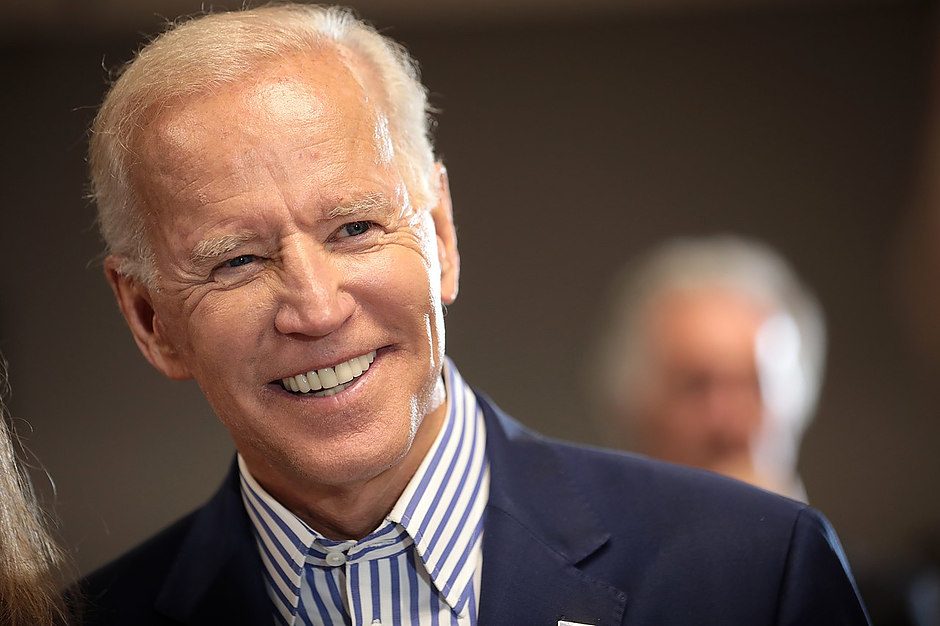

Biden administration announces framework for digital dollar

The Biden administration is working on plans to herd the public into digital currency controlled by the Federal Reserve.

Last Friday, the Treasury department released a framework for regulating digital assets. One major objective, according to Treasury Secretary Janet Yellen, is to “advance policy and technical work on a potential central bank digital currency, or CBDC."

The administration is pitching a CBDC as a way to improve the security and efficiency of electronic transactions. The real motive, however, may have more to do with improving the efficiency of collecting taxes.

All digital dollar transactions would be logged could potentially be traced back to individuals.

Anonymity? Forget about it.

In recent remarks, Fed chairman Jerome Powell stated that CBDC users would be "identity verified."

One proposed way in which digital dollars would be held and transferred is that everyone would have an individual account at the Fed itself.

There are currently some legal restrictions on the Fed being able to create cash accounts for individuals. Therefore, Fed officials have suggested that commercial banks and other financial institutions act as intermediaries in administering "Fedcoin."

Central bankers and bureaucrats are giddy over the opportunity to roll out their top-down version of a digital economy. But it’s unclear whether commercial banks will favor an idea that seems to supplant them as depository institutions.

If CBDCs become the next phase in the digital currency revolution, it will be a sad irony. Cryptocurrencies such as Bitcoin were originally released with the promise of decentralization, privacy, and unbreakable peer-to-peer security.

Regardless of the touted benefits of Bitcoin or CBDCs, no digital asset should ever be presumed to be sound and stable money.

There's no telling what impact a Fed-issued CBDC will have on inflation. It's quite possible, though, that the currency supply will expand more rapidly – especially if Congress tries to assert the power to create digital dollars to cover budget deficits (as is the aim of Modern Monetary Theorists such as Senator Elizabeth Warren).

The more officials in Washington, D.C. try to herd the public into digital dollars, the more investors who are concerned about preserving privacy and purchasing power should pursue wealth protection in hard assets.

Physical precious metals cannot be digitally tracked, lost, or seized. They cannot be created out of thin air. And their function as sound money cannot be replaced or replicated by technology or decree.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Stefan Gleason

Money Metals Exchange

Stefan Gleason is President of Money Metals Exchange, the national precious metals company named 2015 “Dealer of the Year” in the United States by an independent global ratings group.