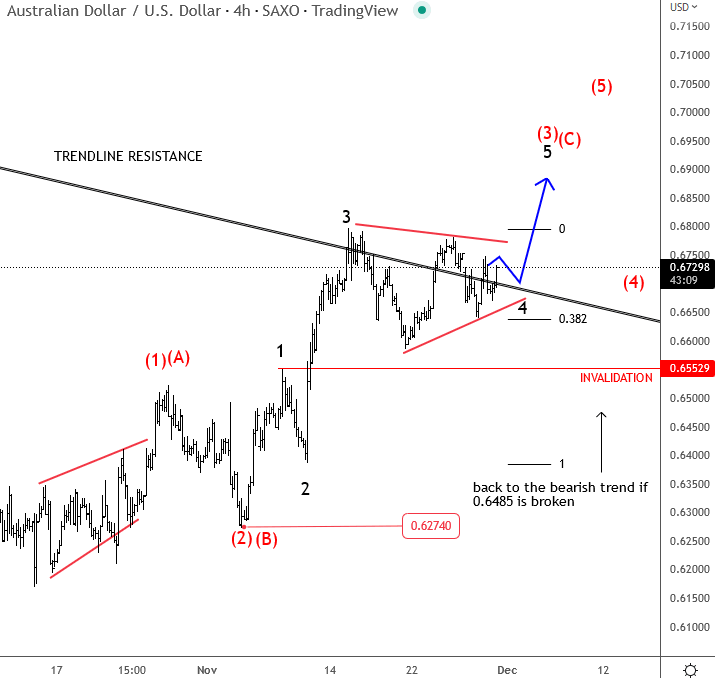

AUD/USD holds support after CPI data – Elliott Wave points higher

Market is slow ahead of Powell speech today, when we will get more decisions about their policy rates. For now, the risk-on is still on the table after China announced that they will allow close contacts of Covid cases to quarantine at home. They also said that they will strengthen vaccinations which sounds positive. AUD CPI data came lower y/y, at 6.9% from 7.6% expected. Inflation is coming down, which means that RBA can be less hawkish but AUDUSD pair was still able to hold the support within a triangle. We see a-b-c-d-e subwaves in wave 4 so be aware of a break higher into wave 5. Rise above 0.68 can call 0.69. A drop below 0.6640 can cause a deeper pullback to 0.6550.

BLACK FRIDAY Monthly 50% Off Lifetime Crypto, FX and major Global Markets. Apply here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.