Australian RBA's Quarterly Inflation Preview: Clues ahead of RBA’s decision

- Australian Q3 CPI is seen recovering after record lows in Q2.

- Investors cautious as the RBA paved the way for a fresh rate cut.

- AUD/USD is technically neutral above the critical 0.7000 threshold.

Australia will release Q3 inflation figures early Wednesday. The quarterly CPI is expected at 1.5%, quite a recovery from the previous -1.9%. When compared to a year early, it is expected to recover from -0.3% to 0.7%. The Trimmed Mean CPI from the Reserve Bank of Australia is expected at 0.3% QoQ from -0.1%, and at 1.1% YoY from 1.2% in Q2. A significant improvement that falls short of RBA’s 2-3% target band.

The Minutes of the latest central bank’s meeting showed that policymakers are inclined to follow current inflation that their own forecasts, which means that there’s a good chance that the market will rush to price in RBA’s possible reaction to inflation figures. Should the numbers miss the market’s expectations, a cash rate cut to 0.1% could be taken for granted for the upcoming meeting, on November 4, with AUD/USD probably falling towards the 0.7000 figure.

However, the market is expecting better-than-previous numbers, based on easing restriction in Victoria’s area. Despite the RBA paved the way for a rate cut, policymakers’ perspectives are generally positive. They keep reaffirming that the economic slowdown was not as bad as initially estimated. In this scenario, upbeat figures could provide support to the Australian dollar. Still, the aussie has a limited bullish potential, amid caution ahead of the next RBA meeting.

AUD/USD Technical outlook

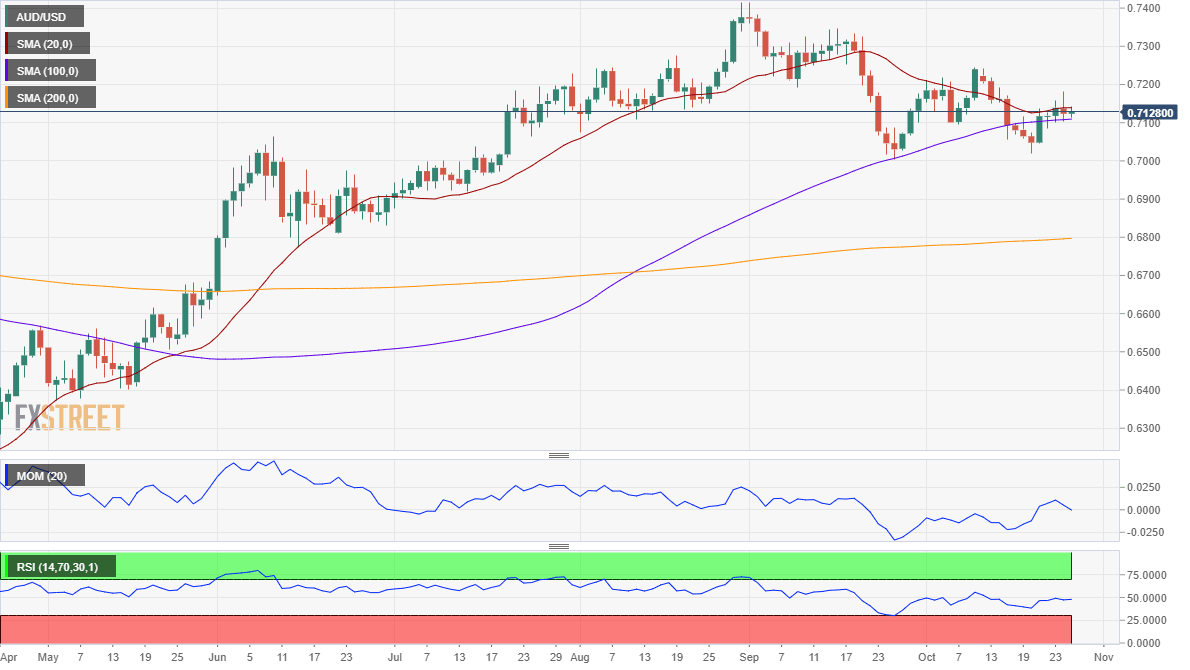

From a technical point of view, the AUD/USD pair is neutral in the mid-term, holding above the 0.7100 figure. The daily chart shows that the pair has spent the week confined to a tight range defined by horizontal 20 and 100 DMAs. Technical indicators, in the meantime, head nowhere around their midlines.

The same chart shows that the pair bottomed at 0.7005 in September and at 0.7020 this October. An intermediate support level is 0.7070, with a break below this last exposing the 0.7000 area. To the upside, 0.7160 is the first resistance level, ahead of the 0.7210/40 price zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.