Bank of Japan holds rates with a hike likely in May

The Bank of Japan (BoJ) unanimously voted to keep its policy rate unchanged at 0.5%. Governor Kazuo Ueda did not indicate when the next rate hike might occur but emphasised the Bank's commitment to its normalisation strategy. Given the strong preliminary Shunto results, inflation and private consumption will be key to watch in the coming months.

Governor Ueda was quite cautious in his guidance

The BoJ statement showed that its assessment of inflation and growth hasn't changed much. However, there was much more emphasis on the uncertainties surrounding US trade policy. Governor Ueda also made several comments on tariff risks during his press conference. Ueda indicated that he would wait and see how the US tariff issues unfold, so markets may be betting more on a July hike than a May hike.

However, our attention is more on his remarks regarding recent wage negotiations, which, while expected, were still stronger than anticipated. The BoJ is closely monitoring the potential upside risks to inflation. Additionally, the recent rise in Japanese government bonds (JGBs) reflects the market's reaction to inflation and economic data developments.

Ueda believes it is not time for the BoJ to step into the bond market, which signals that he is biased on the tightening stance. By giving mixed signals, both hawkish and dovish, the BoJ is likely to retain some room for manoeuvre in future policy meetings. We believe that unless the tariff issue escalates more than what has already been revealed, the BoJ's priority should be given to inflation, consumption and wage growth.

BoJ watch

The preliminary Shunto results suggest another year of above 5% wage growth, which should support the BoJ's virtuous cycle of wage growth and sustainable inflation. The BoJ would like to see how companies pass on the input price rises to retail prices. Usually, companies raise their prices in the first month of their fiscal year, April.

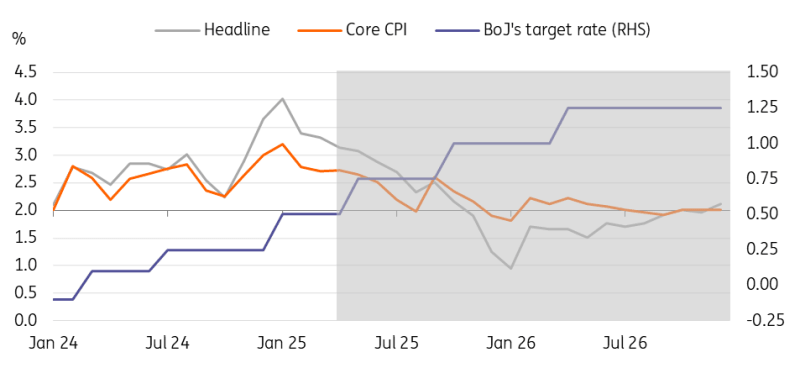

Therefore, the upcoming inflation data is the key to watch. Tomorrow's CPI inflation is expected to ease to 3.5% YoY in February from 4.0% in January due to renewed government energy subsidies and a stabilisation of fresh food prices. We expect the easing to be temporary and inflation to pick up again in March and April. More important to watch should be the April Tokyo CPI data which will be released a few days before the BoJ's April/May meeting. If April Tokyo inflation reaccelerates as we expect, then the odds of a May hike should increase.

Core inflation is expected to stay above 2% for a considerable time

Source: CEIC, ING estimates

Read the original analysis: Bank of Japan holds rates with a hike likely in May

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.