- BOC’s likely to maintain its current monetary policy unchanged in July.

- New Governor Tiff Macklem is likely to repeat its pledged to deliver stable inflation.

- USD/CAD neutral, unlikely to leave its monthly boundaries with BOC.

The Bank of Canada will have a monetary policy decision this Wednesday, the first lead by new Governor Tiff Macklem. A couple of weeks ago he offered his first speech as governor, and reaffirmed that the primary mission of the central bank is to deliver low, stable and predictable inflation, calling it “the foundation of economic growth.”

Policymakers are expected to maintain the main rate at 0.25%, the level set last March when the ongoing coronavirus pandemic forced them into three rate cuts within a month. Speculative interest will be looking for any change in the bond-buying program, although chances of that happening are quite a few. Meanwhile, negative rates in Canada are off the table for now, as well as a rate hike, given the high levels of uncertainty surrounding how the economic recovery will unfold.

Data points to an on-hold stance

Ever since the June meeting, Canadian numbers have been confirming that the economy had hit a bottom, which further points to a wait-and-see stance from policymakers. The country has added roughly 850K new jobs in June after recovering 290K in May. However, Canada has 1.8 million fewer jobs that there were in February.

Manufacturing output also improved, with the Ivey PMI hitting 58.2, its highest since November 2019. The Markit Manufacturing PMI remained within contraction territory but improved from 40.6 to 47.8 in June, a result of the economic reopening.

Inflation is probably the weakest indicator at this point, as yearly CPI resulted in -0.4% YoY in May, negative for the second month in-a-row. However, it’s still too early for policymakers to make decisions based on headline inflation. Governor Macklem has already acknowledged continued downward pressure on inflation.

Also, the central bank released early July the Canadian Survey of Consumer Expectation, which showed that, in the second quarter of 2020, “consumer expectations for one-year-ahead inflation rose slightly from 2.5 to 2.8 percent, close to the peak reached in mid-2018,” probably reflecting higher inflation in food prices following increased spending on store-bought food during the pandemic.

Monetary policy

As it happens with most major central banks, policymakers these days are focused on providing support to the economy throughout the coronavirus crisis. Rates are expected to remain on hold at the mentioned 0.25% for the foreseeable future.

Back in April, the BOC launched the Government of Canada Bond Purchase Program (GBPP), a program to purchase Government of Canada securities in the secondary market, to “address strains in the bond market and to enhance the effectiveness of all the other actions have taken to support core funding markets,” which targets a minimum of $5 billion per week across the yield curve. No changes are expected in the GBPP either this month, as long-term bond yields remain at historical lows, in line with the BOC’s target.

USD/CAD levels to watch

In the last 4-weeks, major pairs have been struggling for direction, and USD/CAD has been no exception. Speculative interest is in wait-and-see mode, seesawing between hopes and fears correlated to coronavirus headlines.

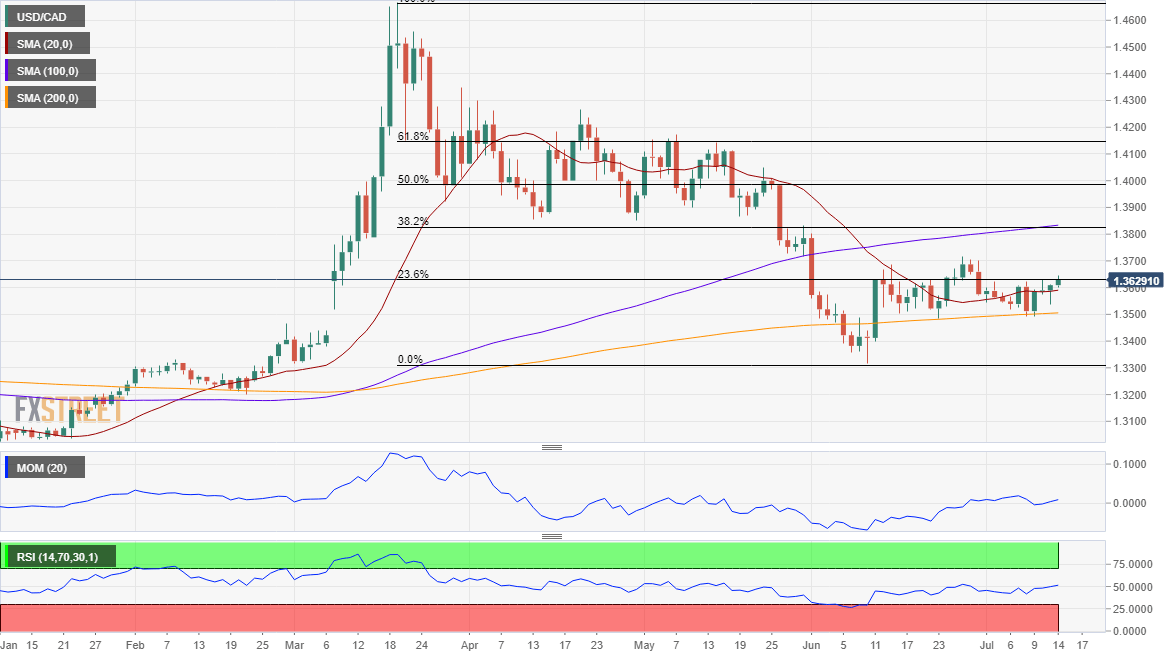

The pair is hovering around the 23.6% retracement of its latest daily decline, neutral in the daily chart. A horizontal 200 DMA around 1.3490 has provided support, while sellers have been strong around the current 1.3630 price zone. The top of the monthly range comes at 1.3715. It seems unlikely that the BOC can trigger a movement strong enough to push the pair outside the mentioned boundaries.

An optimistic stance could see it pulling down to 1.3600, while below this last, an approach to the mentioned 1.3490 level seems likely, particularly considering the market is quick when it comes to selling the greenback. A test of the 1.37 area is possible only if risk aversion returns alongside dovish Canadian policymakers.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD defends 0.6400 after Chinese data dump

AUD/USD has found fresh buyers near 0.6400, hanging near YTD lows after strong China's Q1 GDP data. However, the further upside appears elusive amid weak Chinese activity data and sustained US Dollar demand. Focus shifts to US data, Fedspeak.

USD/JPY stands tall near multi-decade high near 154.50

USD/JPY keeps its range near multi-decade highs of 154.45 in the Asian session on Tuesday. The hawkish Fed expectations overshadow the BoJ's uncertain rate outlook and underpin the US Dollar at the Japanese Yen's expense. The pair stands resilient to the Japanese verbal intervention.

Gold: Buyers take a breather below $2,400 amid easing geopolitical tensions

Gold price is catching a breath below $2,400 in Asian trading on Tuesday, having risen over 1% in the US last session even on a solid US Retail Sales report, which powered the US Dollar through the roof. Easing Middle East geopolitical tensions and strong Chinese data could cap Gold's upside.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Israel-Iran military conflict views and takeaways

Iran's retaliatory strike on Israel is an escalation of Middle East tensions, but not necessarily a pre-cursor to broader regional conflict. Events over the past few weeks in the Middle East, more specifically this past weekend, reinforce that the global geopolitical landscape remains tense.