid global recovery hopes and heightened inflation expectations seems to have put the BoJ in a tough spot with regards to its yield curve control (YCC). Citing BoJ sources, Reuters reported last week that the BoJ could offer clearer guidance on what it sees as an acceptable level of fluctuation in long-term interest rates. While keeping the short-term rate anchored at -0.1%, the BoJ could allow the yield on the 10-year Japanese government bond to deviate modestly from the target level of 0% depending on economic developments.

JGB 10-year yield

Even so, any tweaks to the YCC framework is likely to be minimal as Governor Haruhiko Kuroda argued that it’s not necessary or appropriate to widen the band around the BoJ’s long-term rate target. “Now is time to keep yield curve stably low as COVID-19 still continues to affect the economy,” Kuroda added.

Moreover, the BoJ could make changes to its exchange-traded funds (ETF) buying strategy to have more flexibility in its monetary policy. Currently, the bank has an annual ETF buying target of 6 trillion yen ($55 billion) with an upper limit of 12 trillion yen and the removal of the annual target could be a feasible option. “The BoJ must buy ETFs flexibly when its presence is needed to address sharp widening of risk premia,” Kuroda noted.

Although the above-mentioned changes to the BoJ’s policy could be seen as moderately bullish developments for the JPY, the currency’s reaction is expected to remain subdued with investor having already priced-in these possible adjustments. More importantly, it would be a huge surprise if the BoJ were to forego its extremely dovish outlook and forward guidance given the subdued inflation outlook and downside risks to economic recovery.

Possible JPY strength to be short-lived

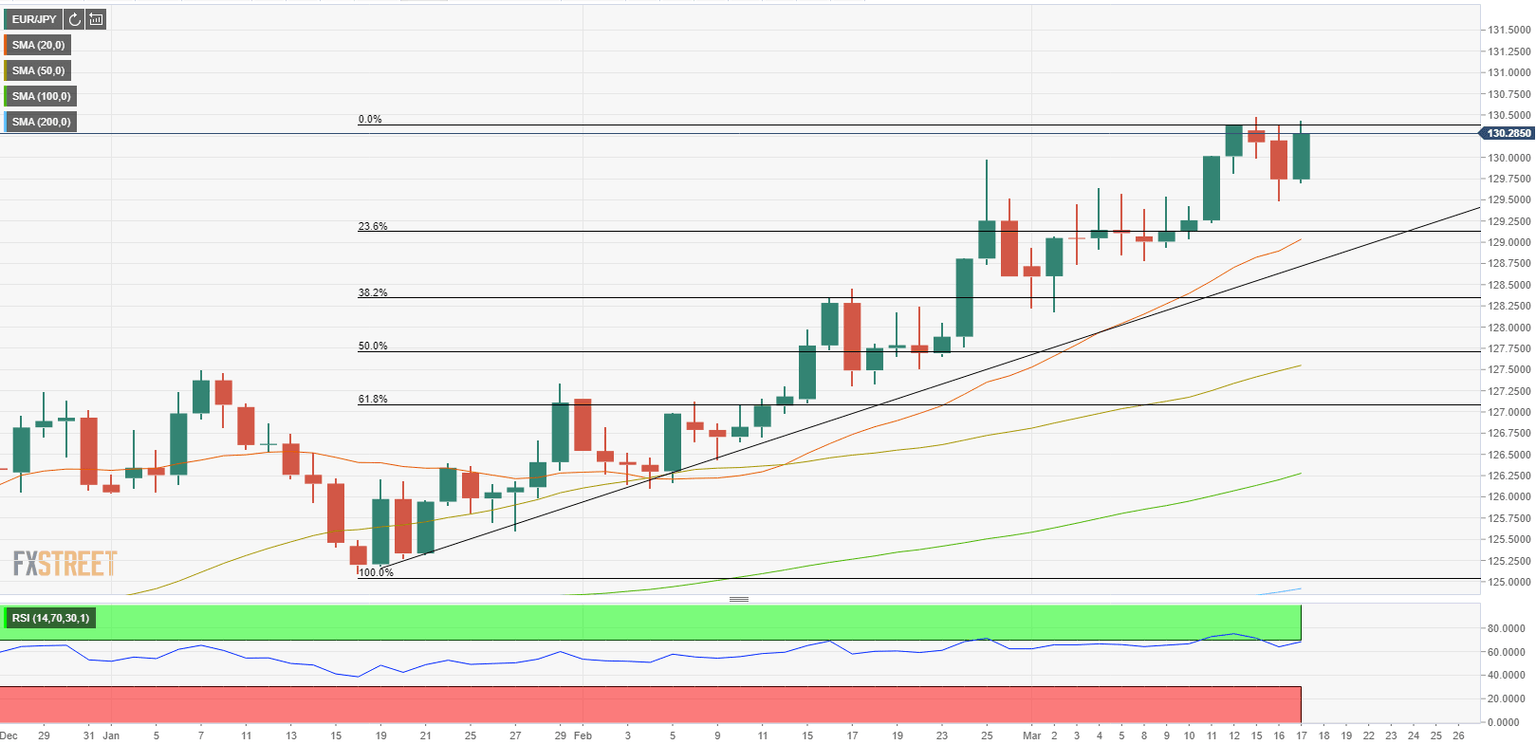

All JPY-denominated pairs have been rising steadily since the beginning of the year as the coronavirus vaccine rollout and the unprecedented fiscal and monetary support point to a steady expansion in the global economy. USD/JPY is up more than 5% in 2021 after closing the last four months of 2020 in the negative territory, GBP/JPY is trading above 152.00 for the first time since April 2018 and EUR/JPY is testing 29-month highs above 130.00.

Among those pairs, EUR/JPY looks relatively vulnerable to a bearish shift with the European Central Bank (ECB) starting to ramp up its weekly asset purchases under the Pandemic Emergency Purchase Programme (PEPP).

On the downside, the initial target is located at the 129.00 area, where the 20-day SMA coincides with the Fibonacci 23.6% retracement of the two-month-long uptrend that started in mid-January. Furthermore, the ascending trendline is also reinforcing this support. A daily close below that level could open the door for additional losses toward 128.50 (Fibonacci 38.2%) retracement.

Nonetheless, the daily chart paints a convincingly bullish picture with the possibility of a technical correction in the near-term and the BoJ by itself is unlikely to force EUR/JPY to reverse its course.

EUR/JPY daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.