AUD/USD Weekly Forecast: RBA to cut rates to record lows, fears hurt the Aussie

- The Reserve Bank of Australia will probably cut rates to a record low of 0.1%.

- In the US, the focus will be on the presidential election, the Federal Reserve and the Nonfarm Payrolls report.

- AUD/USD is at risk of losing the 0.7000 figure and enter a selling spiral.

The Australian dollar felt the heat of resurgent coronavirus cases in Europe and US, despite Australia managed to control the latest outbreak. The AUD/USD pair fell to 0.7001 on the back of risk-aversion, recovering some ground on Friday to settle around 0.7030.

Australian economy slowly coming back to life

Australian “victory” on COVID-19 is nothing to cheer. After over 110 days of lockdown in Victoria, the area reported no new cases for two days in a row. However, authorities are utterly cautious with scheduled reopenings. Not for nothing, the Reserve Bank of Australia anticipated more easing. The central bank will announce its decision next Tuesday and investors are already pricing in a rate cut to a record low of 0.1%.

Meanwhile, the pandemic keeps taking its toll in Europe and the US, as the cold weather begins. Record numbers of new contagions and the consequent lockdowns, particularly in the Old Continent, triggered a sell-off in global equities and fueled the greenback’s demand given its safe-haven condition.

The market ignored upbeat Australian inflation data, as the RBA Trimmed Mean CPI was up by an annualized 1.2% rate in the third quarter of the year. Business Confidence improved in the same period, as the NAB’s index came in at -10 from -15 previously.

Central banks and US elections take center stage

As November kicks in, Australia will provide investors with several macroeconomic figures. Beyond the RBA announcement, the country will publish the AIG Performance of Manufacturing Index for October, and the services index for the same month. It will also release the final version of September Retail Sales, foreseen at -1.5%.

The final readings of October PMIs for China, Australia and the US will also be out throughout the week.

The US presidential election is, for sure, the event of the week. It will take place next Tuesday, with the first results out early Wednesday. However, and given the pandemic context and the mail-in voting, the final counting may take up to two weeks to be completed. Many hope that the new US President will be announced on Friday to the latest, but there’s a good chance it could take longer. And the longer it takes, the more trouble will mean for markets, which will likely remain in risk-off mode.

Right after the election, the US Federal Reserve will announce its latest decision on monetary policy. The American central bank is expected to maintain the status quo. Opposite to other policymakers, US officials will likely say they are comfortable with the current levels of stimulus.

A busy week will end with the US October Nonfarm Payroll Report to be out on Friday. The economy is expected to have added 850K new jobs in the month, while the Unemployment rate is seen decreasing to 7.7% from 7.9%.

AUD/USD technical outlook

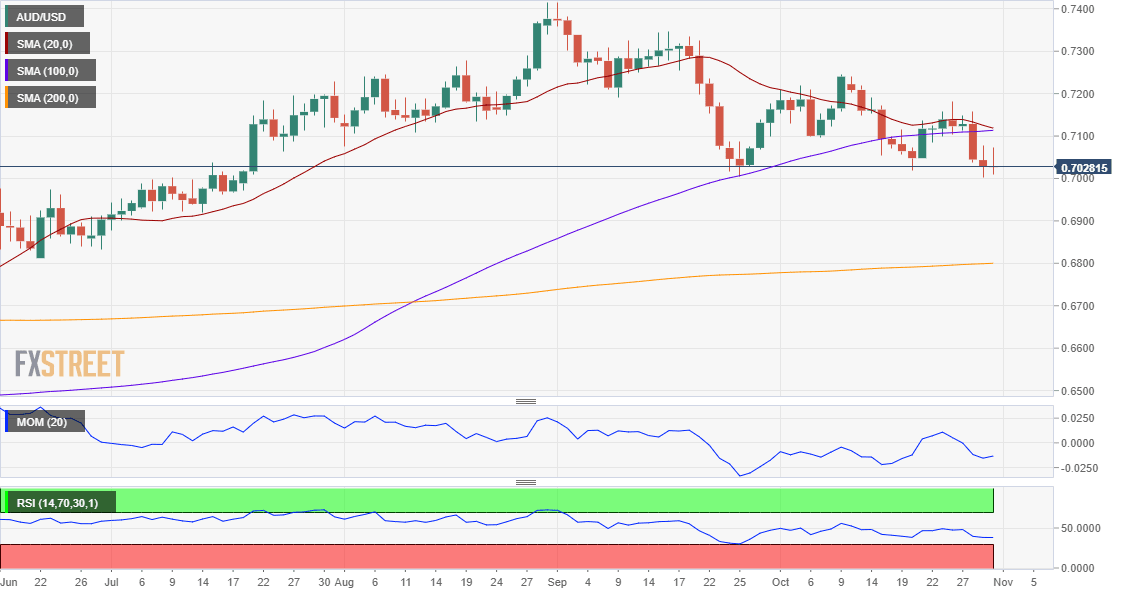

The weekly chart for the AUD/USD pair indicates that the decline may continue as the pair finally finished a week below its 20 SMA. The Momentum indicator is crossing its midline into negative territory, while the RSI heads firmly lower around 50.

The AUD/USD pair is below its 20 and 100 DMAs in the daily chart, while technical indicators consolidate within negative levels, all of which skews the risk to the downside. The pair is ending the day near its lowest since July, and while still pretty much range-bound, the risk has shifted to the downside.

Below the 0.7000 threshold, bears will likely become more convinced and sent the pair south towards 0.6920 first, and 0.6860 later. The immediate resistance level is the 0.7100 figure, followed by 0.7170.

AUD/USD sentiment poll

The FXStreet Forecast Poll for the AUD/USD pair shows that it will likely remain under pressure in the near-term, as bears account for the 63% of the polled experts weekly basis, with an average target of 0.7000. The American currency is seen receding afterwards, as bulls dominate the monthly and quarterly perspectives, with the pair seen on average at 0.7114 and 0.7202 respectively.

In the Overview chart, the weekly moving average turned lower, although the larger ones are horizontal. Most possible targets are accumulated around the current level, with just a few experts expecting movements below 0.6800. The upside, on the other hand, opened up to 0.7600, somehow reflecting bullish intentions in the longer run.

Related Forecasts:

EUR/USD Weekly Forecast: Tumultuous days ahead in the US

GBP/USD Weekly Forecast: Trump or Biden? Brexit, central banks, covid all promise explosive week

Gold Price Weekly Forecast: XAU/USD needs a blue wave for a golden era, all eyes on the elections

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.