Bank of Japan Preview: Time to start with subtle changes in the monetary policy?

- The Bank of Japan will announce its latest decision on monetary policy on Friday.

- Japanese main interest rate will likely be left at -0.1%, despite inflation standing at 3% YoY.

- USD/JPY eased from multi-year highs, but there’s a long way before calling the end of the bullish trend.

The Bank of Japan is undergoing a monetary policy meeting and will announce its decision on Friday, October 28. The central bank has maintained, up to these days, the ultra-loose monetary policy decided in 2016, which implies leaving the main interest rate at -0.1% and a yield-curve control that aims to keep the yield of the 10-year government bond at around 0%.

Such measures were meant to be in place until inflation achieved a 2% target in a stable manner amid years of deflation. However, things changed in the aftermath of COVID-19, as the world faces out-of-control inflationary pressures. In Japan, the inflation rate hit 3% YoY in August 2022 and remained unchanged in September, up on the back of higher food and energy prices.

Japan's inflation finally above 2%

Indeed, Japanese inflation could be considered modest compared to record multi-decade highs in other major economies. Even further, a 3% annual rate could be considered healthy inflation for a developed economy. But that’s not the case. Bank of Japan Governor Haruhiko Kuroda has pledged to keep rates at record lows to support the economy's fragile recovery from the early stages of the pandemic. Furthermore, he expects inflation to fall back below 2% in the upcoming fiscal year.

However, and after two consecutive terms, Kuroda will no longer be the central bank’s governor in the next fiscal year, as his mandate will finish in April 2023.

Meanwhile, the US Federal Reserve is conducting an ultra-aggressive monetary policy, with the main interest rate now standing at 3.00%-3.25%. Central banks’ imbalance has resulted in USD/JPY reaching an over three-decade high of 151.93. Japan’s yield-curve control policy also has to do with the weakening yen, as the BoJ has had to buy an unlimited amount of Japanese government bonds (JGB) to defend an implicit 0.25% cap, a defacto easing policy with a negative impact on their currency valuation.

Despite the BoJ’s efforts, long-term JGBs soared to multi-year highs this week, with that on the 20-year bond peaking at 1.315% and the 30-year bond yield soaring to 1.685%. As a result, the central bank conducted another round of unlimited bond-buying.

Plummeting Yen is a major headache for policymakers

To spice it all up, soaring USD/JPY has led to at least two suspected interventions to halt Yen’s collapse. There was no official word on the matter, although Finance Minister Shunichi Suzuki noted that the central bank easing its monetary policy and a foreign exchange intervention were not contradictory.

“Monetary easing aimed at sustainable and stable price hikes, including wage growth, and currency intervention in response to excessive market moves, are different in terms of policy objectives,” Suzuki said.

The Bank of Japan needs to decide on monetary policy in this impossible scenario. The most likely decision is that the central bank will once again keep the monetary policy unchanged. But there’s a good chance policymakers will introduce a twist in its forward guidance and start moving away from Abenomics. Still, the change could be subtle, aimed to pave the way for a new Governor in the next fiscal year. Eyes will be on inflation forecast revisions and forward guidance, which can be changed to neutral from the current neutral-to-dovish The change would not go unnoticed and will likely spur volatile moves around JPY crosses.

USD/JPY possible reactions

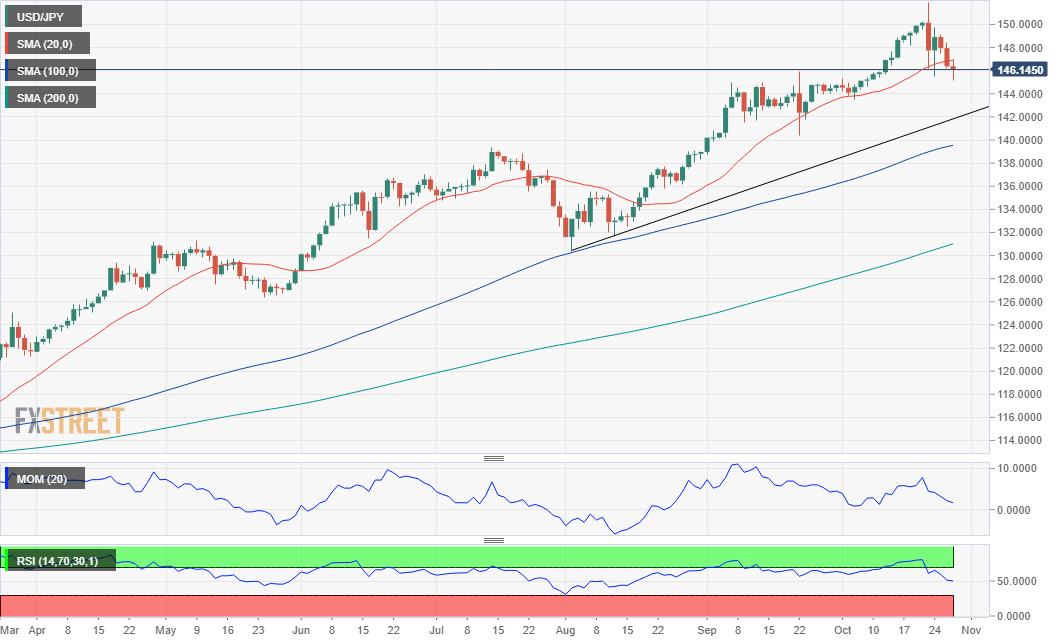

The USD/JPY pair trades above the 146.00 level after bottoming for the week at 145.09 amid the dollar’s broad sell-off. The latter is a result of mounting speculation the US Federal Reserve will slow the pace of tightening after hiking rates by another 75 bps at their November meeting.

The pair could easily move 100/150 pips after the announcement, most likely rising on an on-hold stance and plummeting should policymakers introduce changes to forward guidance.

From a technical point of view, the pair has corrected extreme overbought conditions after hitting the aforementioned multi-year high of 151.93 last Friday, but the bullish trend is far from over. The pair could decline towards the 142.50 price zone and still maintain the upward potential. A daily ascending trend line drawn from the August 2022 low provides support around the aforementioned level. A break through the weekly low could result in a test of the 143.90/144.10 price zone.

Meanwhile, technical readings in the daily chart are in line with the continued overall uptrend as the 100 and 200 SMAs head firmly north well below the August trend line, while technical indicators are losing their downward momentum within positive levels. Bulls can take over on a rally through 147.10, a strong static resistance area. Beyond it, bulls may aim to challenge the BOJ again and push the pair towards 150.00.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.