BoJ intervention 2022 vs 2024

In September 2022, the BOJ Import Index ran 188.1 to Exports and 131.9 to Imports or a 56.2 difference. The yearly Export to Imports rate of change at a 24% increase was matched by an 85% difference.

The Import line for all 2022 from 35.4 to 48.00 increased +52% and a 30% difference while Exports traveled + 15% and a difference of 45.0%.

USD/JPY was factored at 143.00's and intervention occurred 900 pips higher at 152.00's.

The BOJ's trade dilemma actually began in August 2021. Oil, petroleum and Natural gas contributed 40% to the Import Line and 37% to Chemicals. Oil's rise increased 171.0% in 2022 and a difference of 54%. The Oil price since moderated from 60.00's to 80.0's yet offers no trade relief to Imports.

March Import Index at 163.8 and 137.5 offers a 26 point difference and an overall variation of 17.45%. The index yearly rate of change for Imports and Exports runs 40% and 1.59 to Imports and Exports.

The United States in September 2022 ran Imports at 143.1 vs 156.8 to Exports or a difference of 9.13% and an increase of 367.48% .Exports above Imports varied at 9.57%.

For 2022. the Import index ran from 140.1 to 148.5 or an 8.4 difference to index points and a 5.82% difference. The Export side from 148.2 to 166.70 or an 18.5 difference to index points ran a variation of 11.74%. Imports to exports on the low side ran a rate of change at 5.82% and 17.34% on the high side.

For March Imports at 140.4 Vs Exports 149.0 or an 8.6 point difference to index points and 5.94%. The overall increase runs 6.12%

For all 2022, the BOJ import line increased +52% to the US at 5.82% and 17.34% while BOJ exports traveled +15% to 5.82 and 17.34 and roughly a 25% difference.

The BOJ is in a rough spot but a 26 point difference to index points and 40% vs 1.59% to Imports and Exports doesn't bode well to spend 6 billion USD to intervene. USD/JPY for March is factored at 149.00's and USD/JPY at 154.00 trades 500 pips above.

The BOJ raised to positive interest rates and the 180 day rate just turned positive. The BOJ had to know USD/JPY would maintain higher for longer until all interest rates were aligned positively.

In the short term, lower Oil would greately assist the BOJ, lower Inflation and higher GDP. Oil to the BOJ is just as superior as Inflation and GDP.

What radically changes Imports and Exports lines are central bank interest rate changes. Inflation and new lows below 3.0, GDP and Oil. What is seen is solid bottoms and tops and multi year trades.

The BOJ views Imports and Export lines from Current year and to Fiscal years.

The BOJ is one side to the Import/ Export equation while the USD side offers confirmation.

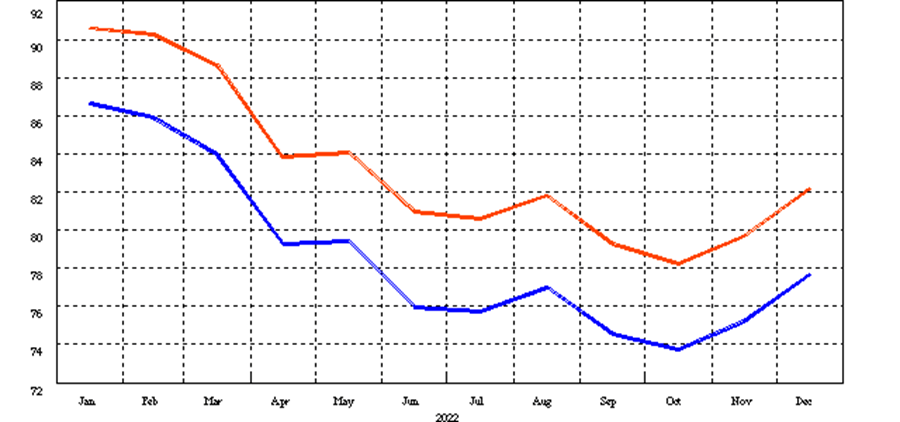

Below is USD/JPY as spot and as the Trade Weight Index for 2022.

Author

Brian Twomey

Brian's Investment

Brian Twomey is an independent trader and a prolific writer on trading, having authored over sixty articles in Technical Analysis of Stocks & Commodities and Investopedia.