Bears to have the last laugh

S&P 500 nary consolidated, and continued higher as was most likely. Dollar down, bonds up and the risk appetite was visible very well across real assets especially. Given the weakening in bonds before the closing bell, and the extended position of tech stocks, some real daily consolidation wouldn‘t be that surprising on Monday – I‘m looking for the stock market to stall during August, and to roll over. It‘s still my view that we‘re in a bear market – that a new bull run hasn‘t yet begun – and that a washout in the very least, awaits us. Still before the Sep FOMC.

Let‘s come back to the anticipated Wednesday bullish turn, and quote from the lengthy explanation I published Thursday:

(...) On one hand, the 75bp rate hike is over, on the other hand less clarity about future rate hikes rules now – markets remained anchored in the now, running with the glass is half full message. The part where Powell mentioned that an aggressive September rate hike is on the table if justified by incoming inflation data (an outsized September one won‘t happen in my view), got less scrutiny. And the same goes for his willingness to tolerate below-trend economic growth and some pain in the labor market.

So, why is the market rallying then? The upcoming CPI would come in a bit softer on account of the June gasoline and heating oil peaks, which would be balanced out against unrelenting services inflation. Think rents that are lagging behind the housing prices – housing is only starting to cool down. There is more pain ahead, but of course the consumer discretionaries don‘t see that yet – it‘s not the right time as the consumer sentiment hasn‘t yet filtered through to retail sales. Compared to what awaits at year end, the U.S. economy is still doing very fine now (however incredibly this sounds to the very sensitive small business owners, close to half of who perceive the U.S. already to be in a recession). Coupled with tech layoffs, hiring freezes, and e.g. bad META earnings just in, this weakness isn‘t yet universal as the key aspect of the prior 4 weeks was this – the 100bp rate July hike that I didn‘t trust one bit as coming, took the markets down inordinately (the bears got ahead of themselves simply). Reversion to the mean – talked in Monday‘s extensive analysis – is thus winning.

The stock market pendulum has since decidedly swung in the bullish direction, yet I‘m looking for this rally to run out of steam, and roll over. Remember that Powell said that with the 75bp hike, the Fed funds rate is now close to neutral. Sure that inflation is peaking and the following CPI readings would be a little more pleasant deceleration rather than acceleration continuation (PCE at 6.8% annualized is highest since 1982), but the Fed would take the opportunity and try pushing the Fed funds rate a bit above what it sees as the natural rate. And I am not even raising the aspiration to be shrinking the balance sheet by up to the whopping $95bn a month (something similar went on into spring 2019, well after the hikes of 2018 ended), which would cool down the housing market a lot more than it appears to be the projected case now. Also the job market effects would take the unemployment rate noticeably higher, and that would deal with the wage inflation while the cost push one would decelerate, yet service driven one remain unyielding. Simply put, inflation is to cool off somewhat.

Apart from macroeconomic reality catching up with the bear market rally, it‘s also earnings projections where I am looking for quite a few downgrades in the 2H 2022. Coupled with the Fed surprising the markets on the balance sheet reduction front (there isn‘t enough attention paid to this yet – let alone to the liquidity withdrawal aftermath), and the deepening yield curve inversion, we‘re in for a lot of recessionary trouble – at the very least teetering on the brink already. Deteriorating consumer sentiment would also cascade into retail sales – coming full circle to the earnings ahead.

Precious metals are buying the monetary shift arguably the best, copper is following with certain reservations – but crude oil continues basing, and lagging behind oil stocks. Black gold still has great potential to surprise on the upside (the tail risk) – the Fed can‘t increase supply of anything real, it can just cool down the economy (decrease demand), which they are doing successfully. That‘s the only way given the circumstances how Powell can get inflation somewhat under control.

Today, I’m releasing the extended analytical synopsis customarily available for premium subscribers who enjoy some more stocks and bonds charts with observations.

Let‘s move right into the charts – today‘s full scale article features good 6 ones.

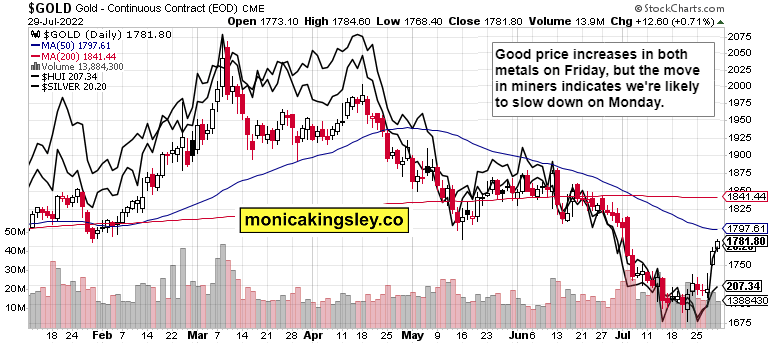

Gold, silver and miners

Precious metals haven‘t yet met the sellers, but the pace of gains immediately ahead, would slow down. Miners are still lagging, and need to catch up. As yields are likely to retreat, helping the dollar down a little, gold and silver would act on the medium-term advantage.

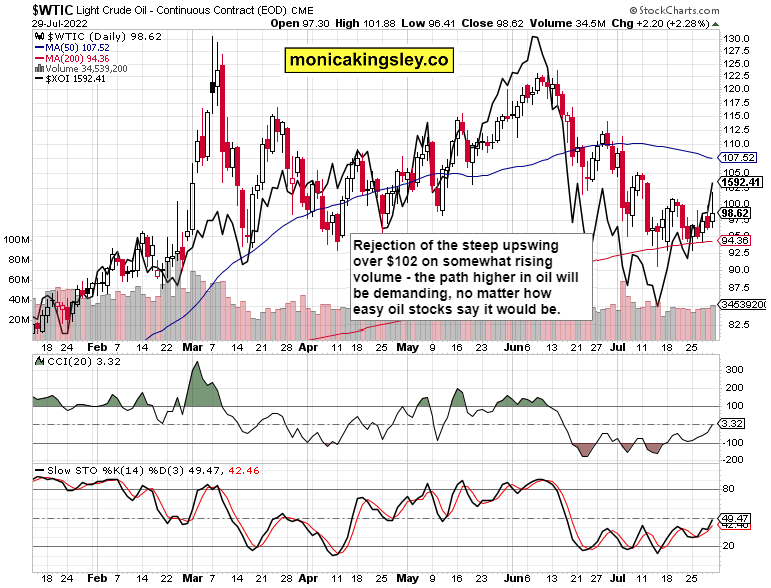

Crude oil

Crude oil upper knot is a short-term worrying sign, but has good odds to be gradually overcome. It‘s not a show-stopper but a minor setback. The real economy isn‘t cooling down all that quickly, and the SPR releases obviously don‘t have a lasting or too significant effect.

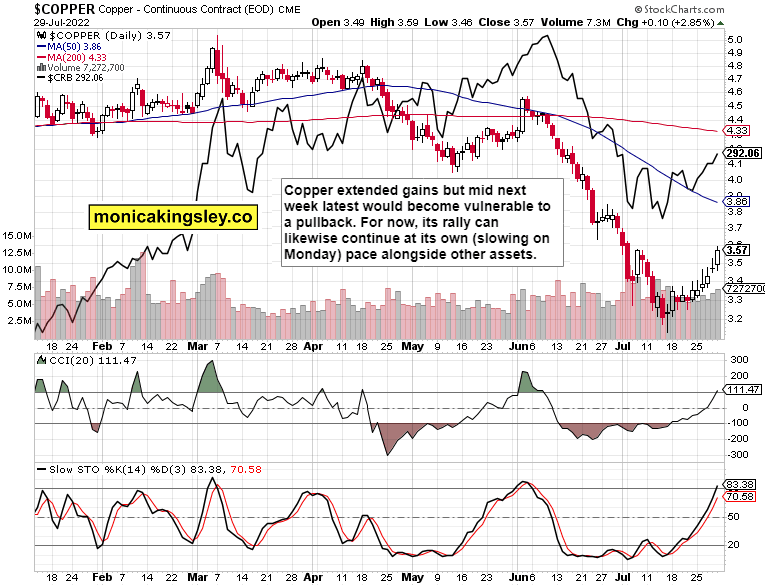

Copper

Copper is duly benefiting, the upswing in commodities can continue for a while longer, but the peak in base metals (zinc, nickel etc) tells me that the rest of 2022 would be characterized by slowly declining inflation, especially its part coming from raw materials.

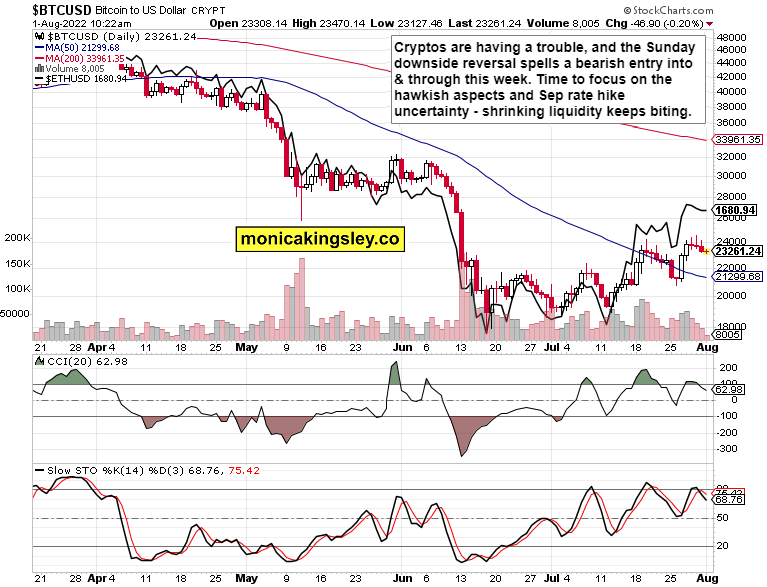

Bitcoin and Ethereum

Cryptos are losing momentum, and even if they put up some fight early Aug, the bears have taken over the reins.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.