Bitcoin price crashes after Tesla stops accepting the currency

Bitcoin and other cryptocurrency prices retreated in the overnight session as traders reflected on the decision by Tesla to stop accepting the digital currency. In a statement, Elon Musk cited the substantial energy consumption needed to mine the currency. It is still unclear whether Tesla will sell its remaining Bitcoin holdings. Also, it is not known whether the number of people buying cars and accessories using the currency was significant. In the statement, he added that the company will be looking to use other cryptocurrencies that use a proof-of-stake consensus. Bitcoin and other digital currencies also retreated after the rising US inflation data.

The US dollar rose against other currencies after the latest US inflation numbers. Data by the Bureau of Statistics showed that prices rose by 4.2% in April, the highest jump in 13 years. This annual gain was mostly because consumer prices crashed in April last year as the government started to implement lockdowns. Other top contributors were the fact that shipping and commodity price have jumped recently.

For example, the price of lumber has more than quadrupled, pushing the house prices higher. Similarly, the price of iron ore has jumped to an all-time high, pushing appliances and electronics higher. The recent stimulus by the United States also contributed to the gains. Later today, the currency will react to the latest initial jobless claims and producer price index (PPI) data.

The euro retreated even after the European Commission boosted its economic outlook for the region. In a note, the commission said that it expects the bloc’s economy to grow by 4.3% this year and by 4.4% in 2022. This was an upgrade from the previous estimate of 3.8%. The upgrade came after the bloc published weak industrial production and inflation data. It also reflects optimism that the bloc will manage to sharply boost its vaccination process.

EUR/USD

The EUR/USD price retreated to a low of 1.2065 after higher US inflation data. This drop happened a few sessions after the pair formed a double-top pattern on the hourly chart. The price also declined to the 61.8% Fibonacci retracement level. It also moved below all moving averages. Further, the pair seems to be forming a bearish flag pattern while the Relative Strength Index (RSI) has moved from the oversold level of 23 to 38. Therefore, the pair will likely resume the downward trend, with the next target being at 1.2000.

GBP/USD

Like the EUR/USD pair, the GBP/USD dropped sharply after the latest US inflation numbers. It fell to a low of 1.4068, which was the lowest level since Monday this week. The pair also broke out below the lower side of the bullish flag pattern that had been forming. It is still slightly above the 25-day and 15-day exponential moving averages while the Relative Strength Index (RSI) has declined from the overbought zone. The pair will remain in a bullish trend if the price is above the moving average.

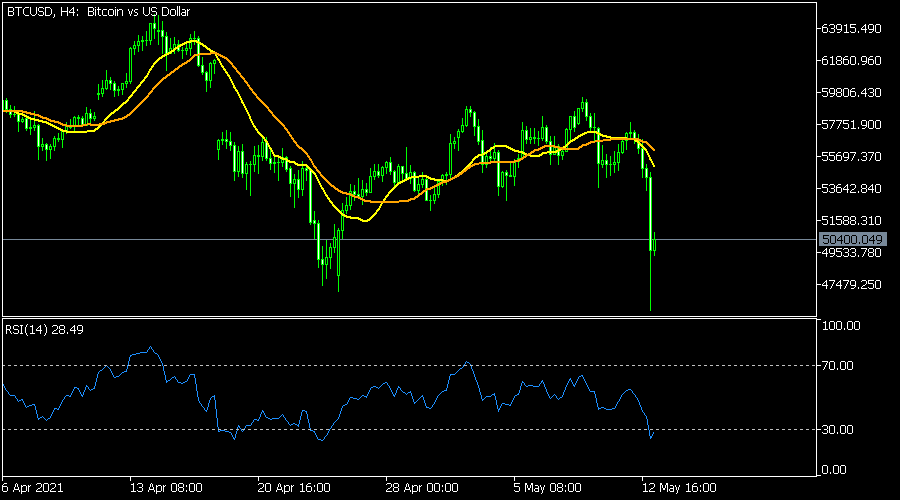

BTC/USD

The BTC/USD pair declined sharply after news that Tesla would stop accepting the digital currency. It fell to 45,882, which was the lowest level since March 1. It then bounced back to the current 50,500. On the four-hour chart, the pair has dropped below the moving averages while the RRI has moved slightly above the oversold level of 30. Therefore, the pair will likely resume the upward trend as investors rush to buy the dips. However, a drop below the overnight low of 45,882 will invalidate the bullish thesis.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.