BoJ hold interest rates at 0.5%, US Retail Sales sink, Yen steady

The Japanese yen is slightly higher on Tuesday. In the European session, USD/JPY is trading quietly at 144.58, down 0.08% on the day. The Bank of Japan held interest rates, while US retails sales were lower than expected at -0.9%.

BoJ holds rates for third straight time

There were no surprises from the Bank of Japan on Tuesday, as the central bank maintained its short-term interest rate unchanged at 0.5%. This leaves the rate at its highest level since 2008.

The BoJ started the year on a hawkish note, hiking rates by 0.25%. However, any hopes for a series of rate increases were dashed as US President Trump unleashed his wide-ranging tariffs which led to significant turmoil in the financial markets. Central banks responded with extreme caution to the geopolitical risks and the BoJ has remained on the sidelines.

Today's decision was unanimous, which underlines the cautious stance that BoJ policymakers are taking. Last week, Governor Ueda said that if the BoJ is convinced that underlying inflation will approach the 2% level, the BOJ will continue to raise rates.

At today's press conference, Ueda said that inflation expectations aren't yet at the 2% level and voiced concern about tariffs affecting future wages. This dovish message reads "caution, caution, caution" and could mean that the Bank won't raise rates before 2026.

BoJ says will slow pace of reduction in JGB purchases

Although the BoJ didn't raise rates at today's meeting, it confirmed plans to reduce Japanese government bond purchases by JPY 400 billion each quarter through Q2 2026. However, the Bank said it would cut in half the pace of reduction after that, to JPY 200 billion every quarter through Q2 2027. This indicates a slower move away from ultra-loose monetary policy, reflecting a more gradual approach in response to the uncertain economic environment.

USD/JPY technical

-

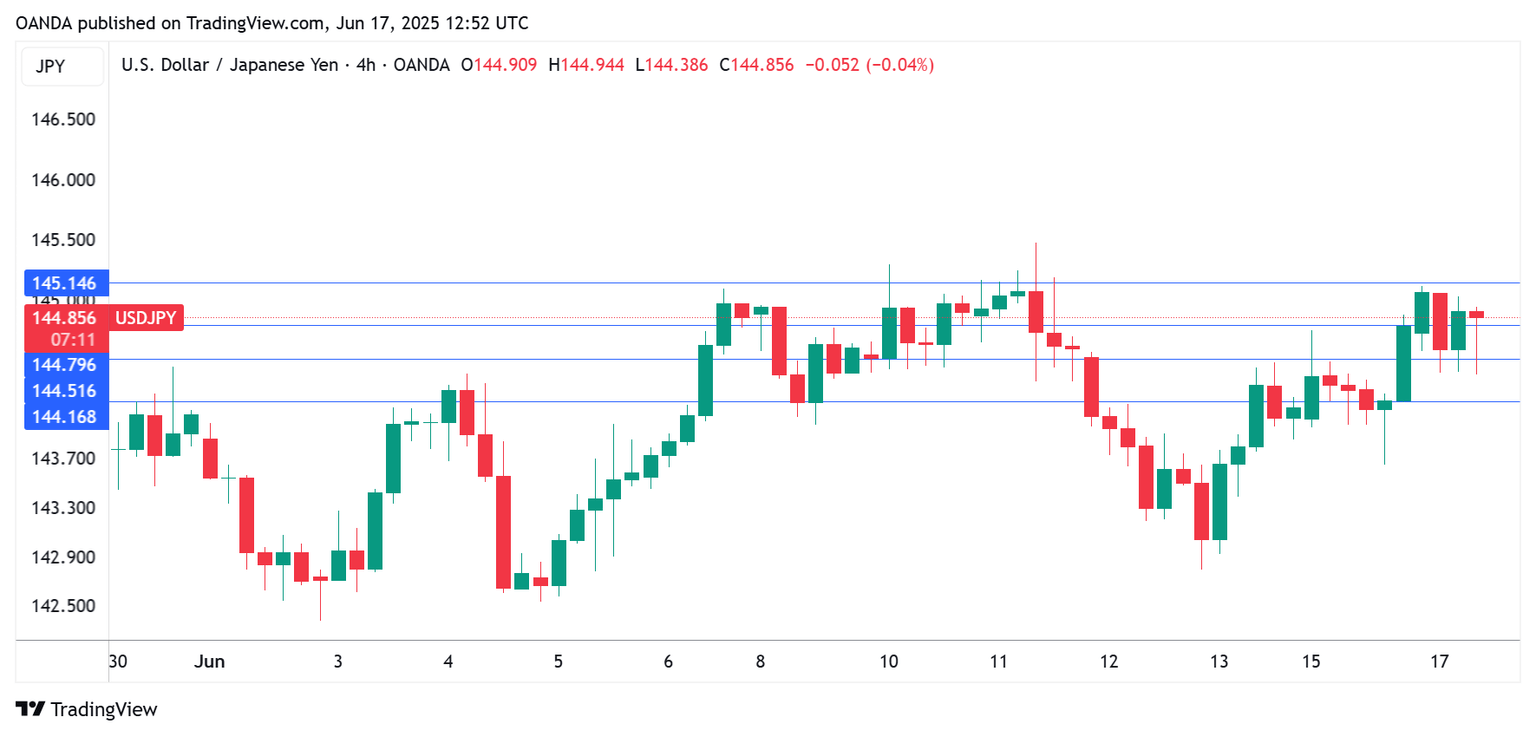

USD/JPY tested support at 144.53 earlier. Below, there is support at 144.16.

-

There is resistance at 144.78 and 145.16.

USDJPY 4-Hour Chart, June 17, 2025

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.