BoE Interest Rate Decision Preview: Preparing ground for a rate hike pause in May

- The Bank of England is expected to hike rates by 25 bps in March from 4.0% to 4.25%.

- BoE to assess the latest inflation data and the extent of the global banking crisis.

- The vote split and language in the statement to hold the key; GBP/USD set to rock.

The Bank of England (BoE) is seen keeping up its interest rate increases, although at a slower pace in March, as the world battles financial sector risks. The BoE will announce its interest rate decision at 12:00 GMT on Thursday. It’s not a ‘Super Thursday’ as there are neither updated economic forecasts at this meeting nor Governor Andrew Bailey’s press conference.

BoE to signal a pause in the next meeting

Following the all-important Federal Reserve policy meeting, the Bank of England will likely deliver a 25 basis points (bps) rate hike this Thursday, raising the key policy rate from 4.0% to 4.25%. It will be the eleventh straight hike and probably the final one before the central bank adopts a wait-and-see approach.

At its February meeting, the Bank of England raised rates by 50 bps and made subtle changes in its policy statement, replacing the phrase “further rate increases were needed” with it would act only on the evidence of “persistent inflationary pressures”.

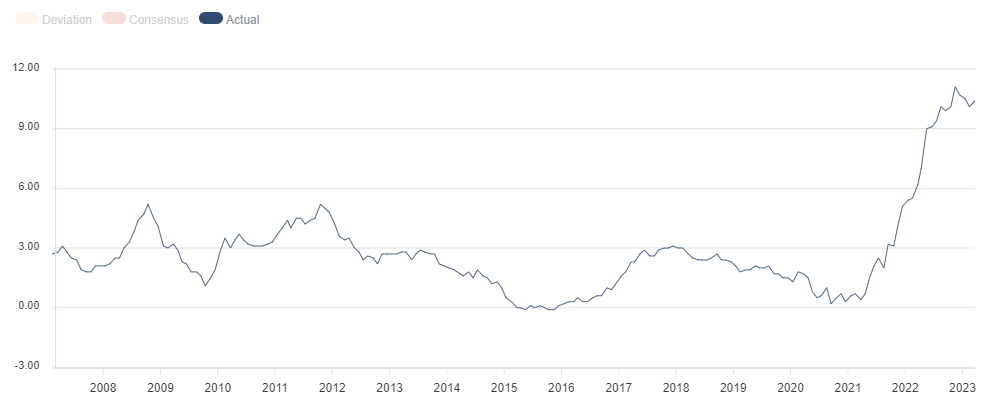

Since then, the UK annualized Consumer Prices Index (CPI) has eased to 10.1% in January against December’s 10.5% increase. The Core CPI gauge (excluding volatile food and energy items) dropped sharply to 5.8% YoY in the reported period versus 6.2% expected and 6.3% seen in December. The February month annualized CPI unexpectedly jumped to 10.4% while the Core figure also increased to 6.2% YoY.

UK annualized inflation

Source: FXStreet

The UK Gross Domestic Product (GDP) data showed an expansion of 0.3% in January, compared with 0.1% expectations and -0.5% previous. Elevated inflation levels and a resilient economy justify the central bank’s intent to sustain its tightening cycle. Markets are now pricing a 96% probability of a 25 bps rate hike by the Bank of England this week.

Given the upheaval in the global banking sector over the past two weeks, the market expectations for the UK interest rates shifted dramatically, leaning in favor of a hold. Further, growth in wages in Britain lost pace in the three months to January. The UK’s average weekly earnings, excluding bonuses, arrived at 6.5% 3Mo/YoY in January versus 6.7% last and 6.6% expected. The Bank of England is watching the wage growth data closely and a slowing pace suggests the Bank could contemplate pausing its run of interest rate hikes.

BoE Governor, Andrew Bailey, warned investors earlier this month, “at this stage, I would caution against suggesting either that we are done with increasing bank rate, or that we will inevitably need to do more.”

With ebbing fears over the global banking sector turmoil, markets are more optimistic about a 25 bps rate increase. Meanwhile, UK Chancellor, Jeremy Hunt, reaffirmed on Wednesday that the country’s banks are in an `immensely stronger position' vs. pre-2008.

Against this backdrop, investors will closely scrutinize the language in the central bank’s policy statement and the vote split for any hints of a likely pause in the BoE’s tightening cycle at the next meeting. During the previous meeting, the BoE’s Monetary Policy Committee (MPC) voted, by 7 to 2, to deliver their final 50 bps rate hike.

To conclude

With a 25 bps rate hike, BoE will take the lead from the European Central Bank (ECB) and the Federal Reserve to stick to its script, which would help strengthen the market’s confidence. However, if the statement and the Minutes of the meeting communicate a potential pause at the next meeting, it could weigh heavily on the GBP/USD pair. However, the losses could be capped by the persistent risk tone and the US Dollar price action.

The pair could also come under intense selling should the central bank surprise the market with an on-hold interest rates decision. In case the BoE signals more tightening ahead (personally I see a slim chance), it could trigger a fresh rally in the GBP/USD pair.

Ahead of the BoE policy announcement, the Federal Reserve is set to hike rates by 25 bps on Wednesday. The Fed-driven market sentiment and the US Dollar dynamics could influence GBP/USD reaction to the BoE verdict.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.