Australian Employment Preview: Upbeat figures could send AUD/USD to 0.71

- Australia is foreseen recovering over 110K job positions in June.

- Wage growth in the country will likely remain depressed until mid-2021.

- AUD/USD is bullish on sentiment, employment data would have a limited effect on it.

Australia is scheduled to release its June employment data this Thursday, and the country is expected to recover 112.5K jobs in the month, after losing 227.7K positions in May and roughly 600K in April. The unemployment rate, however, is seen rising to 7.4% after jumping to 7.1% in the previous month and almost two-decade high.

Relief to be only temporal

As it happened worldwide, the setback in employment figures was the result of the ongoing coronavirus pandemic. Australia was enjoying some relief after the initial hit, as it seemed to have the illness under control. The country reopened ahead of other countries, which could lead to an upward surprise in jobs’ creation. However, authorities have to reimpose restrictions and lockdown larger parts of the economy around Melbourne to contain the latest outbreak. The negative effects of this last decision on employment figures will probably be clearer in the next two months.

Australian wage growth is released quarterly and apart from the monthly employment report. The latest data available shows that the wage price index rose by 2.1% YoY in the first quarter of 2020, slowing from 2.2% in the previous quarter. Experts expect nominal wage growth could slow to below 1.0% throughout the rest of 2020 and the first half of 2021.

Meanwhile, the RBA has had a monetary policy meeting, leaving the cash rate at record lows as the ongoing crisis will continue to affect RBA’s employment and inflation targets. Rates would remain unchanged for “some years to come,” according to Governor Lowe. However, policymakers have clarified that they stand ready to provide additional support to the economy.

AUD/USD possible scenarios

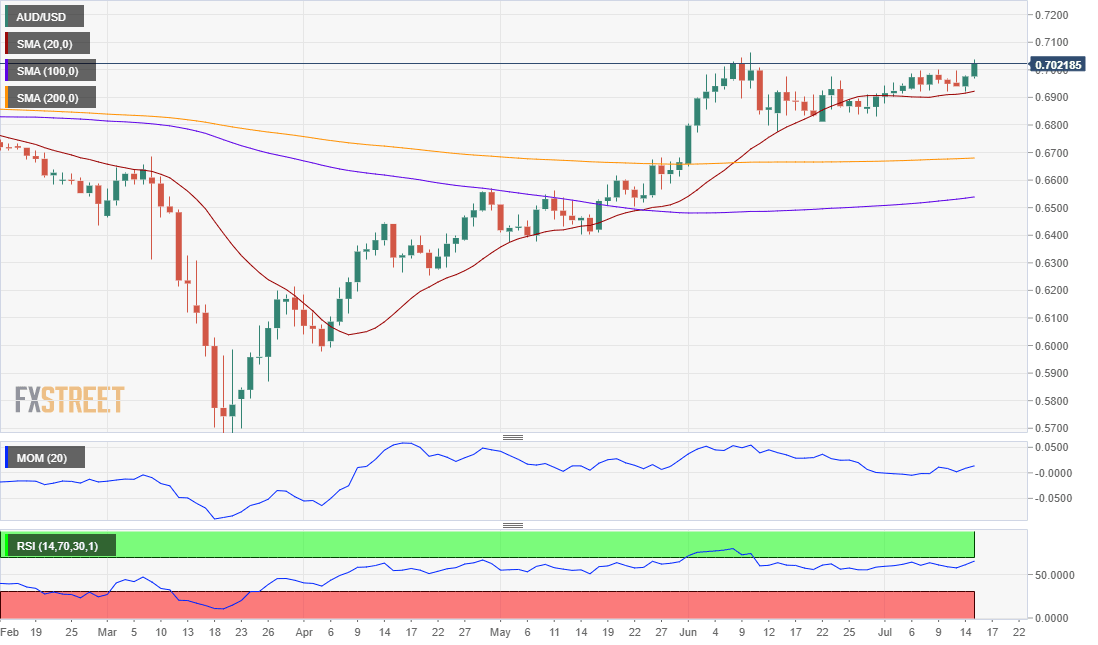

In the meantime, financial markets trade alongside sentiment. The AUD/USD pair has been ranging for almost a month amid the uncertainty surrounding the economic future, with speculative interest seesawing between hopes and fears.

The pair is currently at the upper end of its latest range above 0.7000, as optimism rules after Moderna reported its vaccine has provided immunity in phase one tests. Coronavirus-related headlines trigger much more interesting movements among currencies than macroeconomic data.

Nevertheless, an upbeat outcome will likely fuel the ongoing rally in AUD/USD. The immediate resistance and critical level to surpass is 0.7063 the high set last June. Beyond it, the advance could continue towards the 0.7100 figure. Further gains will depend on the market’s sentiment.

An immediate short-term support level comes at 0.6990, with a break below it on a dismal employment report exposing the 0.6940/50 price zone. Seems unlikely that the pair could lose the 0.6900 level in the current risk-on scenario, no matter how terrible employment data could be.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.