Australian Dollar Price Forecast: Next target emerges at 0.7000

- AUD/USD reclaims the 0.6800 hurdle for the first time since October 2024.

- The US Dollar recedes as investors keep digesting President Trump’s comments.

- The Australian jobs reports surpassed expectations in December.

The Australian Dollar (AUD) is back on the rise, and AUD/USD is surpassing the 0.6800 hurdle. The move shows that investors are more willing to take risks, especially after President Trump spoke in a way that was more friendly to the market at the World Economic Forum (WEF) in Davos.

The rally in the Australian Dollar shows little sign of fading on Thursday, pushing AUD/USD to levels last seen in October 2024 past 0.6800 the figure and keeping the bullish bias firmly in place for a fourth straight day.

The pair’s lift has almost exclusively derived support from renewed selling pressure on the US Dollar (USD). Investor sentiment has improved notably following Trump’s remarks in Davos, alongside a cooling of geopolitical worries linked to Greenland, allowing risk-sensitive currencies like the AUD to shine. In addition, firmer domestic data underpins the Aussie’s extra uptick.

Australia: slowing down, not falling over

Recent Australian data haven’t exactly been exciting, but they’ve hardly been alarming either. The economy is losing some momentum, yet it still fits comfortably within a soft-landing narrative.

That balance shows up clearly in December Purchasing Managers’ Index (PMI) readings. Both Manufacturing and Services eased slightly but stayed firmly in expansion. Retail Sales remain reasonably resilient, and although the trade surplus narrowed to A$2.936 billion in November, it stayed solidly in positive territory.

Growth is cooling, but only gradually. Gross Domestic Product (GDP) rose 0.4% QoQ in the July–September period, down from 0.7% previously. Furthermore, the annual growth held steady at 2.1%, broadly in line with Reserve Bank of Australia (RBA) forecasts.

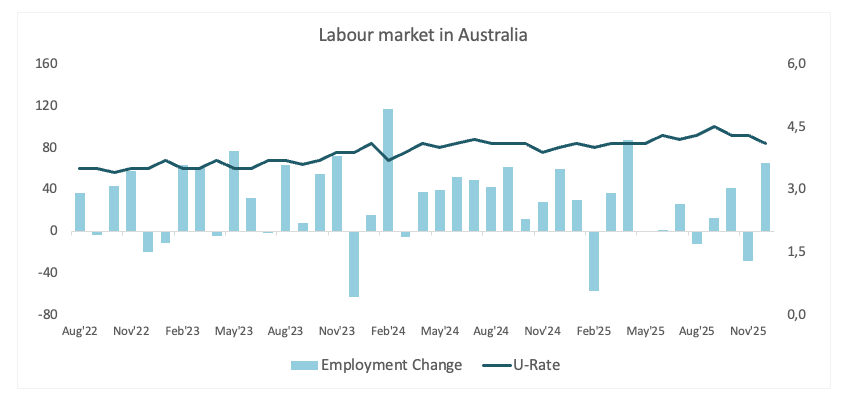

The labour market continues to look healthy: Employment Change rose by 65.2K in December, while the Unemployment Rate unexpectedly ticked down to 4.1% from 4.3%.

Inflation remains the trickiest part of the picture. Progress is being made, but slowly. Headline Consumer Price Index (CPI) inflation eased to 3.4% in November, while the trimmed mean slipped to 3.2%, still above the RBA’s target band. A modest positive came from the Melbourne Institute survey, where consumer inflation expectations edged down to 4.6% from 4.7%.

China: still a tailwind, just not a turbocharger

China continues to offer underlying support to the AUD, though its influence is more muted than in past cycles.

The economy grew at an annualised pace of 4.5% in the October–December quarter, with quarterly growth at 1.2%. Retail Sales rose 0.9% from a year earlier in December, respectable figures, but not the kind that once powered sharp AUD rallies.

More recent data hint at stabilisation. Both the official Manufacturing PMI and the Caixin index edged back into expansion at 50.1 in December. Services activity also improved, with the non-manufacturing PMI at 50.2 and the Caixin Services PMI holding at a solid 52.0.

Trade stood out as a clear bright spot. The surplus widened to $114.1 billion in December, driven by a near-7% jump in exports and a healthy 5.7% rise in imports.

Inflation, however, remains a mixed bag: CPI inflation was unchanged at 0.8% in the year to December, while Producer Price Index (PPI) inflation stayed in negative territory at -1.9%, underlining that deflationary pressures haven’t fully disappeared.

For now, the People’s Bank of China is sticking to a cautious, wait-and-see stance. Loan Prime Rates (LPR) were left unchanged this week: 3.00% for the one-year and 3.50% for the five-year, reinforcing the view that any policy support will be gradual rather than aggressive.

RBA message: no rush to ease

The RBA struck a hawkish tone at its latest meeting, keeping the cash rate unchanged at 3.60% and signalling little urgency to shift policy.

Governor Michele Bullock pushed back firmly against expectations of near-term rate cuts, making it clear the Board is comfortable holding rates higher for longer and stands ready to tighten further if inflation proves stubborn.

The December meeting Minutes added nuance, showing ongoing debate over whether financial conditions are restrictive enough, a discussion that keeps rate cuts firmly in the “not guaranteed” camp.

Attention now turns to the fourth-quarter trimmed mean CPI release later this month, which could prove pivotal for the next stage of the policy debate.

Even so, markets are currently pricing close to a 55% probability of a rate hike at the February meeting, with around 50 basis points of tightening priced in over the year.

Positioning: shorts trimmed, but conviction still lacking

Positioning data suggest the worst of the bearish sentiment may be over, though confidence remains fragile. Commodity Futures Trading Commission figures for the week ending January 13 show speculative net short positions in the AUD trimmed slightly, hovering near 19K contracts, the least bearish reading since September 2024.

That said, open interest has started to lose momentum, easing to around 229.5K contracts. In short, fresh money is still hesitant, pointing more to caution than to a decisive bullish shift.

What’s driving the next move

Near term: US data releases and tariff-related headlines are likely to keep driving the USD side of the equation. At home, the sense that the RBA may still hike this year should continue to lend support to the AUD.

Risks: The AUD remains highly sensitive to global risk sentiment. Any sharp risk-off turn, renewed concerns around China, or a stronger-than-expected rebound in the USD could quickly limit further upside.

Technical landscape

For now, the pair’s bullish outlook remains unchanged, although some caution should be on the cards as spot flirts with the overbought region. In the meantime, further gains are likely while above its 200-week and 200-day Simple Moving Averages (SMAs) at 0.6620 and 0.6537.

If bulls push harder, AUD/USD should now meet its next hurdle at the 2026 ceiling at 0.6828 (January 22). Once this area is cleared, a test of the 2024 peak at 0.6942 (September 30) could start shaping up ahead of the 0.7000 round level.

In the opposite direction, there are immediate contentions at weekly troughs at 0.6659 (December 31) and 0.6592 (December 18), prior to another weekly low at 0.6592 (December 18). South from here comes the key 200-day SMA at 0.6536 followed by the November floor at 0.6421 (November 21).

In the meantime, momentum indicators favour extra upside, although a “technical correction” should not be ruled out in the very near term: the Relative Strength Index (RSI) enters the overbought zone past the 72 level, while the Average Directional Index (ADX) near 32 suggests that the current trend remains strong.

-1769099114333-1769099114334.png&w=1536&q=95)

Bottom line

AUD/USD remains closely tied to global risk sentiment and China’s economic path. A clean break above 0.6800 would be needed to send a clearer bullish signal.

For now, a choppy USD, steady, if unspectacular, domestic data, an RBA in no hurry to ease, and modest support from China keep the bias tilted towards gradual gains rather than a decisive breakout.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.