BoC to cut rates again, what's next? – Preview

-

Bank of Canada to slash rates by 25bps for the second time in a row

-

More easing expected, but policymakers might signal a data-dependent approach

-

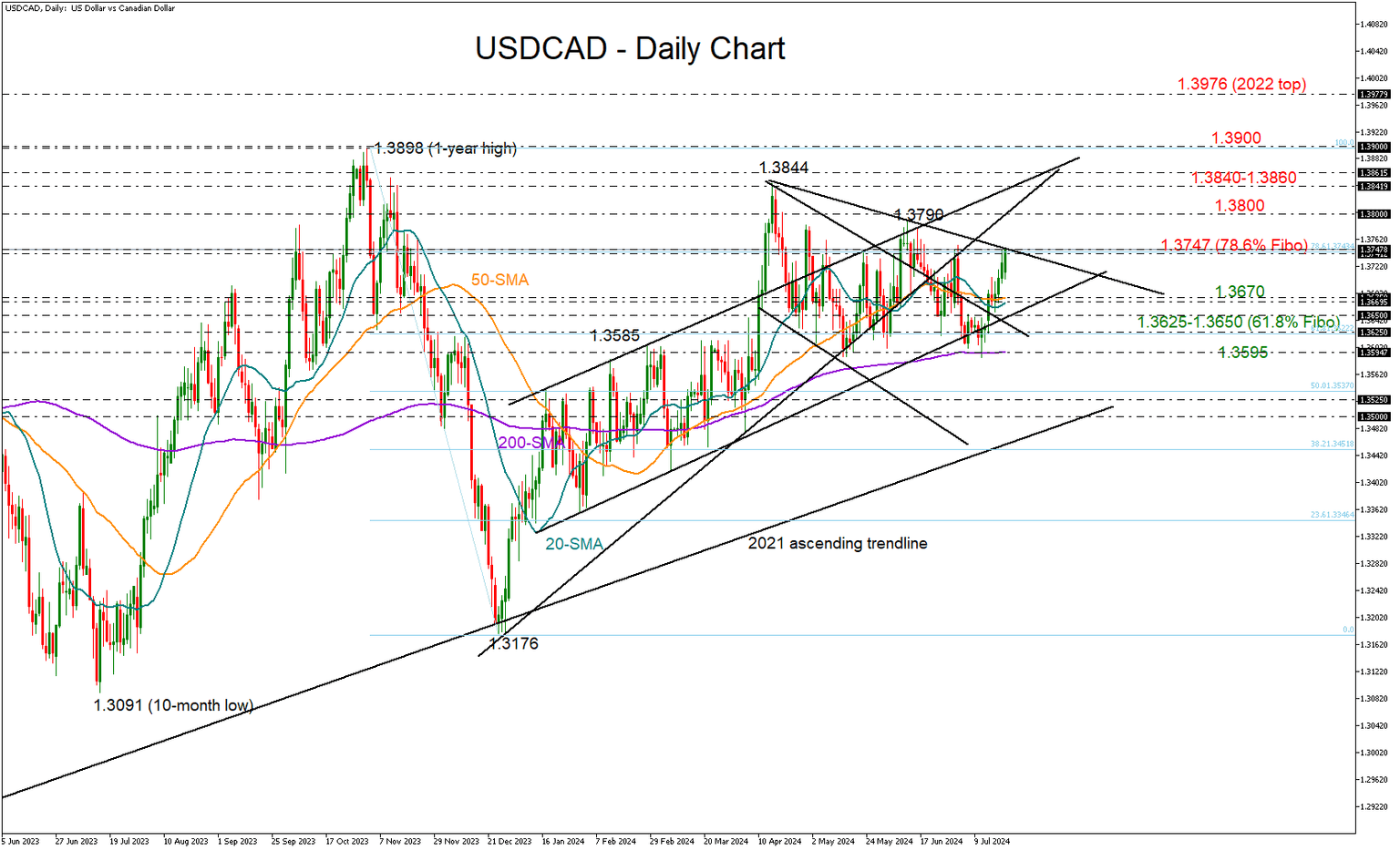

USDCAD tests key resistance of 1.3740; key support at 1.3620

Investors are confident that the Bank of Canada (BoC) will cut interest rates by a quarter percentage point for the second time in a row to 4.5% when it announces its policy decision on Wednesday. If that scenario plays out, the BoC will be ahead of major central banks in the easing cycle. But will the central bank feel comfortable moving forward with further back-to-back reductions given that its major peers are still uncertain?

What led to June’s rate cut?

Back on June 5th, headline inflation displayed the lowest annual change since March 2021, clocking in at 2.7% y/y and within the central bank’s control range of 1-3%. Although that was still higher than the BoC’s 2.0% midpoint target, the core measure, which excluded food, energy, tobacco and mortgage rates, was below that threshold at 1.6%; once mortgage costs are excluded, it’s evident that monetary policy does not need to be so restrictive.

With the unemployment rate climbing to a two-year high and household debt remaining problematic, the BoC did not hesitate to slash its borrowing costs and join its Swedish and Swiss counterparts.

Will there be a second reduction?

The question now is whether a second cut in a row is necessary. In June, inflation slipped back to 2.7% y/y after a pickup to 2.9%, staying below the BoC’s Q2 projection of 3.0%. On the other hand, the core measure climbed to 1.9% but held near the 2.0% midpoint target.

Furthermore, the unemployment rate increased to 6.4% and the central bank’s most recent business survey indicated a decline in sales outlook and weaker expectations for wage growth, alleviating concerns of labor shortages and potential widespread inflation from rising wages. Recall that retail sales have been in the negative region every single month since the start of the year excluding the month of April.

Even though the central bank has not declared victory over inflation yet, the above stats could be enough reasoning for a second rate cut this month. According to futures markets, this is a done deal. Besides, back-to-back rate reductions are common during monetary easing cycles in Canada. Taking this into consideration, investors might shrug off the rate decision and pay more attention to whether there will be additional rate cuts by the end of the year.

How many rate cuts are priced in?

There are three more meetings in September, October and December, and investors foresee at least one rate reduction.

Policy divergence between the US and Canada tends to face limits and it has not exceeded 100bps since the 2007-2009 financial crisis. But with the FOMC expected to step into its easing cycle in September, the BoC may not feel there are any barriers in further lowering its borrowing costs. That said, policymakers might avoid straightforward communication and could instead endorse a data-dependent approach, citing elevated services inflation, and a potential increase in global trade barriers if Trump becomes the next president.

USD/CAD outlook

As regards the loonie, it has been on the backfoot against the US dollar lately, completely losing its July wins. A relatively hawkish BoC communication linked to a data-dependent attitude could provide some relief to the currency. In this case, USDCAD could slide towards its 20- and 50-day simple moving averages (SMAs) at 1.3670. A bigger test could come slightly lower at 1.3650, where the 2024 protective trendline is placed. If the 1.3625 zone proves easy to pierce too, the bears could target the flattening 200-day SMA at 1.3595, a break of which would damage the short-term outlook.

In the event the central bank surprises investors with no rate cuts, the pair could experience a steep downfall.

Alternatively, if policymakers feel more confident about their price stability mission, flagging more rate decreases ahead, USDCAD could surpass the wall at 1.3747 to meet the next barrier at 1.3800. Even higher, the pair could stop somewhere between 1.3840 and 1.3860.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.