Australian data looks bleak

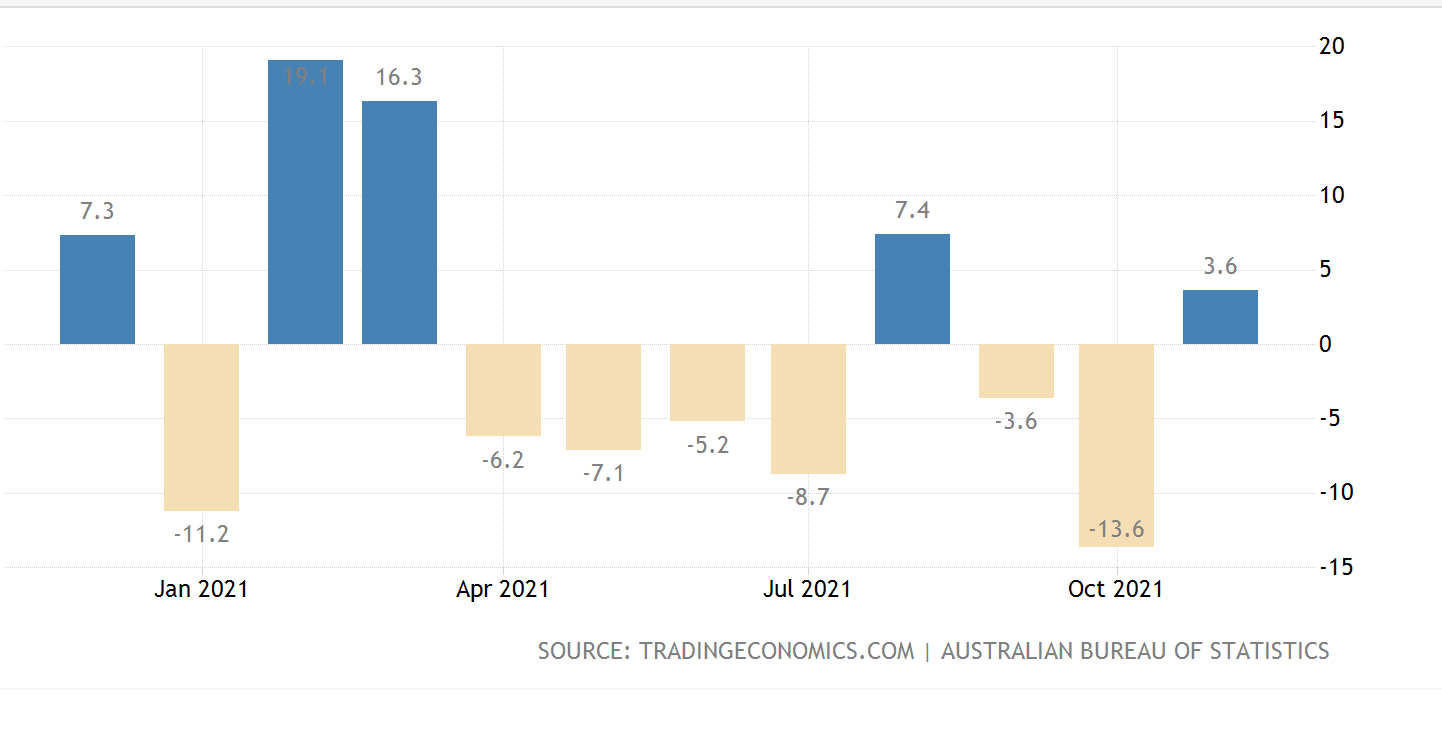

Australian building permits

Up 3.6% last month. Which delivers a seven-month total since the renewed lockdowns of negative 44% and small recovery phases of just 11%. Nice to see a positive month but not something to get terribly excited about.

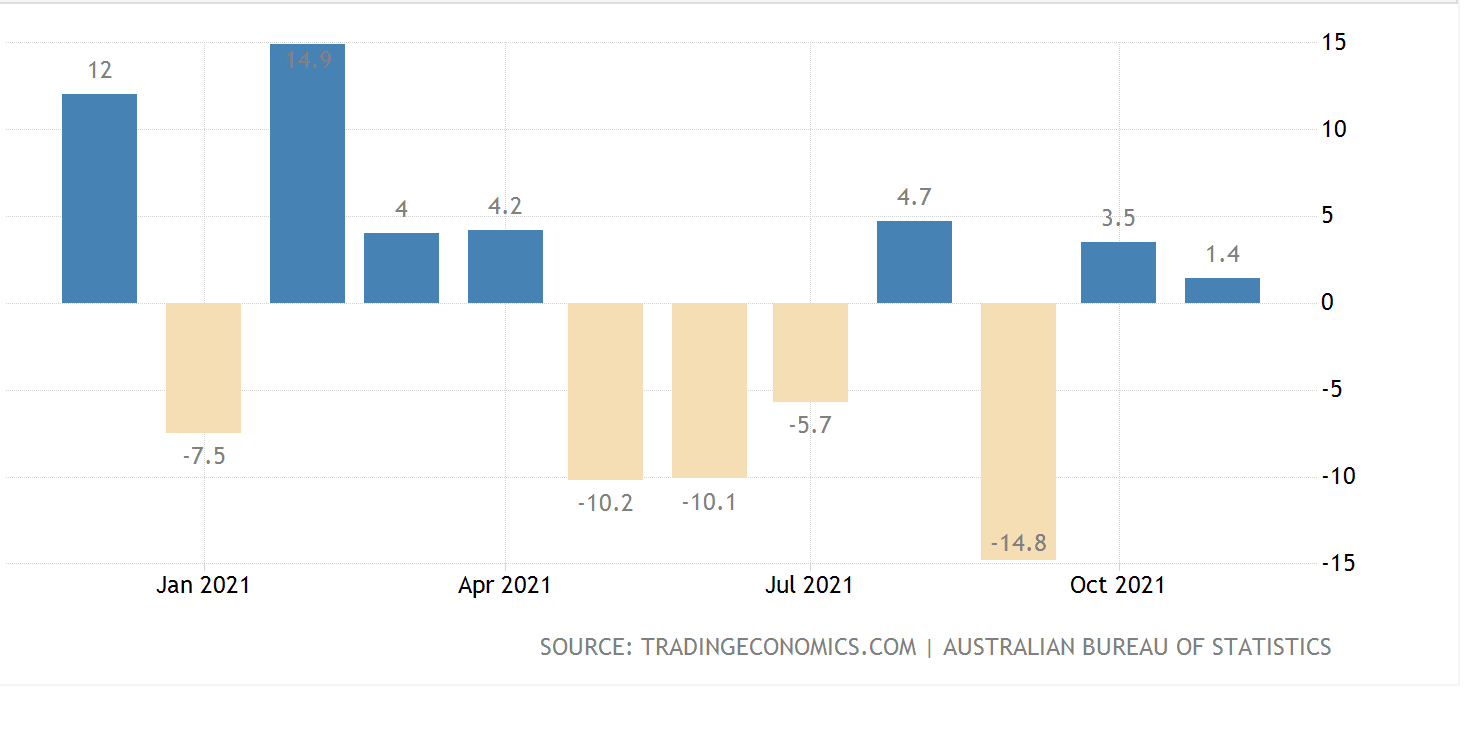

Australian private house approvals

Again slowing, and with just 9.6% total gains against 40.8% in declines. These are not strong economy or even momentary lockdown recovery spikes.

Australian 10 year bond yields

Continue to threaten a sharp break back into the 2.5% to 3.5% area as forecast last year.

It is worth noting that 69% of hospitalizations in NSW are double vaccinated. As unfortunately are around 70% of deaths. As high as 80% on Sunday.

We all need to be careful, but not fearful. Even if you get Covid, the probability of going to hospital is very low. It is just that the absolute numbers are so high. Causing health system stress. The relatively high numbers in the course of the Australian experience mean voluntary semi-lockdown economic behavior will persist for several more weeks.

The outlook

Is for a weakening trend in economic growth overall combined with rising interest rates. Entrenched below-trend growth over the next few years is unavoidable. All while inflation begins to trend significantly higher.

Government over-stimulus spending and Reverse Bank bad management have painted our economy into a rather dim corner.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a